In this article, we review the 10 Best Forex Brokers side by side to determine which broker offers the best trading conditions. We also highlight the features of each broker and include unbiased pros and cons.

In this article, we review the 10 Best Forex Brokers side by side to determine which broker offers the best trading conditions. We also highlight the features of each broker and include unbiased pros and cons.

Every broker has something special to offer and it depends on your trading experience, your trading portfolio and your trading capital.

There is a broker out there that’s right for YOU and we hope to help you find that broker by comparing some of our top-rated international brokers.

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

We looked at how long each broker has been in the industry, how regulated each broker is, the minimum deposit requirements and maximum leverage allowed, the account currencies each broker accepts and all the account types offered by each broker.

Our top 5 Forex Brokers are:

🏆Exness (click to read review)

🏆Fx Pro (click to read review)

Admirals (click to read review)

easyMarkets (click to read review)

Exness

Exness is a highly regulated broker that offers commission-free trading, raw spreads from as low as 0 pips and unlimited leverage.

USD 10 FSA, CBCS, FSC, FSC, FSCA, CySEC, FCA 📱 Platforms MT4, MT5 ₿ Crypto Yes 💵 Account Currency USD, EUR, ZAR, CHF, NZD, SGD, JPY, AUD Yes 1:unlimited 🛒 Instruments 100+ Forex, Cryptocurrencies, Energies, Metals, Shares, Stocks, Commodities 🏛️ Visit Broker

Exness provides a great selection of analytical tools, an economic calendar and a currency converter.

Exness clients have access to Trading Central WebTV and this broker is also one of our top-rated social trading brokers.

Exness Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No trading bonus |

| Commission-free trading | High minimum deposit on Professional accounts ($500) |

| Instant withdrawals | |

| 100+ Forex pairs |

HFM

HFM (formerly HotForex) offers more than 1,200 instruments and this broker has won more than 60 industry awards.

USD 5 FCA, FSA, FSCA, DFSA, CySEC, FSC 📱 Platfoms MT4, MT5 ₿ Crypto No 💵 Account Currency USD, ZAR, USD, NGN Yes 1:1000 🛒 Instruments Forex, Metals, Energies, Indices, Shares, Commodities, Bonds, Stocks, ETFs 🏛️ Visit Broker

HFM has more than 3.5 million clients and all clients have access to Autochartist and VPS hosting.

HFM Pros and Cons:

| ✔️Pros | ❌Cons |

| Many promotions | 4 account currencies |

| 1,200+ instruments | Inactivity fee |

| Beginner-friendly | |

| Loyalty program |

Fx Pro

Fx Pro is an NDD broker that offers commission-free trading and has more than 2.1 million clients.

USD 100 FCA, CySEC, FSCA 📱 Platforms FxPro platform, cTrader, MT4, MT5 Yes 💵 Account Currency EUR, USD, GBP, CHF, PLN, AUD, JPY, ZAR Yes 📊 Leverage 1:200 🛒 Instruments Forex, Metals, Indices, Shares, Energies

Fx Pro has won more than 95 industry awards and offers one type of account with competitive trading conditions that can be used on multiple platforms.

Fx Pro Pros and Cons:

| ✔️Pros | ❌Cons |

| 2,100+ instruments | 1 account type |

| 5+ account currencies | Inactivity fees |

| Tight spreads | No clients from USA, Canada & Iran |

Admirals

Admirals is available in more than 130 countries and this broker offers high-quality trading courses for beginners.

USD 1 ASIC, FCA, EFSA, CySEC 📱 Platforms MT4, MT5, Admirals app ₿ Crypto Yes 💵 Account Currency USD, CHF, EUR, BGN, HRK, PLN, RON, CZK, HUF, GBP Yes 1:30 🛒 Instruments Forex, Commodities, Indices, Stocks, ETFs, Bonds 🏛️ Visit Broker

Admirals also hosts a weekly podcast and provides global market updates and premium analytics.

Admirals Pros and Cons:

| ✔️Pros | ❌Cons |

| Free market news and research | Cash rebates only available to UK and Australian clients |

