The price changes of currencies can be represented graphically and knowing how to read charts will give you the advantage of entering markets and closing trades at the right moment. You should be able to recognize trend indicators and use trend tools, such as trend-followers and trend confirmation tools, which can be used for optimal chart analysis to maximize your potential profits. The following article explores the Trading Patterns Every Trader Should Master to Succeed.

What are Forex chart patterns?

Chart patterns can be analyzed to detect major explosions in the market, which can potentially result in great profits. These patterns are used to identify current trends or to predict future trends, and they give an indication of when big market breakouts will occur, based on past movements.

The indicators of chart patterns are likely to occur under certain market conditions, which affect the movement of prices going forward.

Repeated movements of prices over time, will create a pattern or trend that can be followed.

Before you attempt to read the patterns, you need to understand what their main components of Forex charts are and what they mean.

What are Bars, Lines and Candlestick Charts?

The three main categories of charts in Forex are bars, lines and candlesticks. They represent information about opens/closes of positions for a certain currency and also show the highs/lows of its prices. The charts show how prices change over hours, days, months or years.

Most day traders rely on candlestick charts because of the way information is represented, but many people also use line charts and bar charts, depending on the context they need.

Charts are timelines of how prices have moved over time and they can be used to predict future movements. All successful traders know how to read charts because chart patterns can be used as a map to navigate the markets.

Why are bars, lines and candlestick charts important?

Trading charts represent the relationship between price and time, and these charts can be analyzed to identify patterns within the trends of the markets and instruments. Having a foundational understanding of Fundamental and Technical Analysis will greatly increase your chances of success.

Trading patterns are useful when you are trying to choose the right moment to exit or enter a market, and this is why Technical Analysis is so important.

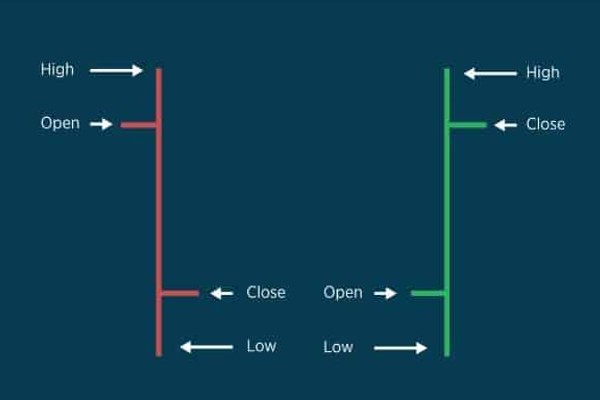

A “Bearish bar” is a red bar that indicates that the opening price is higher than the closing price for a specified period of time.

A green bar indicates that the opening price is lower than the closing prices, and is referred to as a “Bullish bar”.

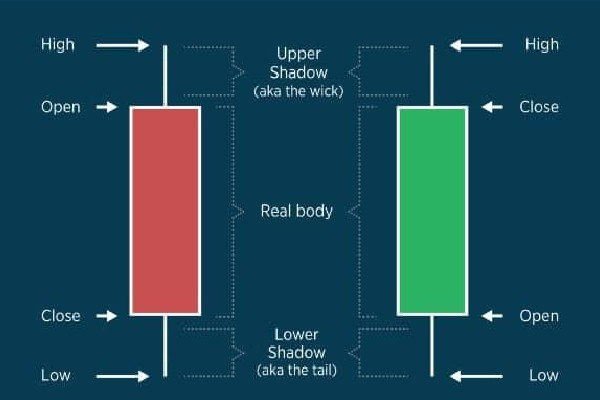

The following Candlestick pattern represents the same information as the bar graph above:

What are the Types of Chart Patterns?

A chart pattern is determined by the potential price direction of the pattern, and there are 3 main groups of chart patterns in trading, namely Continuation Patterns, Reversal Patterns and Bilateral Patterns. Each group has several different types of trading patterns.

Some of the most common trading patterns include Head and Shoulders, Double Top, Double Bottom, Rounding Bottom, Cup and Handle, Wedges, Pennants or Flags, Ascending Triangle, Descending Triangle and a Symmetrical Triangle.

