When investors trade Gold, they speculate on the prices of gold markets to make a profit. In this article, we will review the features, trading conditions and pros and cons of the 15 Best Gold Trading Brokers.

Gold is usually traded in the form of futures, options, spot prices or shares and exchange-traded funds (ETFs). Physical gold bars are not handled when a transaction takes place and transactions are settled in cash instead.

Gold typically moves in long-term trends and a gold trading strategy is generally a combination of fundamental, sentimental, and technical analysis.

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

Gold coins, along with Krugerrands, can be purchased from the South African Mint or through an authorised coin dealer. If you are interested in buying gold coins, you can find a list of accredited authorised gold coin dealers on the South African Mint website.

Our 5 Best Gold Trading Brokers are:

🏆Tickmill

🏆Plus500

🏆FXTM

Vantage

So, let’s find out which brokers you can trade with if you are interested in trading Gold:

Tickmill

As a Tickmill client, you can trade Energies, Stocks, Commodities, Forex, Indices, Bonds, CFDs, Metals and Shares, and a great variety of trading tools, such as Autochartist, Myfxbook and Pelican trading features, are available.

USD 100 FCA, FSCS, FSA, CYSEC, MiFID, ESMA 📱 Platforms MT4, MT5 ₿ Crypto Yes 💵 Account Currency EUR, GBP, USD Yes 1:500 🛒 Instruments Stocks, Shares, Indices, Metals, Energies, Bonds, CFDs, Forex, Commodities 🏛️ Visit Broker

This broker is suitable for inexperienced traders and is regulated by MiFID, FSCS, CYSEC, ESMA, FSA, FCA.

Pros and Cons of Tickmill:

| ✔️Pros | ❌Cons |

| Negative Balance Protection | No US clients |

| MetaTrader support | 3 base currencies |

| Trading bonuses | No crypto |

| Many regulations | |

| Beginner-friendly |

Plus500

There are two account types offered by Plus500, one for retail traders and the other for professionals.

USD 100 FCA, CySEC, ASIC, FMA 📱 Platforms Plus500 app ₿ Crypto Yes 💵 Account Currency USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, SGD Yes 📊 Leverage 1:300 🛒 Instruments Forex, Indices, Cryptocurrency, Commodities, Shares, Options, ETFs 🏛️ Visit Broker

Since its founding in 2008, Plus500 has served more than 22 million customers.

With minimal spreads and in-the-moment quotes, Plus500 offers commission-free trading.

A FTSE 250 company, Plus500 is traded on the London Stock Exchange.

Pros and Cons of Plus500

| ✔️Pros | ❌Cons |

| 22mil+ clients | Does not support copy trading, hedging or scalping |

| 2,800+ instruments | Inactivity fee |

| 16 Account currencies supported | Futures account only available in US |

| Highly regulated |

FXTM

FXTM is a broker that is governed internationally and has more than 4 million clients.

USD 10 CySEC, FCA, FSC 📱 Platforms MT4, MT5, FXTM Trader ₿ Crypto No 💵 Account Currency USD, EUR, GBP, NGN Yes 1:2000 🛒 Instruments Metals, Stocks, CFDs, Indices, Forex, Commodities 🏛️ Visit Broker

Spreads starting at 0 pip are available, and FXTM has more than 1,000 trading instruments.

For beginners, FXTM is a fantastic option because it offers a wealth of educational materials.

