In this Admirals Broker Review, we will discuss the platforms, educational resources, accounts, fees and trading tools they offer and provide you with a list of unbiased pros and cons.

Admirals (formerly Admiral Markets) has been operational since 2001, currently based in London and providing trading solutions to over 30 countries across the globe. South African research suggests it is one of the best-rated Forex brokers in 2021.

Customer satisfaction is a priority for this brokerage, and they offer trading opportunities with currencies, commodities, shares, indices and bonds.

The website can be used to trade on Metatrader platforms and users have access to innovative analytics tools, such as Forex calendars, trading podcasts and blogs, and articles about trading strategies.

Admirals has compiled an impressive library of educational and market resources, trading guides and informative videos.

Users can choose from 5 different types of MetaTrader accounts, which all include automated trading features and expert advisors, analysis tools and news updates, and a variety of trading tools to ensure that traders make informed, responsible decisions.

Admirals is externally audited and highly compliant with trading and financial regulations. It is a licensed brokerage and financial reports can be accessed directly from the website, for traders who seek reassurance that their funds are secure.

USD 1 ASIC, FCA, EFSA, CySEC 📱 Platforms MT4, MT5, Admirals app ₿ Crypto Yes 💵 Account Currency USD, CHF, EUR, BGN, HRK, PLN, RON, CZK, HUF, GBP Yes 1:30 🛒 Instruments Forex, Commodities, Indices, Stocks, ETFs, Bonds 🏛️ Visit Broker

It is a globally recognised brokerage with an exceptional product offering, including over 3000 single stocks, more than 300 ETFs, 32 Crypto assets, 26 commodities, 55 currency pairs and 40 indices.

Overview of Admirals

| Time to open an account | Instantaneous with 1 day for verification |

| Bonus | n/a |

| Publicly traded – listed on stock exchange | n/a |

| Country of regulation | FCA, CySEC, ASIC |

| Trust score | 83 |

| Platforms | Metatrader 4 and MT5, Webtrader & Supreme Edition |

| Mobile App | Yes |

| Copy Trading | Yes |

| Islamic account | Yes |

| Demo account | Yes |

| Base currencies | EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

| Ave spread EUR/USD | From 0.5 pips |

| Leverage | Up to 1:30 |

| Trading fees (low, average, high) | Low |

| Minimum deposit | 200 EUR/USD |

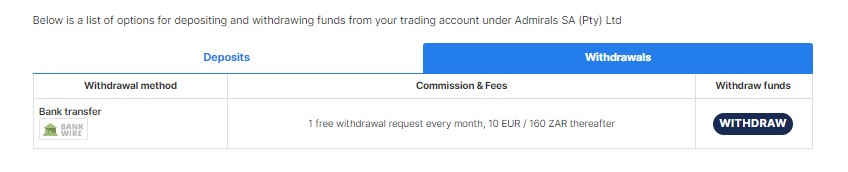

| Withdrawal fee | 2 free withdrawal requests every month |

| Currency pairs | 80+ |

| Cryptocurrency trading | Yes |

| Deposit with electronic wallet | Yes |

So what are the pros and cons of trading with Admirals?

Admirals Pros and Cons

| ✔️Pros | ❌Cons |

| 5 types of Metatrader accounts to choose from | Bank cash deposits are not accepted as payment option |

| Access to popular Metatrader trading platforms | |

| All fees are disclosed | |

| Innovative research and analytics tools | |

| Exceptional educational library | |

| Financial security guaranteed |

Regulations

Admirals operates under the supervision of 5 international organizations, including:

- Australian Financial Services Licence (AFSL)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Conduct Authority (FCA)

- EFSA

- MiFID

They are compliant with all regulatory requirements and are audited externally, making it a credible and trustworthy brokerage.

The Financial Conduct Authority (FCA) requires that deposits made by clients should be held under CASS regulations in isolated and regulated accounts, ensuring that it cannot be used by the brokerage for any reason or be classified as an asset to the company.