The 3 main groups of trading patterns:

-

Continuation Chart Patterns

the Continuation Pattern indicates that there is a high probability that movement will continue in the same direction.

Examples of Continuation Patterns include Pennants and Rectangles.

Sometimes Wedges fall under this group unless they are reversed.

-

Reversal Chart Patterns

Reversal Chart Patterns appear when a trend is coming to an end and are an indication that the direction of the movement might be reversed.

Examples of Reversal Chart Patterns include Double Top/Bottom, Triple Top/Bottom, Head and Shoulders, and Ascending/Descending Triangles.

Wedges can also fall under this category.

-

Bilateral Chart Patterns

Bilateral Chart Patterns indicate that a movement will happen, but it is not possible to say in which direction.

Bilateral Chart Patterns are useful when you want to open a neutral position to be ready for a sudden jump in prices.

Within these groups, there are several different types of Trading Patterns:

-

Pennant Chart Pattern

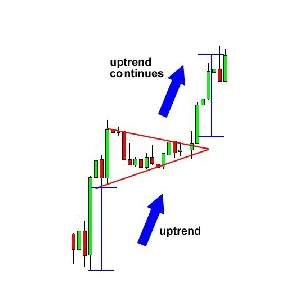

Pennants are Continuation chart patterns that appear after big upward or downward market moves.

Prices consolidate because trades are paused momentarily before continuing trades in the same direction, and a small symmetrical triangle, known as a pennant, is formed on the chart.

Pennants can be Bearish or Bullish, and it is recommended that positions are opened whenever a price closes a Candle beyond the Pennant.

When this pattern appears, traders should place their Stop Losses beyond the opposite level of the Pennant.

Traders usually initiate a sudden jump to push the Pennant out of its formation.

-

Bearish Pennants

Bearish Pennants are formed when there is a steep downtrend that is almost vertical. The price consolidates because many sellers close their positions and some traders join the trend during this time, which balances the movements.

Pennants signal single the strongest movements and once a certain number of sellers have jumped in, the price will break below the bottom of the Pennant and continue to move downwards.

-

Bullish Pennant

Bullish Pennants indicate that there will be a continuous upward movement in prices after a pause in the market.

Sometimes, a price will make a sharp vertical climb before pausing to climb again.

-

Rectangle Chart Pattern

Rectangles fall under Continuation chart patterns and they appear when prices move sideways and form rectangles. They can be bearish or Bullish depending on the direction of the trend and other movements can break the formation.

-

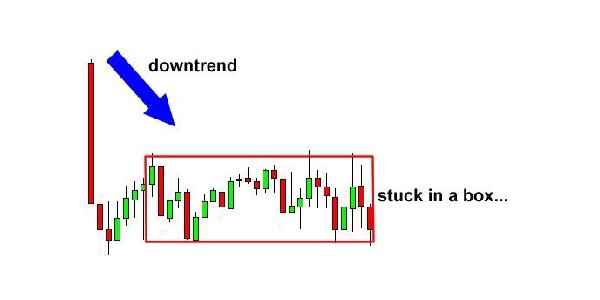

Bearish Rectangle

Bearish Rectangles form when prices consolidate briefly during downward trends. Prices are driven down lower by traders and the rectangle appears when traders briefly pause before jumping back in.

When this happens, it will appear as if the chart is stuck in a box and it will happen after a price shoots down very far.

After the pair falls below the support line, a movement the size of the rectangle will be made below the support.

-

Bullish Rectangle

A Bullish Rectangle is another example of a rectangle that forms when traders pause after an uptrend and the price consolidates before it keeps moving.

The price continues moving all the way up after breaking above the top of the rectangle pattern.

once the pair breaks, the next move will usually be about the size of the rectangle, in the same direction it was going in.

Whenever you trade with Rectangles, your Stop Losses should be placed at the opposite end of the Rectangle formation. This pattern is similar to Pennants, except that the swings of the formation stay within the same price zone.

-

Reversal Chart Patterns

Reversal Chart patterns begin when a Double Bottom or Double Top pattern appears. Reversal patterns can also be in the form of Triple Top and Triple Bottom patterns.

