Silver is a precious metal that is frequently used as a safety net or inflation hedge. In this article, we reveal our 15 Best Silver Trading Forex Brokers and we review the features, trading conditions and instruments these brokers offer.

Contrary to traditional silver investing, which entails purchasing and holding silver bars and coins, silver trading allows you to access the market price without acquiring any actual physical silver.

Futures, spot prices, shares, and ETFs are used for the majority of silver trading. When you trade silver using futures contracts, you purchase a future supply of this valuable metal in physical form equal to a predetermined amount.

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

Silver trading gives you access to the market price without acquiring any physical silver, in contrast to traditional silver investing, which entails purchasing and storing silver bars and coins.

Our top 5 brokers for trading Silver are:

🏆 XTB

🏆 AvaTrade

🏆 IG

Plus500

So, let’s find out which brokers you can trade with if you are interested in trading Silver.

XTB

USD 0

FCA, KNF, CySEC, IFSC

📱 Platforms

xStation 5

₿ Crypto

Yes

💵 Account Currency

EUR, USD, GBP, HUF

Yes

📊 Leverage

1:500

🛒 Instruments

2,100+

Forex, Commodities, Indices, Crypto, Stocks, ETFs, CFDs

🏛️ Visit Broker

An FCA-approved Forex and CFD broker, XTB was established in 2002.

With just one account type that can be used to trade more than 2,100 instruments, XTB has amassed close to 400,000 devoted customers.

New traders can use XTB’s trading academy to learn about the fundamentals of trading, and various training programs are offered, depending on experience levels.

XTB Pros and Cons:

| ✔️Pros | ❌Cons |

| 2,100+ instruments | Inactivity fees |

| No minimum deposit | No USA clients |

| Beginner-friendly | No MetaTrader support |

| Cashback rebates |

AvaTrade

Since its founding in 2006, AvaTrade has served 300,000 traders as a fully-licensed CFD and Forex broker.

USD 100

MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA

📱 Platforms

MetaTrader 4, MetaTrader 5

₿ Crypto

Yes

💵 Account Currency

AUD, EUR, USD, GBP, CHF

Yes

1:400

🛒 Instruments

Forex, Bonds, Stocks, Commodities, ETFs, Indices, Crypto

🏛️ Visit Broker

AvaTrade is governed and authorized globally across 5 continents and has received more than 100 international awards.

In addition to demo accounts for new customers and beginners and Islamic accounts for customers of the Muslim faith, AvaTrade offers four flexible account types.

AvaTrade Pros and Cons:

| ✔️Pros | ❌Cons |

| Quick and easy to open an account | Service not offered to US citizens |

| Deposits and withdrawals are free | Higher than average spreads |

| Great educational materials | High inactivity fees |

| Highly regulated |

IG

With more than 300,000 clients and access to more than 17,000 international markets, IG was established in 1974 as an award-winning CFD and Forex broker.

USD 0

FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC

📱 Platforms

MT4, ProRealTime, L2 Dealer

₿ Crypto

Yes

💵 Account Currency

USD, GBP, AUD, EUR, SGD, HKD

Yes

1:30

🛒 Instruments

Crypto, Forex, Indices, Shares, Commodities

🏛️ Visit Broker

In addition to facilitating corporate, institutional, and retail trading, IG offers top-notch services for professional traders.

In addition to supporting API and algorithmic trading, IG is compatible with ProRealTime and MetaTrader platforms.

IG Pros and Cons:

| ✔️Pros | ❌Cons |

| Exceptional web platform | Product portfolio needs more options |

| Great educational tools | Phone support could be better |

| Low trading fees |

Plus500

There are two account types offered by Plus500, one for retail traders and the other for professionals.

USD 100 FCA, CySEC, ASIC, FMA 📱 Platforms Plus500 app ₿ Crypto Yes 💵 Account Currency USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, SGD Yes 📊 Leverage 1:300 🛒 Instruments Forex, Indices, Cryptocurrency, Commodities, Shares, Options, ETFs 🏛️ Visit Broker

More than 22 million people use Plus500, which was established in 2008.

With small spreads and real-time quotes, Plus500 offers commission-free trading.

A FTSE 250 company, Plus500 is listed on the London Stock Exchange.

Plus500 Pros and Cons:

| ✔️Pros | ❌Cons |

| 22mil+ clients | Does not support copy trading, hedging or scalping |

| 2,800+ instruments | Inactivity fee |

| 16 Account currencies supported | Futures account only available in US |

| Highly regulated |

eToro

Since 2007, eToro has developed into one of the most well-known and reputable brokers for the NASDAQ100 and stocks.