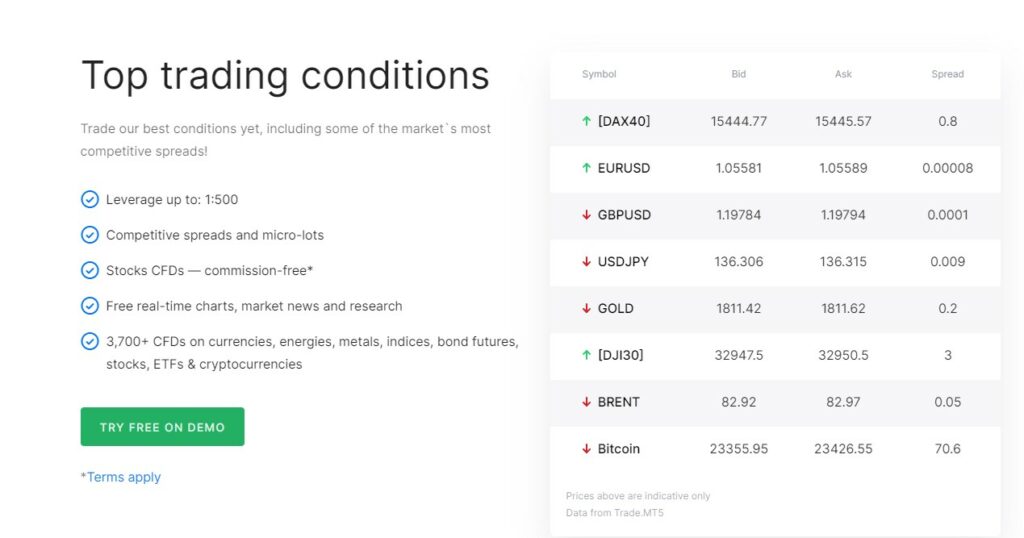

Leverage

Traders can choose to trade with higher leverage as their experience increases. Once they can trade professionally, leverage for retail customers will no longer be limited.

Leverage is available on all major currency pairs (up to 1:30), commodities (up to 1:20), indices (1:10), as well as CFDS on stocks (1:5), ETFs (1:5), cryptocurrencies (1:2) and bonds (1:5).