-

Double Top

After there is an extended upwards movement, a Double Top Reversal pattern will appear.

Peaks are formed when prices hit a level that cannot be broken. The price will not move beyond this point but will return to the neckline instead.

When two peaks appear at approximately the same level, a Double Top is formed and this happens when the price bounces off the first peak, falls and then rises again.

On the other hand, a Double Bottom pattern forms when two price dips appear at the same level.

Triple Tops and Bottoms work the same way, but instead of two peaks or dips, there will be three.

When there is a Double Top or Double Bottom, buying pressure is dissipating and there is a strong chance of a Reversal occurring.

When Double Tops appear, entry orders should be positioned below the neckline because a Reversal of the uptrend is anticipated at the neckline and continues moving down.

The price drop will be about the same size as the Double Top formation. This is essential when setting profit targets.

-

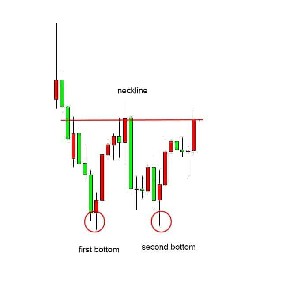

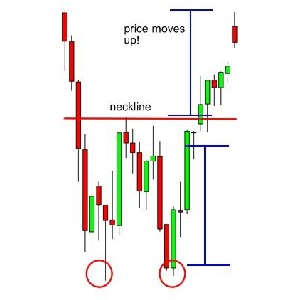

Double Bottom

Double Bottom patterns are Reversal formations that are formed when two bottoms or “valleys” form after an extended downtrend.

Double Bottoms are formed when two valleys are formed at points where prices cannot break past and go lower.

In the graph below, the second bottom was not able to break the first bottom, which indicates that the selling pressure is finishing and a Reversal will appear soon.

The price will climb the height of a double formation when the price breaks the neckline and moves upwards.

Both Double Tops and Double Bottoms appear as Reversal formations after strong downtrends.

-

Head and Shoulders Pattern

The Head and Shoulders chart pattern is the most reliable and will often be seen during uptrends. It is a Reversal formation and indicates a topping reversal after a Bullish trend.

The Shoulders form peaks and the head is a higher peak, and there will always be two shoulders with a head in between.

Necklines can be drawn by connecting the lowest points (valleys) with a straight line. The line can be slanted up or down, but downwards slants produce more reliable signals.

Once the price closes a candle beyond the neckline, a fully-formed Head and Shoulder formation appears and it is an indication that traders should get ready to place entry positions.

With Head and Shoulder Formations, entry orders should be placed below the neckline. Targets can be calculated by measuring the highest point of the head to the neckline. The distance is the approximate distance of how far the price will move before it breaks the neckline.

You will notice that after a price has gone below the neckline, it will move a distance at least the size of the distance between the neckline and the head.

Using these guidelines allows you to monitor and predict price movements without getting too ambitious when prices keep moving after they reach their targets.

-

Inverse Head and Shoulders

The Inverse Head and Shoulders is like a person doing a headstand. The shoulders are higher than the head in this formation and the head is the lowest point.

This formation usually appears after a Bearish trend.

When the Inverse Head and Shoulders formation appears, a long entry must be placed above the neckline and the target will be calculated the same way as before, by measuring the distance from the neckline to the head and anticipating an upward move of the same size.

Once the price has moved up and reached your target, take your profits and be careful of not getting greedy!

There are three types of Triangle Patterns, namely Ascending, Descending, and Symmetrical triangles:

-

Ascending Triangle

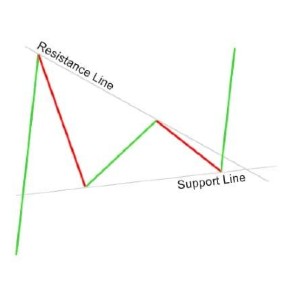

Ascending Triangle chart patterns indicate that there are resistance levels at the top, but lows get higher the more prices move and the triangle slopes into an ascending triangle.

The price will not be able to break through the resistance levels.

A breakout is inevitable because the resistance levels are put under pressure the more the prices rise from the valleys.

Research suggests that the price will eventually break past the resistance level, but it is not guaranteed.