USD 50 FCA, CySEC, ASIC 📱 Platforms eToro app, OpenBook, eToro CopyTrade ₿ Crypto Yes 💵 Account Currency USD, AUD, CNY, CAD, GBP, EUR, JPY, RUB Yes 1:30 🛒 Instruments Stocks, Commodities, Indices, Forex, ETFs, Cryptocurrencies 🏛️ Visit Broker

With excellent educational content and a wide range of markets to trade in, eToro provides a user-friendly website.

More than 25 million traders use eToro worldwide, and US citizens can also use it.

eToro Pros and Cons:

| ✔️Pros | ❌Cons |

| Commission-free trading | No account comparison |

| Beginner-friendly | Inactivity fees |

| Flexible leverage | Withdrawal fees |

| Money management app |

XM

USD 5

ESMA, CySEC, ASIC, FCA, IFSC, DFSA

📱 Platforms

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

₿ Crypto

No

💵 Account Currency

USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB

Yes

1:1000

🛒 Instruments

Commodities, Forex, Stocks, Crypto, Metals, Shares, Energies

🏛️ Visit Broker

With over 5 million customers and accessibility to residents of 196 countries, XM provides multilingual customer support that is available around-the-clock.

Additionally, XM provides unlimited access to video tutorials, personal account managers, and market research.

Customers of XM have access to more than 1,000 tradable securities and stocks from more than 600 foreign corporations.

XM Pros and Cons:

| ✔️Pros | ❌Cons |

| User-friendly website | Fixed spreads not offered |

| Low minimum deposit | Not available to US clients |

| Negative Balance Protection | Inactivity is penalised |

| Promotions and signup bonuses |

City Index

£50 IIROC, JFSA, ASIC, FCA, CFTC MT4, City Index app ₿ Crypto No USD, CHF, EUR, GBP, HUF, AUD, JPY, PLN Yes 1:30 🛒 Instruments Indices, Shares, Forex, Metals Bonds, Options, Commodities 🏛️ Visit Broker

Established in 1985, City Index has had a decorated run as Forex Broker.

Based in London, they are a global spread betting, Forex and CFD provider with a solid history and are trusted to deliver a good reliable trading experience.

City Index is part of GAIN Capital a New York-listed investment company and is regulated by the top-tier Financial Conduct Authority (FCA), ASIC the Australian Securities and Investments Commission and MAS the Monetary Authority of Singapore.

Once you complete the effortless user registration, you will have access to amazing training and educational materials.

Customer tech support is available via telephone and is great at resolving queries.

City Index Pros and Cons:

| ✔️Pros | ❌Cons |

| Low Forex fees | Desktop platform needs development |

| Quick user registration | High fees for Stock CFDs |

| Good research resources | Inactivity fee |

| No fees for withdrawals | |

| No deposit fee | |

| Highly regulated |

easyMarkets

USD 25

CySEC, ASIC, FSA

📱 Platforms

MT4, TradingView, easyMarkets app

₿ Crypto

Yes

💵 Account Currency

EUR, CAD, CZK, JPY, NZD, USD, SGD, CHF, GBP, MXN, AUD, PLN, TRY, CNY, HKD, NOK, SEK, ZAR, BTC

Yes

1:400

🛒 Instruments

Forex, Shares, Crypto, Metals, Commodities, Indices

🏛️ Visit Broker

Over 100,000 customers currently use the award-winning forex broker easyMarkets, which was established in 2001.

EasyMarkets is a broker that welcomes new traders and offers 10 free eBooks that can be downloaded on various topics.

Deal Cancellation and Rate Freeze are exclusive features of easyMarkets.

easyMarkets Pros and Cons:

| ✔️Pros | ❌Cons |

| 19 base currencies supported | Not available to US citizens |

| Fixed spreads | |

| Negative Balance Protection |

OctaFX

USD 100 FSA, SVGFSA 📱 Platforms MT4, MT5, OctaFX app ₿ Crypto Yes 💵 Account Currency EUR, USD Yes 1:500 🛒 Instruments Forex, CFDs, Stocks, Commodities, Cryptocurrencies 🏛️ Visit Broker

More than 6 million accounts have been opened with OctaFX since it was founded in 2011, and a total of 3 accounts are offered that can be funded using either EUR or USD.

A minimum deposit of $100 is required to activate a live account with OctaFX and demo accounts and Islamic accounts are provided.

OctaFX is a suitable broker for beginners and supports copy trading, scalping and hedging, and also allows the use of Expert Advisors.