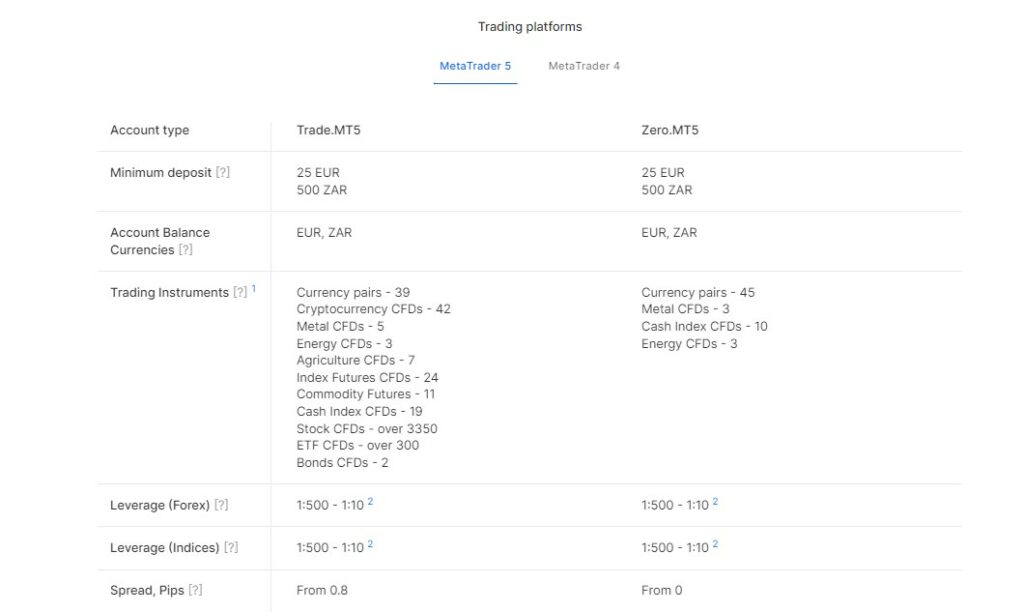

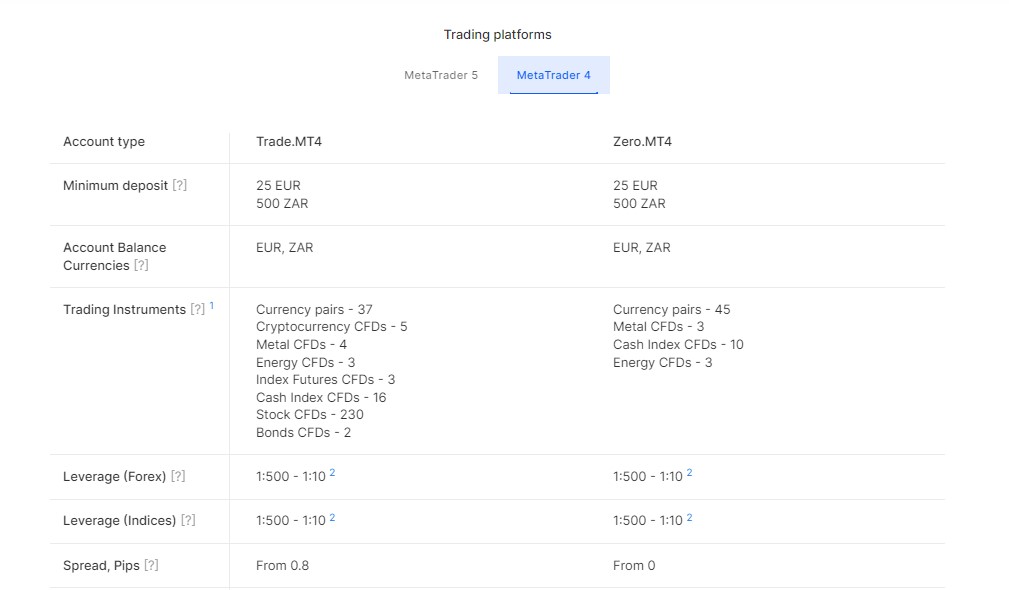

Account Types

Admirals gives beginners and experienced traders an opportunity to experiment with a variety of different account types and they also offer demo accounts for beginners who would like to gain trading experience without the risks.

Demo accounts expose new traders to a real-time trading experience, along with a, introductory guide and current news updates.

These accounts can be used for 30 days and are accessible from any device.

All accounts give traders access to automated trading tools and expert advisors, updates on market news and analysis, economic calendars and trading central.

Additional features include the MT Supreme Edition add-on, one-click trading, market depth and volatility protection settings.

Traders have access to Metatrader platforms and they can use different MT trading accounts, such as Invest.MT5, Zero.MT4 and MT5, and Trade.MT4 and MT5, which is currently the most popular option.

For traders of the Muslim faith, Admiral Markets offers a swap-free Islamic account, which is the same as regular Metatrader accounts with all the additional features, except that no interest fees are credited or debited from their accounts.