FXTM Pros and Cons:

| ✔️Pros | ❌Cons |

| Tight spreads | No US clients allowed |

| Fast trade execution | Penalty fees for inactive users |

| Option to start trading with $10 |

Vantage

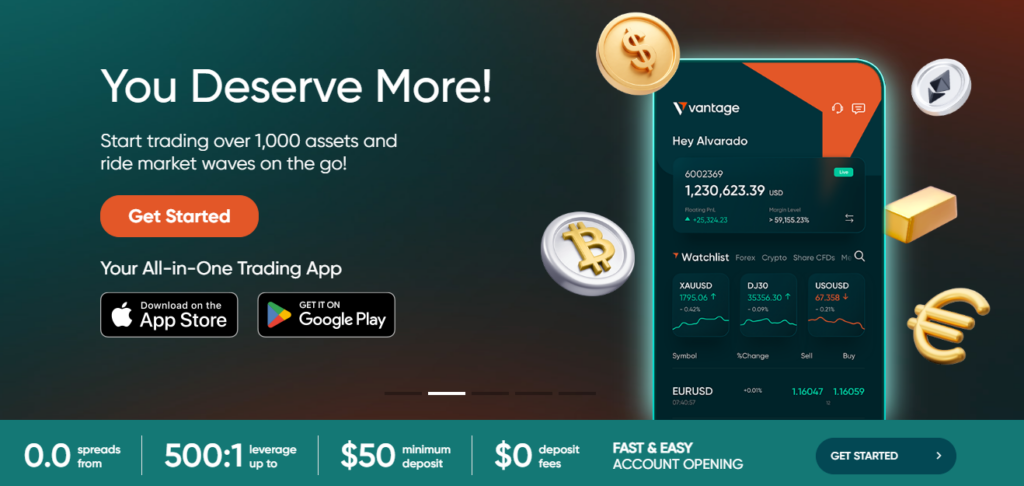

Vantage is a popular low-cost CFD broker that provides free market insights and offers more than 300 instruments.

USD 200 ASIC, FCA, CIMA 📱 Platforms MT4, MT5, Vantage app, Protrader, Metaquotes apps, ZuluTrade, DupliTrade, MyFxBook ₿ Crypto No 💵 Account Currency AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD Yes 1:500 🛒 Instruments Forex, Indices, Energy, Soft commodities, Metals, CFDs 🏛️ Visit Broker

Vantage is a great option for beginners and you can visit the educational section of this broker’s website to learn the basics of trading.

Vantage also offers professional-level trading tools and market news.

Vantage Pros and Cons:

| ✔️Pros | ❌Cons |

| Commission-free trading | Commission-free account has higher spreads |

| Tight spreads | Non-withdrawable deposit |

| No deposit fees |

FXCM

USD 50 ASIC, FCA, FSCA 📱 Platforms Trading Station, MT4, NinjaTrader, ZuluTrade, Capitalise AI, TradingView ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, CHF Yes 1:200 🛒 Instruments Forex, Shares, Indices, Crypto, Commodities 🏛️ Visit Broker

FXCM rewards its clients with cash rebates and a referral program, and also accommodates for beginners by providing a wide range of trading material to help inexperienced traders learn how to trade with ease.

USD 50 ASIC, FCA, FSCA 📱 Platforms Trading Station, MT4, NinjaTrader, ZuluTrade, Capitalise AI, TradingView ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, CHF Yes 1:200 🛒 Instruments Forex, Shares, Indices, Crypto, Commodities 🏛️ Visit Broker

As an FXCM client, you will be able to trade Commodities, Shares, Crypto, Forex and Indices, and a minimum deposit of only 50 USD can get you started.

FXCM Pros and Cons:

| ✔️Pros | ❌Cons |

| Suitable for copy traders | High bank withdrawal fees |

| Plenty of educational content | 4 base currencies |

| Trading bonuses | Penalty fees for inactivity |

| Low minimum deposit |

OctaFX

USD 100 FSA, SVGFSA 📱 Platforms MT4, MT5, OctaFX app ₿ Crypto Yes 💵 Account Currency EUR, USD Yes 1:500 🛒 Instruments Forex, CFDs, Stocks, Commodities, Cryptocurrencies 🏛️ Visit Broker

OctaFX is an Indonesian-based Forex broker that specializes in STP/ECN Forex trading and Commodities.

All major currency pairs are offered with a maximum leverage of 1:500, and the OctaFX server can be reached by clients from more than 100 countries.