| 3,700+ Stock CFDs | Inactivity fees |

| Negative balance protection | |

| Tight spreads |

easyMarkets

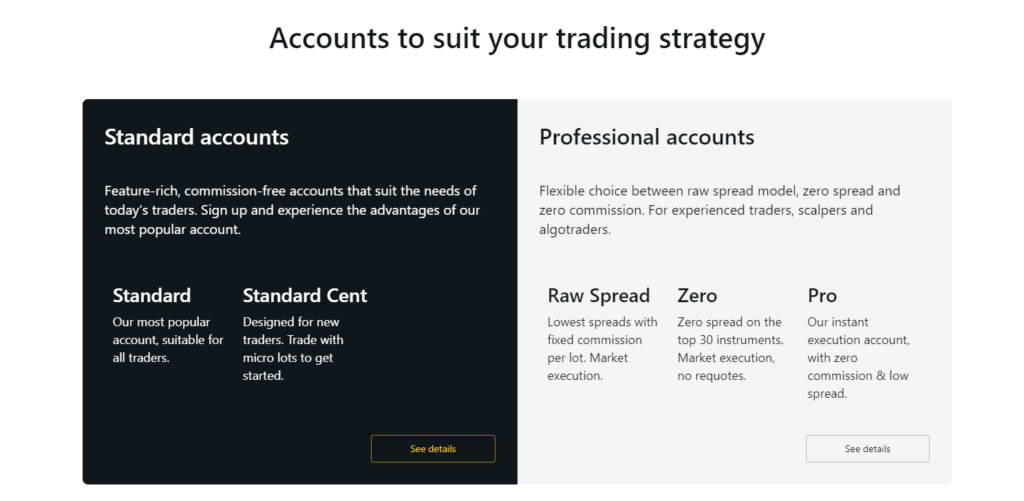

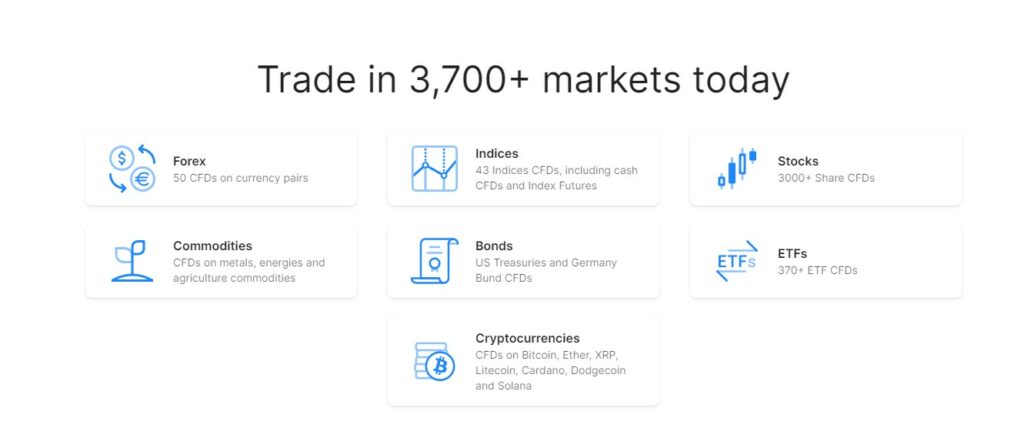

easyMarkets offers commission-free trading on all accounts and each account type has a personal account manager.

USD 25 CySEC, ASIC, FSA 📱 Platforms MT4, TradingView, easyMarkets app ₿ Crypto Yes 💵 Account Currency EUR, CAD, CZK, JPY, NZD, USD, SGD, CHF, GBP, MXN, AUD, PLN, TRY, CNY, HKD, NOK, SEK, ZAR, BTC Yes 1:400 🛒 Instruments Forex, Shares, Crypto, Metals, Commodities, Indices 🏛️ Visit Broker

easyMarkets does not charge any account fees and all accounts have access to fundamental analysis reports.

easyMarkets Pros and Cons:

| ✔️Pros | ❌Cons |

| Tight fixed spreads | No USA clients |

| No slippage | Only VIP and MT5 accounts have spreads below 1 pip |

| Negative Balance Protection | MT5 account does not have fixed spreads |

XM

USD 5 ESMA, CySEC, ASIC, FCA, IFSC, DFSA 📱 Platforms Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform ₿ Crypto No 💵 Account Currency USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB Yes 1:1000 🛒 Instruments Commodities, Forex, Stocks, Crypto, Metals, Shares, Energies 🏛️ Visit Broker

XM has more than 5 million clients and is available in 196 countries.

XM offers more than 1,000 instruments and the demo account has a virtual balance of $100,000.

XM Pros and Cons:

| ✔️Pros | ❌Cons |

| 1,000+ instruments | No fixed spreads |

| 24/7 support | No USA clients |

| Negative Balance Protection | Inactivity fees |

| Free daily technical analysis |

AvaTrade

USD 100 MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA 📱 Platforms MetaTrader 4, MetaTrader 5 ₿ Crypto Yes 💵 Account Currency AUD, EUR, USD, GBP, CHF Yes 1:400 🛒 Instruments Forex, Bonds, Stocks, Commodities, ETFs, Indices, Crypto 🏛️ Visit Broker

AvaTrade is an award-winning broker that offers competitive trading conditions and low-cost trading.

AvaTrade is a beginner-friendly broker and there are plenty of educational guides and tutorials that you can use to learn the basics of trading.

AvaTrade’s mobile app can be used to trade more than 250 instruments and it comes with a great selection of built-in trading tools and different charts.