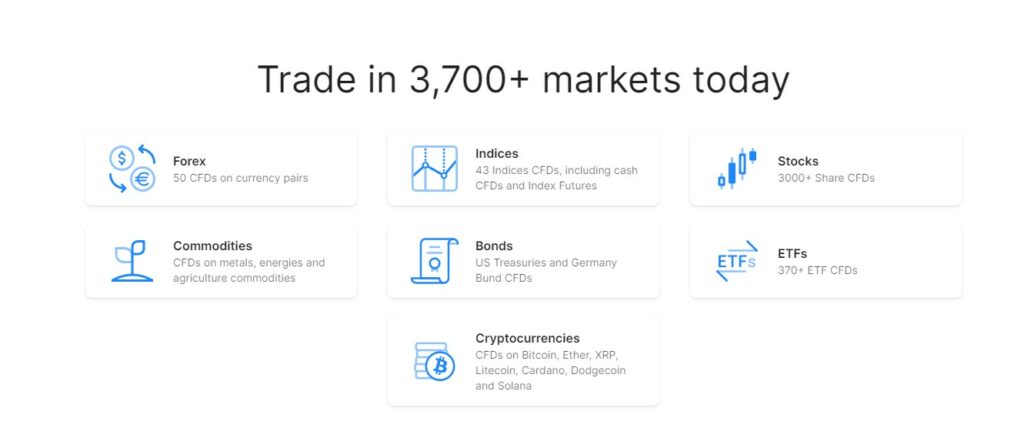

Market Instruments

Admirals gives traders an opportunity to engage with international markets where they can choose from a variety of popular market instruments, such as gold, crude oil, DAX30 and #BMW or trade with commodities, cryptocurrencies, indices, shares, bonds and ETFs.

There are over 40 CFDs on currency pairs and Share CFDs are available for Apple, Google, Microsoft, Facebook and Tesla. Commodity CFD options include Gold, Silver, Platinum, Natural gas and Oil.