OctaFX is compatible with MetaTrader 4 and 5, and cTrader. Traders have Negative Balance Protection and no slippage.

OctaFX Pros and Cons

| ✔️Pros | ❌Cons |

| No commission accounts | Tradable instruments are lacking |

| Freed deposits and withdrawals | Limited educational resources |

| Compatibility with popular platforms | VPS not offered |

| Regulated by CySEC | |

| Forex and stock index CFD fees are low | |

| Easy to make deposits and withdrawals |

BDSwiss

USD 200 CySec, FSC, FSA, BaFin, NFA 📱 Platforms MT4, MT5, BDSwiss app Yes 💵 Account Currency EUR, USD, GBP, PLN, CHF, SEK, DKK, NOK Yes 1:500 🛒 Instruments Forex, Commodities, Shares, Indices, Cryptocurrencies

BDSwiss is regulated by CySEC, FSC, FSA and BaFIN, and offers its own innovative proprietary trading platform.

This broker offers demo accounts and swap-free accounts for clients of the Muslim faith and offers more than 250 trading instruments and a trading academy for inexperienced traders.

A minimum deposit of 100 USD is required to activate a live trading account with BDSwiss and accounts can be funded using USD, EUR or GBP.

Pros and Cons of BDSwiss:

| ✔️Pros | ❌Cons |

| Many top-tier regulations | 3 base currencies |

| Trading academy | No US clients |

| Instant withdrawals | |

| Beginner-friendly |

XTB

USD 0 FCA, KNF, CySEC, IFSC 📱 Platforms xStation 5 ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, HUF Yes 📊 Leverage 1:500 🛒 Instruments 2,100+ Forex, Commodities, Indices, Crypto, Stocks, ETFs, CFDs 🏛️ Visit Broker

XTB is a Forex and CFD broker that is governed by the FCA. It was established in 2002.

With just one account type that can be used to trade more than 2,100 instruments, XTB has amassed close to 400,000 devoted customers.

New traders can use XTB’s trading academy to learn about the fundamentals of trading, and a variety of training programs are offered, depending on experience levels.

XTB Pros and Cons:

| ✔️Pros | ❌Cons |

| 2,100+ instruments | Inactivity fees |

| No minimum deposit | No USA clients |

| Beginner-friendly | No MetaTrader support |

| Cashback rebates |

Saxo Bank

USD 2000 FCA, ASIC, FSC, JFSA, FSA, MAS 📱 Trading Desk SaxoTraderGO, SaxoTraderPRO ₿ Crypto Yes 📈 Total Pairs 182 No Low 🕒 Account Activation Time 24 Hours 🏛️ Visit Broker

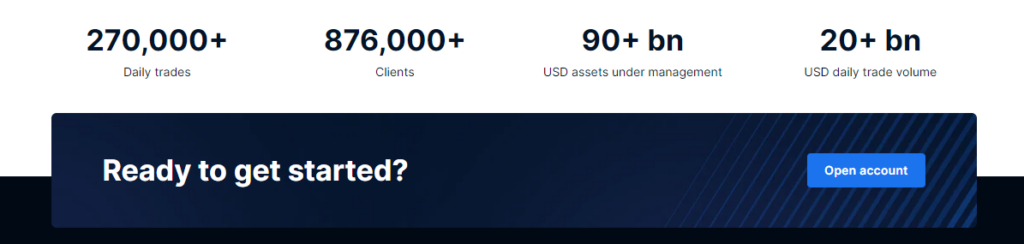

With more than 800,000 clients worldwide and 40,000 tradeable instruments, Saxo Bank is well-established and fully regulated.