OctaFx Pros and Cons:

| ✔️Pros | ❌Cons |

| Low minimum deposit | Limited products |

| Low spreads | Only 2 base currencies |

| CopyTrading allowed | |

| Bonus offers |

FBS

USD 1

CySEC, IFSC, FSCA, ASIC

📱 Platfroms

MT4, MT5, FBS trader, CopyTrade

₿ Crypto

Yes

💵 Account Currency

EUR, USD

Yes

1:30

🛒 Instruments

Forex, Indices, Stocks, Metals, Energies, Crypto

Welcome bonus

🏛️ Visit Broker

FBS has launched a new type of account specifically for trading cryptocurrencies.

The new Crypto account has over 100 instruments with digital currencies.

BTC, LTC, and ETH are just some of the instruments that will be available for trading against other cryptocurrencies or against more traditional currencies, commodities, and other instruments.

- – Currency: USDT (Tether)

- – Leverage: 1:5

- – Initial deposit: from $1

- – Commission on opening positions: 0.05%

- – Commission on closing positions: 0.05%

Over 17 million clients use FBS actively, and more than 1 billion orders have been placed since 2009.

FBS has more than 150,000 partners and affiliates and has garnered numerous awards over the years.

This is a beginner-friendly broker with 5 different account types and copy trading support.

FBS Pros and Cons:

| ✔️Pros | ❌Cons |

| Flexible account options | Limited product offering |

| Copy trader-friendly | Only 2 base currencies supported |

| Compatible with MetaTrader platforms | Swap Free option is not available for trading on “Forex Exotic” |

| Plenty of promotions and bonuses |

Exness

USD 10

FSA, CBCS, FSC, FSC, FSCA, CySEC, FCA

📱 Platforms

MT4, MT5

₿ Crypto

Yes

💵 Account Currency

USD, EUR, ZAR, CHF, NZD, SGD, JPY, AUD

Yes

1:unlimited

🛒 Instruments

100+ Forex, Cryptocurrencies, Energies, Metals, Shares, Stocks, Commodities

🏛️ Visit Broker

Exness is a highly regulated broker that provides commission-free trading, raw spreads starting at 0 pips, and unlimited leverage.

An economic calendar and a currency converter are all provided by Exness along with a wide range of analytical tools.

Trading Central WebTV is available to Exness customers, and this broker is also one of our top-rated social trading brokers.

Exness Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No trading bonus |

| Low minimum deposit | No USA clients |

| 5+ base currencies | |

| 100+ Forex pairs |

Forex.com

USD 100 FCA, IIROC, ASIC, CFTC 📱 Platforms MT4, MT5, Forex.com apps ₿ Crypto Yes 💵 Account Currency EUR, GBP, USD No 📊 Leverage 1:40 🛒 Instruments Forex, Indices, Stocks, Commodities, Metals, Crypto 🏛️ Visit Broker

Forex.com accounts that can be funded using USD, JPY, CHF, EUR, GBP and AUD, and there is a total of 3 account types that are compatible with the MetaTrader platforms.

This is a great option for beginners and high-volume traders and a low minimum deposit of only $50 is required to activate a live account with Forex.com.

Forex.com Pros and Cons:

| ✔️Pros | ❌Cons |

| Cash rebates | Low maximum leverage |

| 6 base currencies | Inactivity fees |

| Supports MetaTrader |

InstaForex

USD 1 FSC, BVI, CySEC 📱 Platforms MT4, MT5, InstaTick Trader ₿ Crypto Yes 💵 Account Currency EUR, USD Yes 1:1000 🛒 Instruments Forex, Stocks, Indices, Metals, Oil, Gas, Commodity Futures, Crypto, InstaFutures 🏛️ Visit Broker