Fee Structure

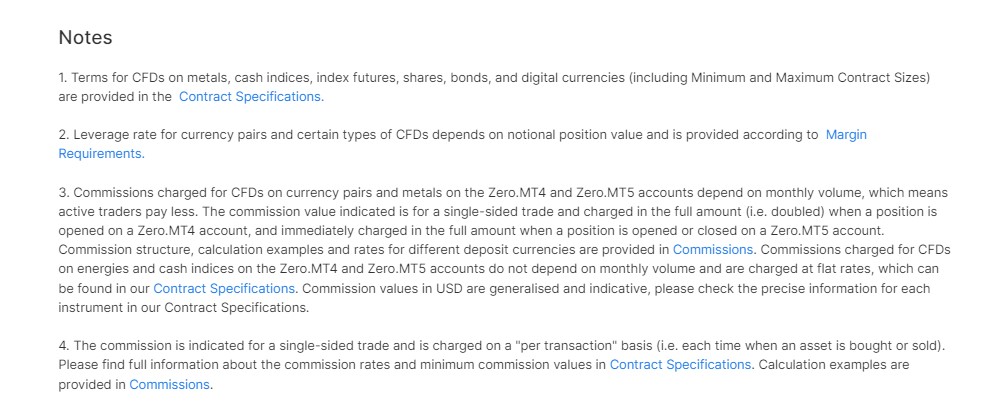

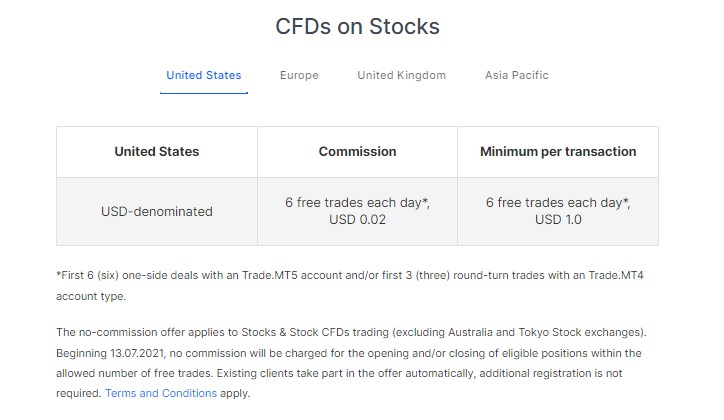

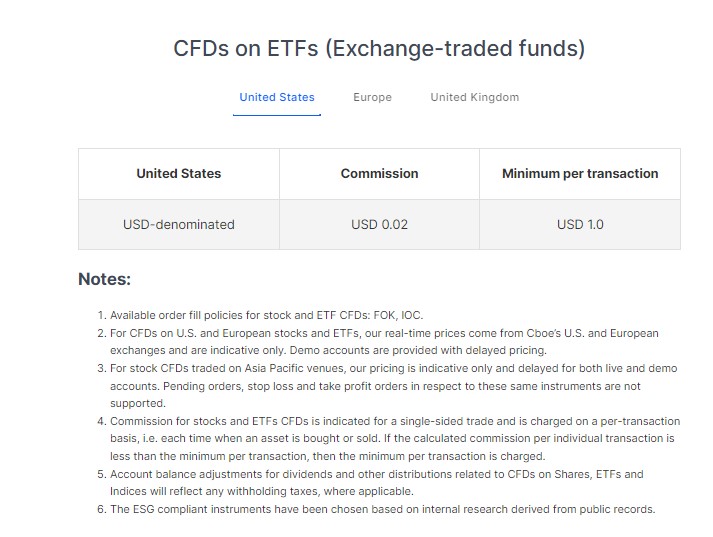

There are no hidden costs involved with Admirals and their pricing structures can be viewed by anyone.

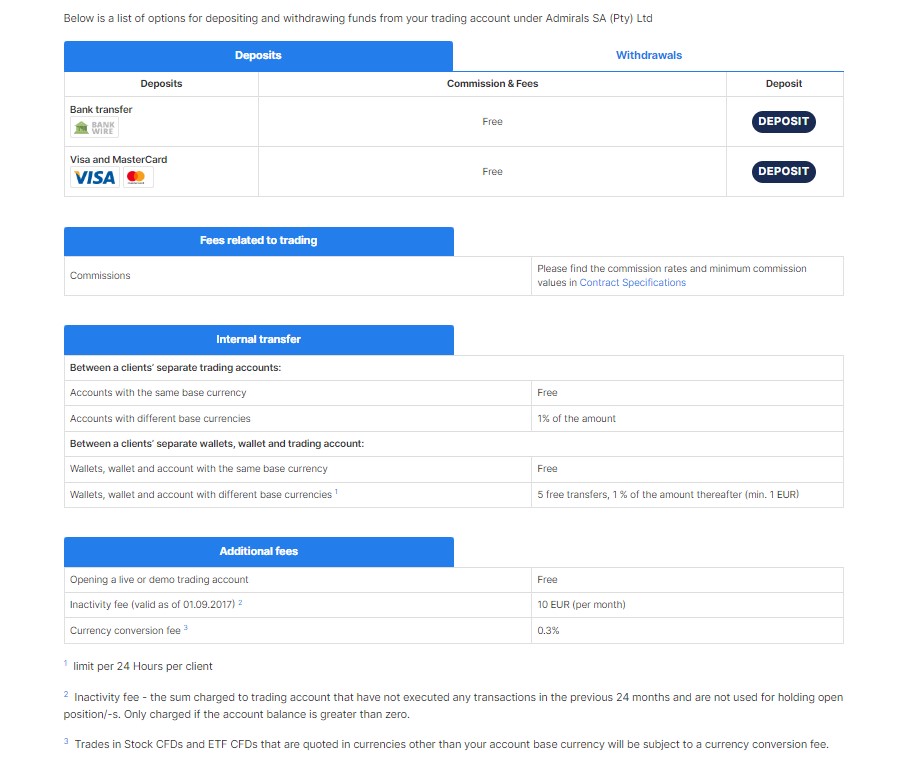

No deposit fees are charged when using Paypal, debit and credit cards, or doing bank transfers. When withdrawals are done using Paypal, Skrill, Bank wire or Neteller, customers can request 2 withdrawals free of charge every month.