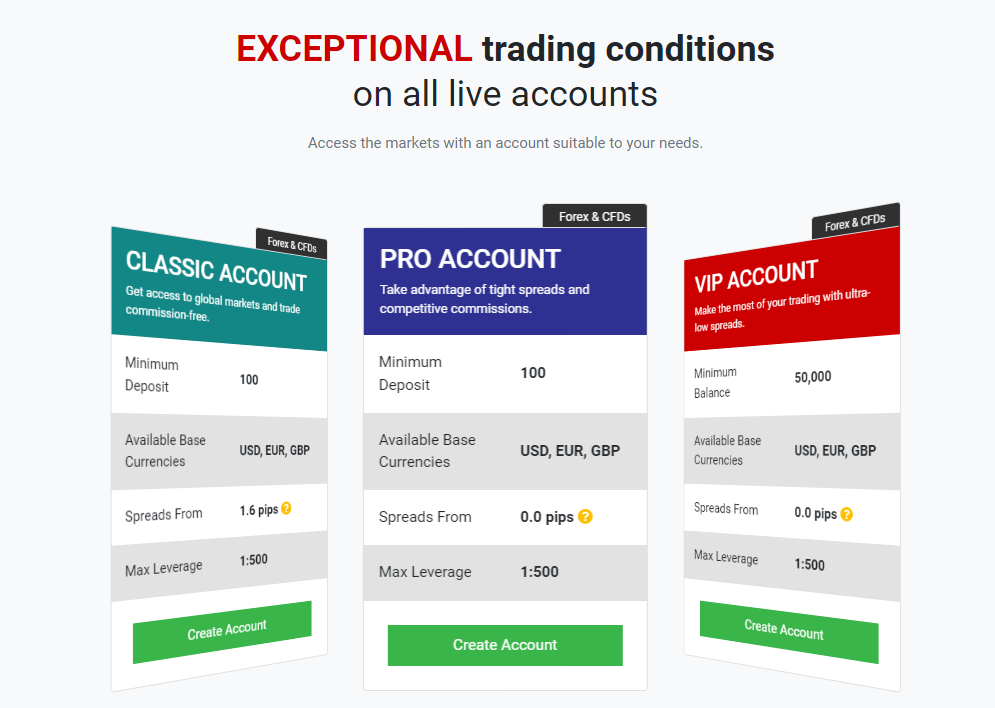

Saxo Bank serves corporate traders, professional traders, and casual retail traders with its three account tiers, Classic, Platinum, and VIP.

Customers of Saxo Bank are rewarded for qualifying trades through a special loyalty point system, and these points can be used as an alternative source of funding for their platinum and VIP accounts.

Saxo Bank Pros and Cons:

| ✔️Pros | ❌Cons |

| Innovative point system | Minimum deposit is high |

| Advanced research data and tools | Not compatible with MetaTrader platforms |

| Withdrawals are free | Penalty fee for inactivity |

| Forex fees are low |

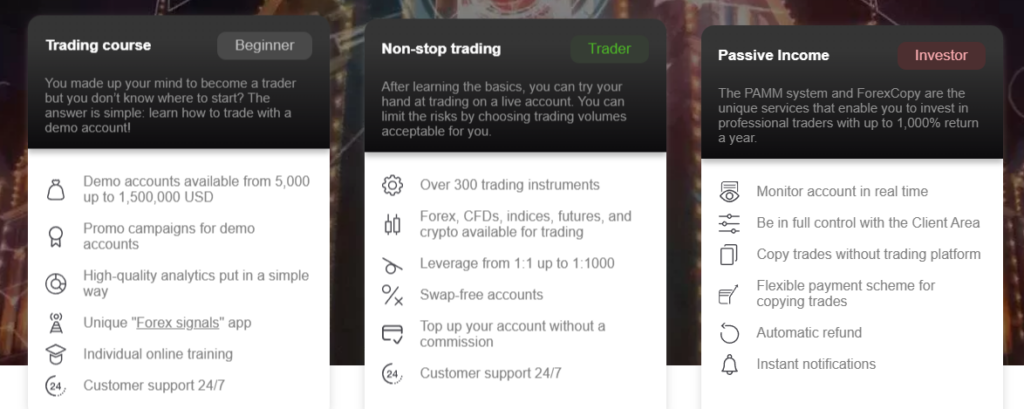

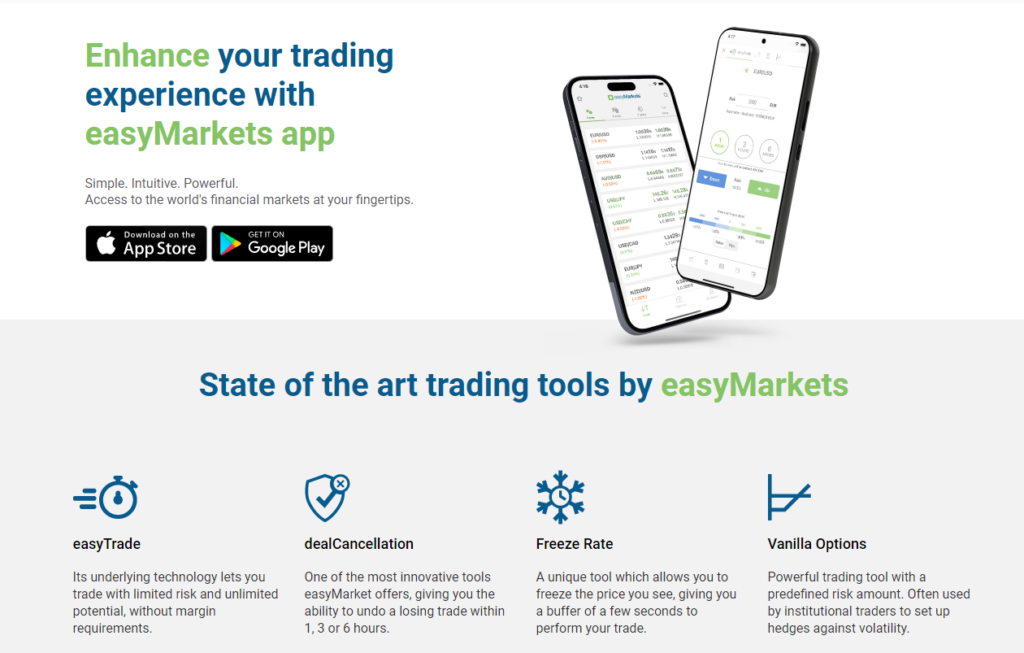

InstaForex

USD 1 FSC, BVI, CySEC 📱 Platforms MT4, MT5, InstaTick Trader ₿ Crypto Yes 💵 Account Currency EUR, USD Yes 1:1000 🛒 Instruments Forex, Stocks, Indices, Metals, Oil, Gas, Commodity Futures, Crypto, InstaFutures 🏛️ Visit Broker

Providing Forex brokerage services since 2007, InstaForex has been maintaining a reputation of being able to provide a capable product offering that can appeal to all traders.

InstaForex gives traders access to an average Forex trading platform available on desktop and mobile but is not equipped with customised features.

Educational and research resources are limited in scope and traders may find little use for them.

Creating an account is quite easy and supported by a capable support team who are able to assist around the clock.