The price will not push through if the resistance is too strong, and the highest price will always stay at or below the resistance level.

The direction will usually go up, but it is impossible to tell for sure.

The Ascending Triangle pattern has resistance levels at the top that cannot be broken through, while the Descending Triangle has a bottom resistance level that prices cannot go below.

These chart patterns are usually considered neutral, but they indicate high chances of trend reversals appearing.

-

Descending Triangle

With Descending Triangle chart patterns, the highs or peaks of the pattern will get lower after each downward movement, and this forms the upper line of the triangle.

Usually, if the support line is weak, then the prices will eventually break through and continue to fall.

If the support level is strong, the prices will not breakthrough and the prices will move back up.

Ascending and Descending Triangles are similar to Rising and Falling wedges.

Whenever a Descending or Ascending Triangle appears, a reversal price movement of the same size in the opposite direction should be anticipated.

-

Bilateral Chart Pattern – Symmetrical Triangle

Symmetrical Triangle patterns are characterized by two slopes of the same angles and sizes. The point of the triangle is on the right-hand side. The high and lows of the price movements move in a way that forms a symmetrical pattern.

When this formation appears, the lows are getting higher and the highs are getting lower in a market. This indicates that there is no clear trend because traders are not pushing the prices hard enough in any direction.

A breakout is approaching when the slopes of a symmetrical triangle near each other and reach a point.

Predicting price movements and breakout directions accurately is not always possible, but when buyers or sellers give in, a strong move will occur.

When a Symmetrical triangle appears, a Stop Loss should be placed at the opposite side of the breakout.

Continuation/Reversal in the case of Wedges

-

Corrective Wedge Pattern

Wedges can be Continuation trends or Reversal formations. When a Wedge appears, traders have not decided how to move the prices and it is an indication that there is a pause in the movement.

There are two types of Wedges, namely Corrective Wedges and Reversal Wedges.

Both Corrective Wedges and Reversal Wedges look the same, but the previous prive movement determines whether the Wedge is a Corrective or a Reversal formation.

Corrective Wedges are represented as a short-term movement period against a trend, which is followed by the price returning to the previous direction.

A Corrective Wedge can push a price in a direction that will trigger another trend, equal to the size of the wedge.

When a Bullish trend is reversed, a Bearish trend can continue and Rising Wedges appear.

Prices are consolidated between upward support and resistance levels when a Wedge rises. The support line will be steeper than the resistance line.

When this happens, higher lows form faster than higher highs and a Wedge is created.

On the other hand, every falling Wedge is Bullish by nature and reverses the bearish trends so that Bullish trends can continue.

As the Wedge narrows towards the right, you should be getting your positions ready regardless of the direction the breakout moves in!

A Rising Wedge is usually formed when an uptrend ends. Price action creates new highs, but slower than the price makes higher lows.

If the price breaks downwards, it indicates that more traders are opening short positions instead of long ones.

The price is pushed down so that the trend line will be broken, and a downtrend may occur.

The price movement will be the same height as the formation.

A Rising Wedge formation can also be viewed as a Bearish Continuation signal.

The price will come from a downtrend and then move to higher highs and higher lows before prices consolidate.

When this happens, the price breaks to the downside and a downtrend continues. The continuation pattern appears while the trend continues in the same direction.

A Rising Wedge that forms after an uptrend will lead to a downtrend if the wedge was formed during a downtrend, and this results in a Continuation pattern in the same downward direction.

-

Falling Wedge

a Falling Wedge is formed at the bottom of a downtrend and could be either a Continuation signal or indicative of a Reversal and uptrend coming.

If the Falling wedge is formed during an uptrend, there is a good chance that prices will continue to move upwards.

A Falling Wedge is usually a reversal signal and occurs after a downtrend. The Falling trend line connecting the highs will be steeper than the slope connecting the lows.

Conclusion

Reading charts and the Trading Patterns every Trader should Master allows you to make informed decisions, based on historical data, instead of guessing all the time. Market trends create chart patterns, and knowing how to read the patterns gives you an opportunity to predict price movements and have positions ready for market breakouts.

Table of Contents

Toggle