Unfortunately, no third-party deposits are accepted by Admirals and fees will always be charged using the same currency as the trader’s preferred account currency.

USD 1 ASIC, FCA, EFSA, CySEC 📱 Platforms MT4, MT5, Admirals app ₿ Crypto Yes 💵 Account Currency USD, CHF, EUR, BGN, HRK, PLN, RON, CZK, HUF, GBP Yes 1:30 🛒 Instruments Forex, Commodities, Indices, Stocks, ETFs, Bonds 🏛️ Visit Broker

The only additional fees incurred when trading is when overnight positions are held for rollovers.

Deposits and Withdrawals

Even though Admirals does not allow bank cash deposits as a payment option, they do offer a variety of transaction options using popular deposit and withdrawal methods for the customer’s convenience.

Customers can make local deposits using Klarna, which is available in Germany, Belgium, the United Kingdom, Austria, Italy, the Netherlands, Hungary, Czech Republic, Spain, Slovakia and France.

Traders can use credit cards from several major companies, including Mastercard and Visa. Paypal is also an option for customers who prefer not to use credit cards.

Bank wire deposits and withdrawals can be processed within 3 days, but all other deposit and withdrawal options are either instantaneous or take one day at most.

Withdrawals made under special conditions will be reflected within 3 days.

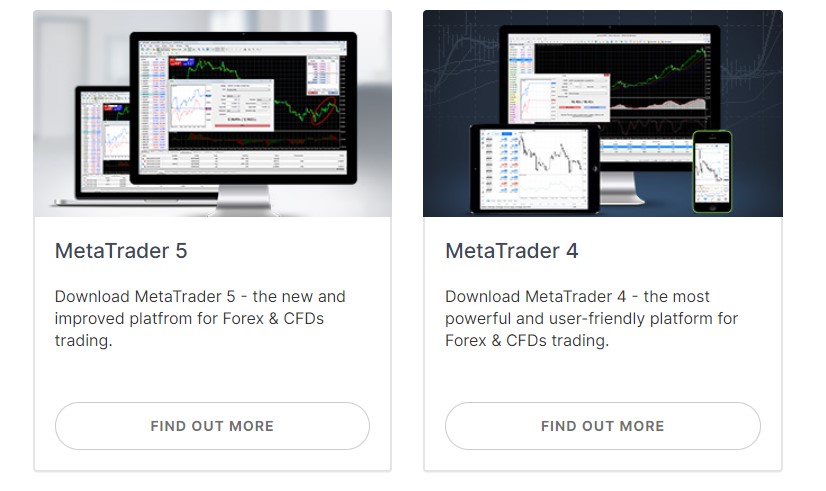

Trading Platforms

Admirals offers access to popular, trusted trading platforms:

- Desktop Trading – use your desktop with full account functionality

- Mobile Trading – Android and IOS compatibility with your smartphone

- Web Trading – trade directly online without downloading any software

- MetaTrader 4 – a popular retail Forex trading platform, mostly used by speculative traders.

- MetaTrader 5 – a free app that can be used to perform technical analysis and trading operations in Forex markets

These customisable, user-friendly platforms give traders access to a vast library of educational content with free market data, news and analysis updates.

Customers will also have Virtual Private Server (VPS) support and access to thousands of global markets that can be navigated using charting tools and automated trading.