InstaForex Pros and Cons

| ✔️Pros | ❌Cons |

| Quick registration | Support only during work week |

| Wide selection of products | Commissions on withdrawals |

| Great customer support | |

| Commission-free account | |

| Plenty of educational material | |

| Trading and economic calendar | |

| Strict regulatory body |

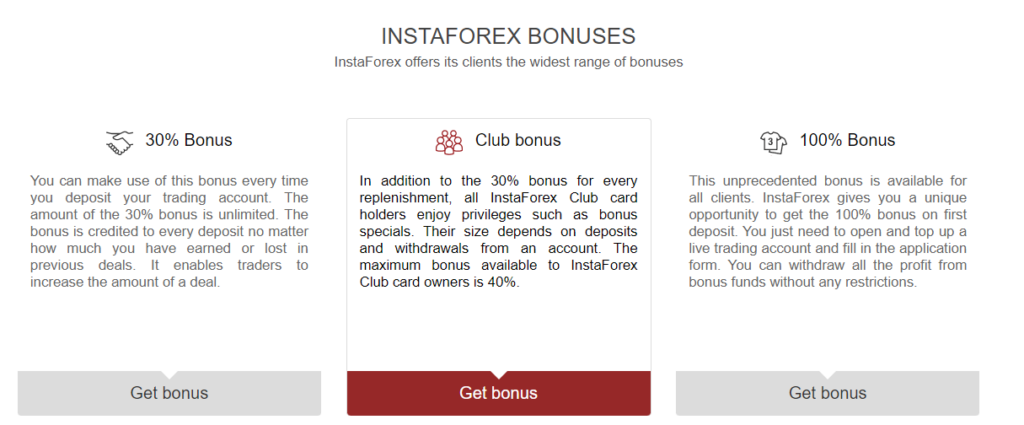

easyMarkets

USD 25 CySEC, ASIC, FSA 📱 Platforms MT4, TradingView, easyMarkets app ₿ Crypto Yes 💵 Account Currency EUR, CAD, CZK, JPY, NZD, USD, SGD, CHF, GBP, MXN, AUD, PLN, TRY, CNY, HKD, NOK, SEK, ZAR, BTC Yes 1:400 🛒 Instruments Forex, Shares, Crypto, Metals, Commodities, Indices 🏛️ Visit Broker

EasyMarkets is a beginner-friendly broker that offers a selection of instructional manuals, platform user guides, and 10 free eBooks that can be downloaded on various topics.

The tools available from this broker are specific to its product offering and include dealCancellation and Freeze Rates.

Easy Markets accounts feature fixed spreads, no slippage, guaranteed stop losses, and negative balance protection.

easyMarkets Pros and Cons:

| ✔️Pros | ❌Cons |

| 19 base currencies supported | Not available to US citizens |

| Fixed spreads | |

| Negative Balance Protection |

Alpari

USD 5 FSC 📱 Platforms MT4, MT5, Alpari Mobile ₿ Crypto No 💵 Account Currency USD, EUR, GBP, NGN Yes 1:1000 🛒 Instruments Forex, Metals, CFDs 🏛️ Visit Broker

Alpari has over 2 million active traders and boasts 20 years of experience in the Forex trading industry, and is regulated by the Financial Services Commission of Mauritius

Traders can choose from more than 250 instruments in the markets of stocks and currencies.

Beginners can use a free demo account along with a variety of educational courses and guides so that they can learn to trade in a risk-free environment.

Experienced traders have access to CopyTrading features and advanced Strategy Managers that can be used on the MetaTrader platforms.

Pros and Cons of Alpari:

| ✔️Pros | ❌Cons |

| Comprehensive educational resources | No fixed spread accounts |

| CopyTrading platform | Not regulated by CySEC, ASIC or FCA |

| Multilingual customer support team | |

| Autochartist signals |

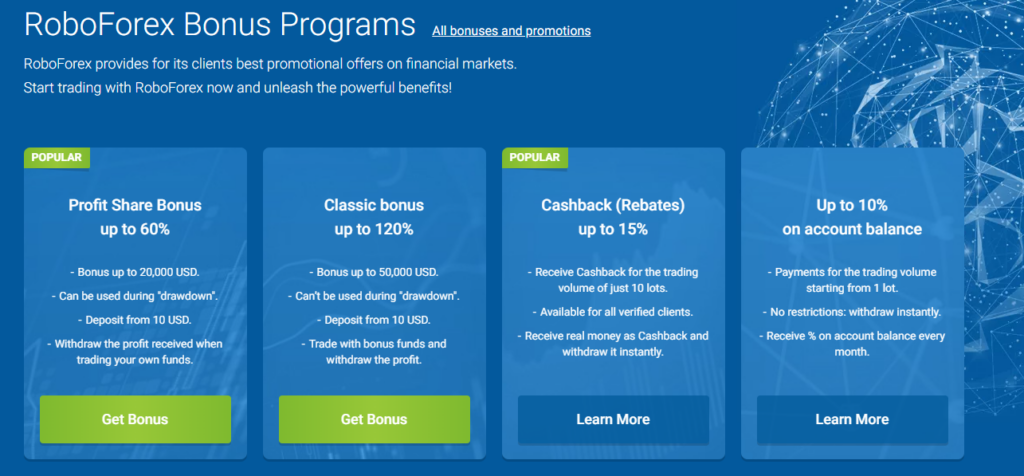

RoboForex

USD 10 IFSC, CySEC 📱 Platforms MT4, MT5, cTrader, R Stocks Trader ₿ Crypto Yes 💵 Account Currency USD, EUR, RUB, CNY, GOLD, BTC Yes 1:2000 🛒 Instruments Forex, Indices, Stocks, Metals, Commodities, ETFs 🏛️ Visit Broker

RoboForex is an award-winning Forex broker that was founded in 2009 and is regulated by IFSC.

RoboForex provides five flexible trading accounts, as well as demo and Islamic accounts, and clients can use MetaTrader, cTrader, R StocksTrader and WebTrader.

RoboForex is trusted by over 800,000 active traders and clients have access from 169 countries globally.

RoboForex offers access to more than 12,000 markets and 7 asset classes.

RoboForex also dedicates an entire section of the website to educating amateur traders and more experienced traders have access to a variety of advanced trading tools.

Pros and Cons of RoboForex

| ✔️Pros | ❌Cons |

| Flexible account types | Not regulated by ASIC or FCA |

| Great affiliate program | USA clients not accepted |

| Excellent variety of educational content | |

| Negative Balance Protection | |

| Free VPS server |

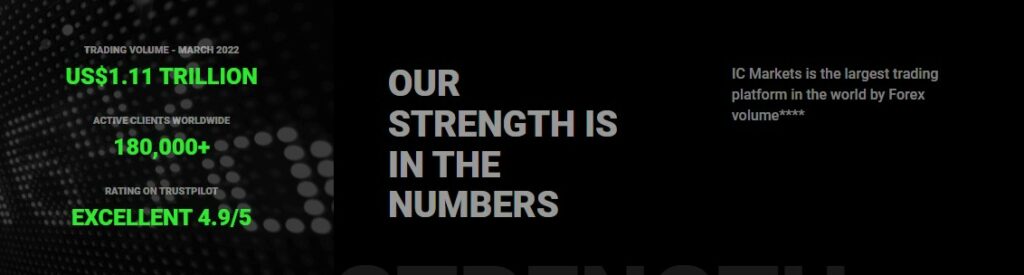

IC Markets

USD 200 FSA, CySEC, ASIC 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF Yes 1:500 🛒 Instruments Stocks, Commodities, Indices, Forex, Bonds, Crypto, Futures 🏛️ Visit Broker

More than 1,980 instruments are available through IC Markets, a well-known CFD broker.

Low latency trading and tight spreads starting at 0 pip are available at IC Markets.

With IC Markets, you can trade more than 1,800 stocks and more than 60 different currency pairs.

Three different account types and commission-free trading are available from IC Markets.

IC Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No USA clients |

| No withdrawal fees | Commission fees on ⅔ accounts |

| 2,250+ instruments |

FxPro

USD 100 FCA, CySEC, FSCA 📱 Platforms FxPro platform, cTrader, MT4, MT5 Yes 💵 Account Currency EUR, USD, GBP, CHF, PLN, AUD, JPY, ZAR Yes 📊 Leverage 1:200 🛒 Instruments Forex, Metals, Indices, Shares, Energies

More than 2100 instruments from 6 asset classes can be traded on the FxPro platform, and a live account can be opened for just $100.

Since its founding in 2006, FxPro has served more than 21 million clients.

FxPro is a great choice for social trading and copy trading because it has 2,100 instruments available.