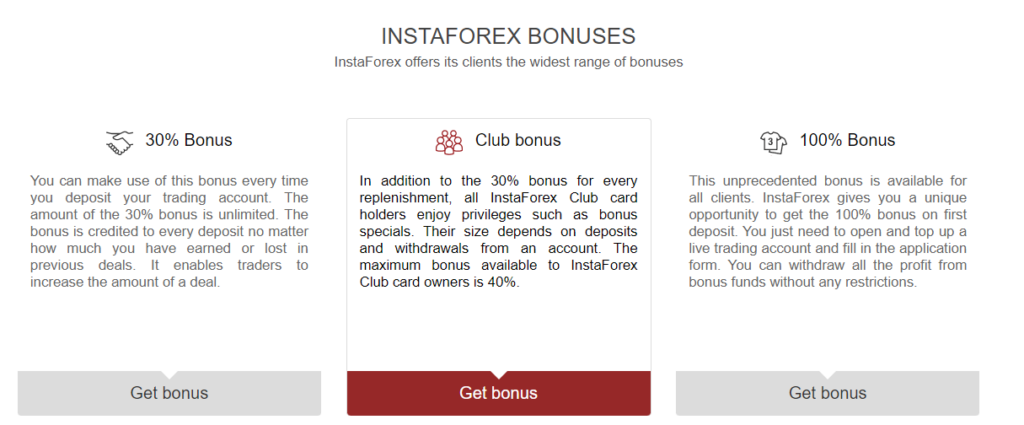

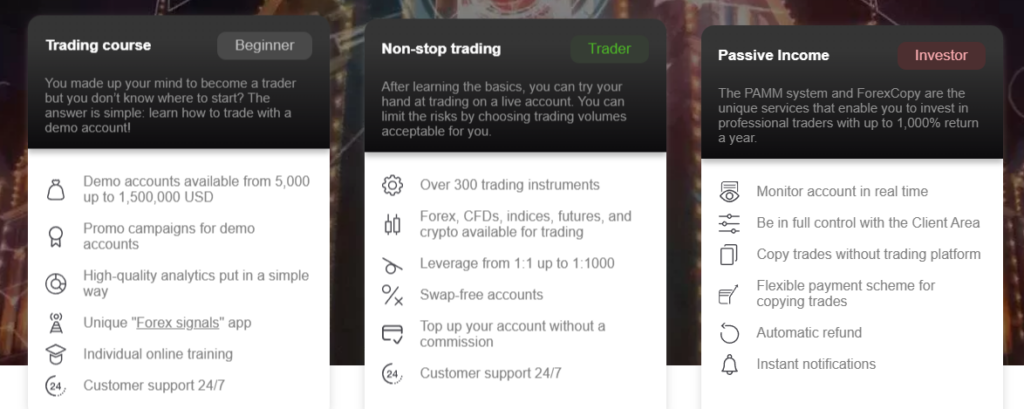

InstaForex is trusted by more than 7 million traders internationally, which greatly exceeds the client base of most Forex brokers.

InstaForex is regulated by FSC, BVI and CySEC and is part of Insta Global Ltd.

InstaForex offers 2 account types, as well as a demo account and a swap-free Islamic account.

InstaForex has dedicated an entire section of the website to beginners to make it easy for new traders to learn how to trade.

InstaForex is highly popular not only for its great product offering but there are also several different contests and events that clients can participate.

InstaForex Pros and Cons:

| ✔️Pros | ❌Cons |

| Cent and Islamic accounts offered | Only 2 base currencies to choose from |

| 10 trading servers provided | US clients not accepted |

| Negative Balance Protection | |

| Great variety of research and trading tools |

Pepperstone

USD 200

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN

📱 Platforms

MT4, MT5, cTrader

₿ Crypto

Yes

💵 Account Currency

USD, GBP

Yes

Low

🛒 Instruments

Forex, Crypto, Shares, ETFs, Indices, Commodities

🏛️ Visit Broker

Spreads start at 1 pip on Pepperstone’s swap-free account.

You can deposit money into this account using USD, EUR, GBP, or AUD.

Scalping, hedging, and EA trading are all permitted on the Pepperstone swap-free account.

The swap-free account has a $200 minimum deposit requirement.

Pepperstone Pros and Cons:

| ✔️Pros | ❌Cons |

| No withdrawal fee | No USA clients |

| Referral program | Low leverage cap |

| 1,200+ CFDs | 2 account currencies |

| No inactivity fees |

TIO Markets

USD 50 FCA 📱 Platforms MT4, MT5 ₿ Crypto No 💵 Account Currency USD, GBP, EUR, CAD, AUD, CZK, ZAR, BTC, ETH, UST Yes 1:500 🛒 Instruments Forex, Stocks, Energies, Indices, Metals 🏛️ Visit Broker

One of our recommended brokers for beginners is TIO Markets.

We view TIO Markets as a secure, low-risk broker because it is overseen by the Financial Conduct Authority and offers $50 minimum account opening requirements.

They have a staggeringly low spread policy and offer trading in more than 300 Forex pairs, stocks, energies, indices, and metals.

TIO Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| No fees on deposits and withdrawals | No Islamic accounts |

| Allows EA and automated trading | Not available to US citizens |

| 120 currency pairs | |

| Fixed spreads |

Conclusion

We hope that this review of our 15 Best Silver Trading Forex Brokers will help you find a broker that aligns with your trading goals so that you can trade with confidence and peace of mind.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Most Regulated Forex Brokers

You might also like: Best Stock Trading Brokers

You might also like: Best NASDAQ100 Forex Brokers

You might also like:Best Hedging Forex Brokers

FAQ

What is the ticker symbol for Silver?

The ticker symbol for Silver is XAG.

Why is Silver considered a haven asset?

Silver IRA is considered a haven asset because this asset retains its value even when markets are volatile.

Which are the best Forex brokers for Silver trading?

Our top 5 brokers for trading Silver are:

- XTB

- AvaTrade

- IG

- Plus500

- eToro

Table of Contents

Toggle