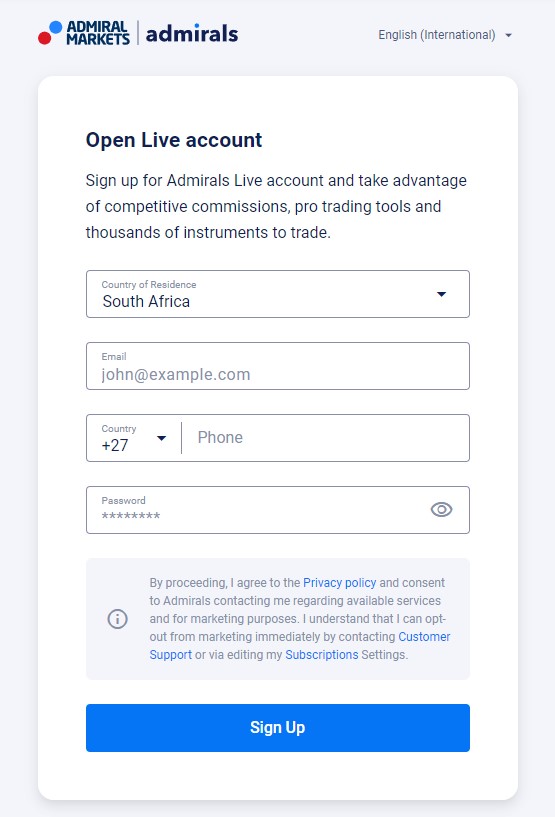

How to Open an Admirals Account

Creating an Admirals account is easy and involves the following steps:

- Visit the website and select “Start Trading”

- Fill in all your personal details

- Sign up and activate your account using the link in your email

- Supply documentation confirming identification and citizenship

- Answer some personal preference questions about trading aims and trading experience

- Accept terms and conditions and create a password

- Download and install the trading platform

- Begin your trading journey!

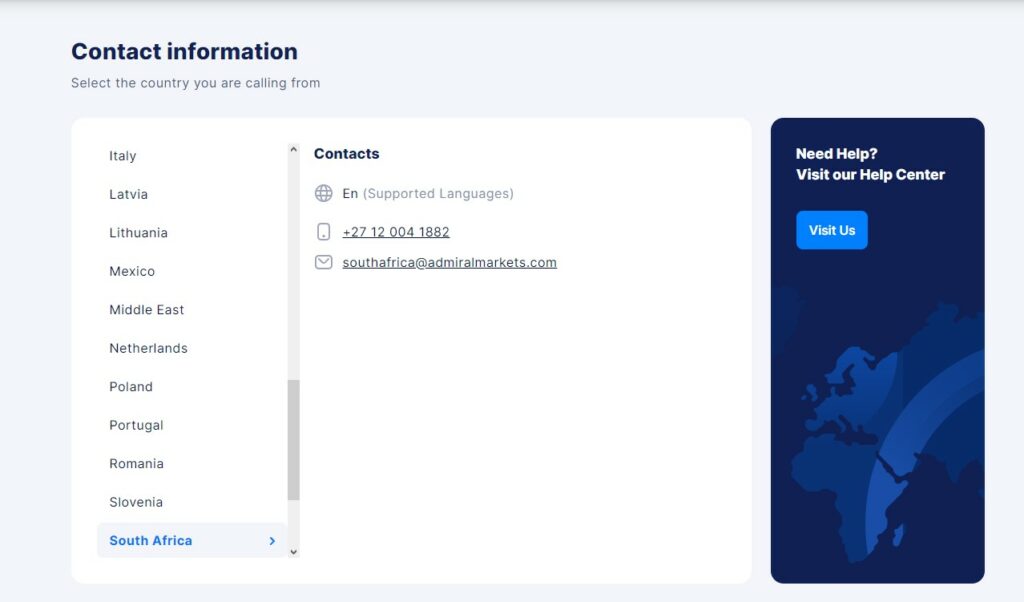

Customer Support

Admirals prioritizes customer satisfaction and takes pride in the positive reviews customers have given over the years.

Customers can request assistance by using live chat, emails and phone calls.

Customer support is offered by a multi-lingual team of professionals who ensure that all queries and issues are resolved within reasonable timeframes.

They communicate in English, Bulgarian, Spanish, Hungarian, Ukrainian, Croatian, Czech, French, Dutch, Russian, Estonian, French, Lithuanian, Slovenian, German, Polish, Serbian, Romanian and Greek.