More than 95 international awards have been given to FxPro, and its customer service is well-regarded.

FxPro Pros and Cons:

| ✔️Pros | ❌Cons |

| Highly regulated | Only 1 account type offered |

| 8 Base currencies | Inactivity fee charged |

| Supports Copy trading and Social trading | No clients from USA, Canada & Iran |

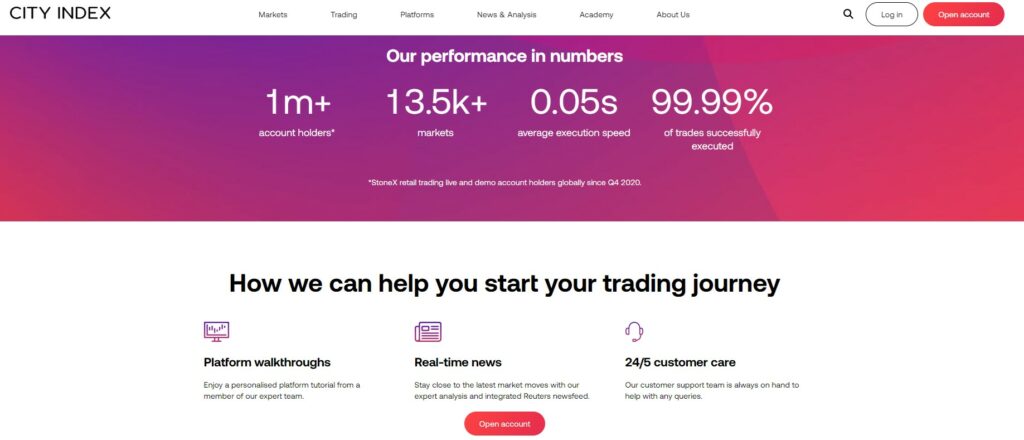

City Index

£50 IIROC, JFSA, ASIC, FCA, CFTC MT4, City Index app ₿ Crypto No USD, CHF, EUR, GBP, HUF, AUD, JPY, PLN Yes 1:30 🛒 Instruments Indices, Shares, Forex, Metals Bonds, Options, Commodities 🏛️ Visit Broker

City Index (a subsidiary of StoneX Financial Ltd. and GAIN Capital Holdings Inc) was founded in 1983 and has over 300,000 clients.

City Index offers both fixed and variable spreads and there are over 12,000 instruments you can trade with them.

City Index offers a variety of trading tools, as well as articles, market news and trading courses and guides.

Pros and Cons of City Index:

| ✔️Pros | ❌Cons |

| 5+ account currencies | Inactivity fee payable |

| 12,000+ markets | Low leverage |

| Many regulations | |

| beginner-friendly |

Conclusion

Gold is a valuable commodity and is one of the rarest Precious Metals. This asset can be used for hedging and does not lose its value, making it a great addition to any tye of investment portfolio.

We hope that this review of our 15 Best Gold Trading Brokers will help you find a broker that aligns with your trading goals so that you can trade with confidence and peace of mind.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Best Precious Metal Trading Brokers

You might also like: Best Stock Trading Brokers

You might also like: Best Forex Silver Trading Brokers

You might also like: Best Hedging Forex Brokers

FAQ

Why is gold a valuable commodity?

Some of the reasons why Gold is so valuable are:

- Gold does not corrode or deteriorate

- Gold is much rarer than silver

- Gold is used for the refinement of valuable jewellery

- Gold can be exchanged for money and used as a store of value

Why should you trade Gold?

Gold markets have high liquidity and this precious metal does not lose value. It is often used for hedging and is a valuable asset to have when markets are volatile.

Which are the best gold trading brokers?

Our 5 Best Gold Trading Brokers are:

- Tickmill

- Plus500

- FXTM

- Vantage FX

- FXCM

What ticker symbol is Gold?

The ticker symbol for Gold is XAU

Table of Contents

Toggle