One of the advantages of trading precious metals is that these instruments are rarely affected by political and economic events. In this article, we will review the features, trading conditions and pros and cons of the 15 Best Precious Metal Trading Brokers.

One of the advantages of trading precious metals is that these instruments are rarely affected by political and economic events. In this article, we will review the features, trading conditions and pros and cons of the 15 Best Precious Metal Trading Brokers.

What is Precious Metal Trading?

When Precious Metals are traded, Gold and Silver are usually exchanged for a major currency. For example, the pair XAGEUR (trades Silver against the Euro), or XAUGBP (Gold against the British Pound).

In most cases, Precious Metals are hedged against inflation, which is why precious metals are so popular. Even if the markets are unstable, precious metals always have some level of stability and high market potential.

Can Precious Metals be traded on spot markets?

Yes, Precious Metals can be traded on spot markets and spot metal traders use both long- and short-term price charts to monitor the price movements of these instruments.

Trades are placed depending on the direction prices appear to be going and depending on market volatility, investors will hold either short- or long-term positions.

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

Our Top 5 Precious Metal Trading Brokers are:

🏆OctaFX

🏆FXTM

So, let’s find out which brokers you can trade with if you are interested in trading Precious Metals:

OctaFX

OctaFx was established in 2011 and has been offering a wide variety of products to beginner and expert traders alike.

USD 100 FSA, SVGFSA 📱 Platforms MT4, MT5, OctaFX app ₿ Crypto Yes 💵 Account Currency EUR, USD Yes 1:500 🛒 Instruments Forex, CFDs, Stocks, Commodities, Cryptocurrencies 🏛️ Visit Broker

Traders will have access to a well-designed web and mobile platforms with amazing customer support to make sure that you’re kept away from any downtime.

OctaFx has research and educational tools that will prove to be useful to the expert and the novice and access to material is given to traders once they complete the fully digital and effortless process.

OctaFX Pros and Cons:

| ✔️Pros | ❌Cons |

| Good range of trading accounts | Withdrawal options are limited |

| Research tools are good | Inactivity attracts penalties |

| Extensive research tools | No VPS |

| Most competitive spread offering | Limited instruments |

| Advanced technology | |

| No fee on deposits or withdrawals | |

| Forex and stock index CFD fees are low |

FXTM

FXTM is a regulated broker that was founded in 2011 and has over 4 million clients.

USD 10 CySEC, FCA, FSC 📱 Platforms MT4, MT5, FXTM Trader ₿ Crypto No 💵 Account Currency USD, EUR, GBP, NGN Yes 1:2000 🛒 Instruments Metals, Stocks, CFDs, Indices, Forex, Commodities 🏛️ Visit Broker

FXTM offers three flexible types of accounts with tight spreads and commission-free instruments.

FXTM’s copy trading system allows traders to use more than 5,000 strategies that have been created and tested by professional traders.

FXTM Pros and Cons:

| ✔️Pros | ❌Cons |

| Low minimum deposit | Inactivity fees |

| Commission-free trading | No USA clients |

| Beginner-friendly |

eToro

eToro is a popular CFD broker that offers powerful copy trading technology.

USD 50 FCA, CySEC, ASIC 📱 Platforms eToro app, OpenBook, eToro CopyTrade ₿ Crypto Yes 💵 Account Currency USD, AUD, CNY, CAD, GBP, EUR, JPY, RUB Yes 1:30 🛒 Instruments Stocks, Commodities, Indices, Forex, ETFs, Cryptocurrencies 🏛️ Visit Broker

eToro was also one of the first brokers to ever offer copy trading and this broker is an excellent choice for social traders.

eToro has been around for many years and is trusted by more than 25 million traders around the world.

eToro Pros and Cons:

| ✔️Pros | ❌Cons |

| Commission-free instruments | Withdrawal fees |

| Available to USA clients | Inactivity fees |

| tier-1 regulations | |

| Social trading allowed |

FXCM

USD 50 ASIC, FCA, FSCA 📱 Platforms Trading Station, MT4, NinjaTrader, ZuluTrade, Capitalise AI, TradingView ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, CHF Yes 1:200 🛒 Instruments Forex, Shares, Indices, Crypto, Commodities 🏛️ Visit Broker

FXCM is a popular Forex broker with referral programs and rebate rewards and offers one trading account to access many international markets.