Traders can use the remote support software application to resolve technical issues regarding the website and Metatrader platforms, without the need of going through various support channels for answers they seek.

Some customers may find that their questions are answered already under the FAQ section of the website or by scanning through the list of educational resources and company documentation made available to the public.

Educational Resources

There is an incredible section on the website that is dedicated to educational content, which is categorised based on whether the trader has a beginner, intermediate or advanced understanding of trading.

All educational resources and tools are free of charge and anyone can access their vast library of articles, webinars and online courses.

Traders will find a special Trader’s Glossary that will familiarize them with common trading terminology, and they can also find content regarding risk management and what to do during sudden market changes, explanations of market-neutral trading strategies and how to use them, FAQ and an e-book about the basics of blockchains.

Research Tools

Managing risks should be a priority for all traders. Fortunately, Admirals offers innovative research tools, automated trading functionality and risk management strategies, which can be used as guidelines for trading responsibly.

The Trader’s Blog makes it easy for traders to spot profitable trading opportunities and keep track of price movements.

Premium Analytics will give customers access to updated and relevant market news, technical analysis, economic calendars and global sentiment indicators.

Market sentiment is a visual, graphical representation of the general activity and attitude of traders regarding specific markets.

Analytics also gives traders access to the top news updates in crypto markets and economic activity, along with comparisons of global economies, market overviews and changes in interest rates.

Research content is provided by some of the highest-ranking financial firms globally, such as Down Jones, Acuity and Trading Central.

Accolades

Admirals has received the following rewards since it was launched:

CFD Broker Awards:

- 2016 – 5 stars for Best CFD Broker, awarded by DKI Customer’s Choice

- 2018 – 5 stars for Best CFD Broker, awarded by DKI Customer’s Choice

- 2018 – Best CFD Broker 1st place for three consecutive years, awarded by Brokervergleich

- 2019 – 5 stars for Best CFD Broker, awarded by DKI Customer’s Choice

- 2019 – 1st place for Best CFD Broker, awarded by Broker-Wahl Awards

- 2021 – Best CFD Broker of 2021, awarded by the German Customer Institute

Forex Broker Awards:

- 2018 – 1st place for Best Forex Broker for 4 consecutive years, awarded by Onlinebroker-Portal.de

- 2018 – Best Forex Broker, awarded by Brokervergleich

- 2020 – Brokerage CEO of the Year in Europe, awarded by Global Banking and Finance Review awards

Forex Platform Awards:

- 2019 – Best Forex Platform, awarded by ADVFN International Financial Awards

Conclusion

Admirals is the top choice for over 100,000 traders, who value the effort that goes into providing reliable market and economic news, educational content that is free and relevant, and the wide range of trading tools and account features, which makes trading with this brokerage enjoyable and risk-free.

They are also compliant with all financial regulations and trading rules and have been awarded over the years for their excellent services, platform functionality and CFD options.

Traders will appreciate the transparency around costs, as there are no hidden fees. Their withdrawals and deposits are processed either instantaneously or within a maximum of 3 days and are free of charge.

Trading experience is not an issue when using this brokerage because they offer all the educational resources and support that any trader would need, and demo accounts can be used to learn how to trade or to test new strategies.

USD 1 ASIC, FCA, EFSA, CySEC 📱 Platforms MT4, MT5, Admirals app ₿ Crypto Yes 💵 Account Currency USD, CHF, EUR, BGN, HRK, PLN, RON, CZK, HUF, GBP Yes 1:30 🛒 Instruments Forex, Commodities, Indices, Stocks, ETFs, Bonds 🏛️ Visit Broker

We hope that this Admirals Broker Review helps you find a broker that aligns with your trading goals.

Good luck with your trading!

Disclaimer

Remember, 75% of retail investors lose money when trading CFDs and there is a high risk of losing your capital in the forex markets.

The information on this website is in no way intended to be used as financial advice and opening an account with any broker is done at your own discretion and risk.

Table of Contents

Toggle