FXCM has been around for more than 20 years and is a trusted broker that can be used with MetaTrader 4 and Trading Station.

This is a well-regulated broker that is suitable for beginners and provides a demo account to practice on.

FXCM also accommodates institutional trading and offers news updates on markets and detailed analysis reports.

Pros and Cons of FXCM:

| ✔️Pros | ❌Cons |

| Great selection of tools | High Bank withdrawal fees |

| Comprehensive educational content | Limited products |

| Rebate and Referral Program | Penalty fees |

| Allows Copy Trading |

FP Markets

You can open a demo account with FP Markets or activate your live trading account with only 100 USD using several currencies, including CAD, USD, EUR, GBP, NZD, HKD, JPY, CHF, AUD and SGD.

USD 100 ASIC, CySEC 📱 Platforms MetaTrader 4, MetaTrader 5 ₿ Crypto Yes 💵 Account Currency EUR, GBP, USD, AUD, CAD, SGD, HKD, JPY, NZD, CHF Yes 1:500 🛒 Instruments Forex, Shares, Metals, Indices, Commodities, crypto 🏛️ Visit Broker

FP Markets offers a proprietary trading app with Expert Advisor support and free VPS, but you can also use MT4 and MT5.

This broker guarantees tight spreads and provides plenty of advanced trading tools and educational content.

Pros and Cons of FP Markets:

| ✔️Pros | ❌Cons |

| 10,000+ CFDs | No trading bonuses |

| Beginner-friendly | No fixed spreads |

| Tier-1 regulations |

AvaTrade

USD 100 MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA 📱 Platforms MetaTrader 4, MetaTrader 5 ₿ Crypto Yes 💵 Account Currency AUD, EUR, USD, GBP, CHF Yes 1:400 🛒 Instruments Forex, Bonds, Stocks, Commodities, ETFs, Indices, Crypto 🏛️ Visit Broker

AvaTrade is a broker that welcomes novice traders and provides a wide range of educational resources in addition to more sophisticated research and analysis tools for seasoned investors.

AvaTrade offers four flexible account types, demo accounts for new customers and beginners, Islamic accounts for customers of the Muslim faith, and other account types as well.

Halal Gold and Silver, Oil, Indices, and Forex can all be traded using the AvaTrade swap-free account.

AvaTrade Pros and Cons:

| ✔️Pros | ❌Cons |

| Quick and easy to open an account | No USA clients |

| Deposits and withdrawals are free | Inactivity fees |

| Beginner-friendly | |

| Highly regulated broker |

Forex.com

We recommend Forex.com if you trade high volumes or if you are interested in buying shares.

USD 100 FCA, IIROC, ASIC, CFTC 📱 Platforms MT4, MT5, Forex.com apps ₿ Crypto Yes 💵 Account Currency EUR, GBP, USD No 📊 Leverage 1:40 🛒 Instruments Forex, Indices, Stocks, Commodities, Metals, Crypto 🏛️ Visit Broker

This broker offers cash rebates for active traders and over 4,500 shares are offered for trading.

Forex.com requires an initial deposit of 50 USD and accounts can be funded using GBP, AUD, JPY, USD, EUR or CHF.

Pros and Cons of Forex.com:

| ✔️Pros | ❌Cons |

| Cash rebate program | No swap-free accounts |

| Beginner-friendly | Inactivity fees |

| Low minimum deposit |

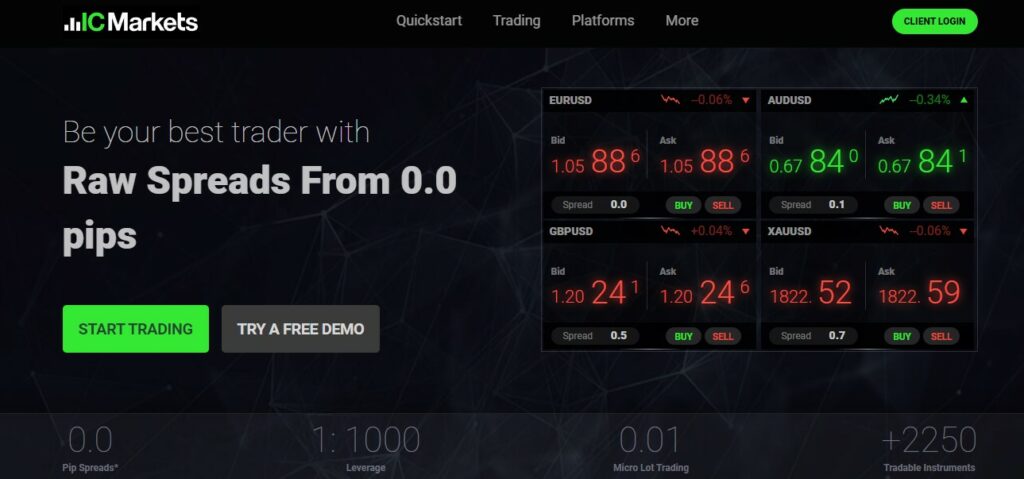

IC Markets

USD 200 FSA, CySEC, ASIC 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF Yes 1:500 🛒 Instruments Stocks, Commodities, Indices, Forex, Bonds, Crypto, Futures 🏛️ Visit Broker

More than 1,980 instruments are available from IC Markets, a well-known CFD broker.

Trading with IC Markets is quick and has tight spreads starting at 0 pip.

IC Markets offers over 1,800 stocks and more than 60 different currency pairs for trading.

Three different account types and commission-free trading are available from IC Markets.

IC Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No USA clients |

| No withdrawal fees | Commission fees on ⅔ accounts |

| 2,250+ instruments |

XTB

USD 0 FCA, KNF, CySEC, IFSC 📱 Platforms xStation 5 ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, HUF Yes 📊 Leverage 1:500 🛒 Instruments 2,100+ Forex, Commodities, Indices, Crypto, Stocks, ETFs, CFDs 🏛️ Visit Broker

Forex and CFD broker XTB was established in 2002 and is governed by the FCA.

With just one account type that can be used to trade more than 2,100 instruments, XTB has amassed close to 400,000 devoted customers.

The trading academy at XTB offers various training programs depending on experience levels, and new traders can use it to learn about the fundamentals of trading.

XTB Pros and Cons:

| ✔️Pros | ❌Cons |

| 2,100+ instruments | Inactivity fees |

| No minimum deposit | No USA clients |

| Beginner-friendly | No MetaTrader support |

| Cashback rebates |

Pepperstone

USD 200 ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency USD, GBP Yes Low 🛒 Instruments Forex, Crypto, Shares, ETFs, Indices, Commodities 🏛️ Visit Broker

Along with SMART trading tools, Autochartist, and Figaro advanced trading tools, Pepperstone offers a selection of tutorials and trading guides for new traders.

Scalping, hedging, and EA trading on Pepperstone accounts may result in legal action.

Pepperstone has more than 300,000 customers worldwide and provides two flexible account types.

Pepperstone Pros and Cons:

| ✔️Pros | ❌Cons |

| No withdrawal fee | No USA clients |

| Referral program | Low leverage cap |

| 1,200+ CFDs | 2 account currencies |

| No inactivity fees |

FxPro

USD 100 FCA, CySEC, FSCA 📱 Platforms FxPro platform, cTrader, MT4, MT5 Yes 💵 Account Currency EUR, USD, GBP, CHF, PLN, AUD, JPY, ZAR Yes 📊 Leverage 1:200 🛒 Instruments Forex, Metals, Indices, Shares, Energies

FxPro was established in 2006 and has more than 21 million customers.

FxPro is a fantastic choice for social trading and copy trading because it has 2,100 instruments available.

More than 95 international awards have been given to FxPro, and customers generally give the company’s customer service positive reviews.

FxPro Pros and Cons:

| ✔️Pros | ❌Cons |

| Highly regulated | No USA clients |

| 8 Base currencies | Inactivity fees |

| Supports Copy trading and Social trading |

Admirals

USD 1 ASIC, FCA, EFSA, CySEC 📱 Platforms MT4, MT5, Admirals app ₿ Crypto Yes 💵 Account Currency USD, CHF, EUR, BGN, HRK, PLN, RON, CZK, HUF, GBP Yes 1:30 🛒 Instruments Forex, Commodities, Indices, Stocks, ETFs, Bonds 🏛️ Visit Broker

FxPro was established in 2006 and has more than 21 million customers.

FxPro is a fantastic choice for social trading and copy trading because it has 2,100 instruments available.

More than 95 international awards have been given to FxPro, and customers generally give the company’s customer service positive reviews.

Admirals Pros and Cons:

| ✔️Pros | ❌Cons |

| Great range of research tools | Cash rebates only available to UK and Australian clients |

| Variety of accounts offered | Penalty fee for inactivity |

| Negative balance protection | |

| Good selection of educational content |

Interactive Brokers

USD 1 FSC, BVI, CySEC 📱 Platforms MT4, MT5, InstaTick Trader ₿ Crypto Yes 💵 Account Currency EUR, USD Yes 1:1000 🛒 Instruments Forex, Stocks, Indices, Metals, Oil, Gas, Commodity Futures, Crypto, InstaFutures 🏛️ Visit Broker

With its premium trading tools, Interactive Brokers enables trading on 130 different markets.

This beginner-friendly broker promises transparent trading and low trading costs.

With access to 80 global market centres, there are a total of more than 7,000 CFD products and more than 100 Forex pairs that can be traded.

Interactive Brokers Pros and Cons:

| ✔️Pros | ❌Cons |

| 100+ currencies | No swap-free accounts |

| No minimum deposit | Low leverage cap |

| Wide range of instruments | |

| 20+ account currencies |

OANDA

In 1996, OANDA, a broker with multiple licenses, was established.

With more than 70 forex pairs available, OANDA offers two different types of trading accounts.

You will get a welcome bonus when you sign up with OANDA.

A sophisticated trader program is also available from OANDA.

OANDA Pros and Cons :

| ✔️Pros | ❌Cons |

| Highly regulated with a good reputation | |

| High-volume traders can use the Active Trader account | No live chat |

| No minimum deposit | |

| Negative Balance protection |

Axi

USD 0 ASIC, FCA 📱 Platforms MT4, Myfxbook, PsyQuation ₿ Crypto Yes 💵 Account Currency AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, PLN, SGD, USD Yes 1:400 🛒 Instruments Forex, Cryptocurrencies, Metals, Indices, Commodities 🏛️ Visit Broker

Axi is suitable for both retail and institutional traders and charges no penalty fees for inactivity, unlike most other brokers.

This broker is regulated by ASIC and 2 other entities and offers flexible account types.

You can start trading with Axi without making an initial deposit and the platforms supported by Axi include Myfxbook, PsyQuation and MT4.

Pros and Cons of Axi:

| ✔️Pros | ❌Cons |

| Inactivity is not penalised | No trading bonuses |

| Low spreads | Account creation takes long |

| Multiple platforms | |

| No minimum deposit |

Conclusion

We hope that this review of our 15 Best Precious Metal Trading Brokers will help you find a broker that aligns with your trading goals so that you can trade with confidence and peace of mind.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Best Gold Trading Brokers

You might also like: Best Stock Trading Brokers

You might also like:Best Forex Silver Trading Brokers

You might also like:Best Hedging Forex Brokers

FAQ

What are precious metals?

Precious metals are used in industrial processes to manufacture components for electronics and chemical applications. The most popular precious metals are gold, platinum, and silver.

What is precious metal trading?

When Precious Metals are traded, Gold and Silver are usually exchanged for a major currency. For example, the pair XAGEUR (trades Silver against the Euro), or XAUGBP (Gold against the British Pound).

Which brokers offer spot metal trading?

Our Top 5 Precious Metal Trading Brokers are:

- OctaFX

- FXTM

- eToro

- FXCM

- FP Markets

What is Hedging?

Hedging is a popular investment strategy that uses financial instruments to offset the risks of unfavourable price movements to “Hedge” one investment by making a trade in another.

Precious metals are relatively stable all the time, so these instruments can be used to offset the risks of trading other more volatile instruments.

Table of Contents

Toggle