AvaTrade Pros and Cons:

| ✔️Pros | ❌Cons |

| Commission-free trading | No USA clients |

| Free deposits and withdrawals | Higher than average spreads |

| Multiple platforms | High inactivity fees |

| Beginner-friendly |

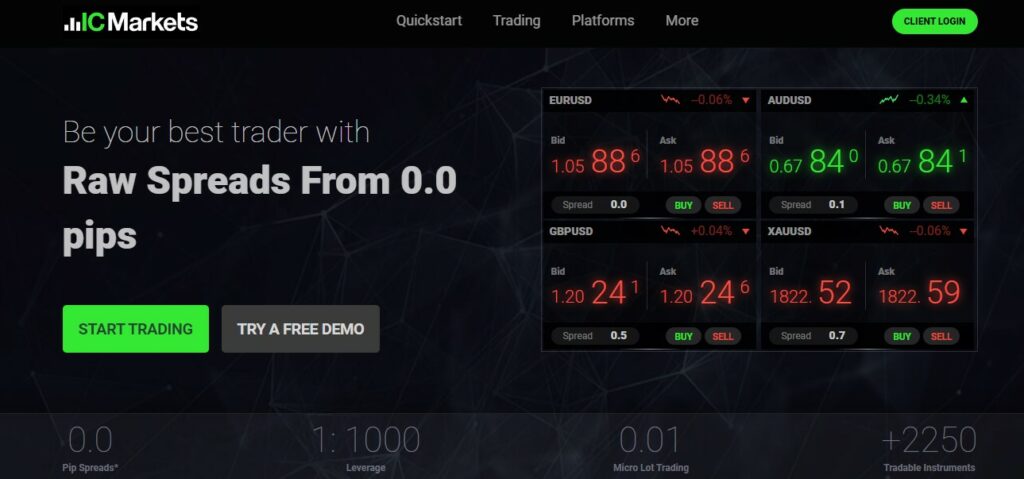

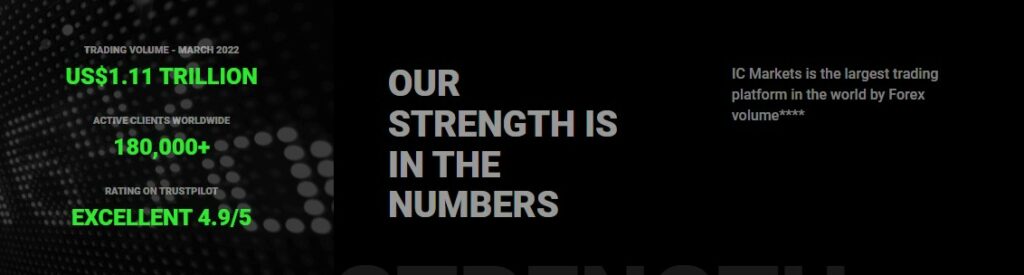

IC Markets

USD 200 FSA, CySEC, ASIC 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF Yes 1:500 🛒 Instruments Stocks, Commodities, Indices, Forex, Bonds, Crypto, Futures 🏛️ Visit Broker

IC Markets has more than 180,000 clients and this broker offers raw spreads from 0 pips.

The trading conditions offered by IC Markets are suitable for beginners, but the minimum deposit is a greater risk for new traders.

If you are interested in trading with ICMarkets and you are new to trading, we recommend practising on a demo account first!

IC Markets accounts are designed for Day traders, Scalpers, EA traders and Discretionary traders.

IC Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No USA clients |

| No withdrawal fees | Commission fees on ⅔ accounts |

| 2,250+ instruments |

eToro

USD 50 FCA, CySEC, ASIC 📱 Platforms eToro app, OpenBook, eToro CopyTrade ₿ Crypto Yes 💵 Account Currency USD, AUD, CNY, CAD, GBP, EUR, JPY, RUB Yes 1:30 🛒 Instruments Stocks, Commodities, Indices, Forex, ETFs, Cryptocurrencies 🏛️ Visit Broker

eToro has 25 million traders and is a social trading broker that is also a popular choice for stock traders.

eToro also has a crypto exchange called eToroX and this broker provides plenty of educational resources that you can use to learn the basics of trading.

eToro offers commission-free stock trading and you can also stake your crypto with this broker.

eToro Pros and Cons:

| ✔️Pros | ❌Cons |

| Commission-free trading | No account comparison |

| Beginner-friendly | Inactivity fees |

| Flexible leverage | Withdrawal fees |

| Money management app |

GO Markets

USD 200 FSC, ASIC, AFSL 📱 Platforms MT4, MT5, GO Webtrader Yes 💵 Account Currency AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD No 1:500 🛒 Instruments Forex, Shares, Indices, Metals, Commodities

GO Markets offers 2 types of accounts and both accounts can be funded with $200.

Both accounts have the same features and can be used for Scalping and EA trading, but the commission-free account has higher spreads.

If you are new to trading, we recommend visiting the GO Markets Education Hub to learn the basics and practice on a demo account before you make a deposit.

GO Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| Tight spreads | No swap-free account |

| Referral program | Commissions fees charged for lower spreads |

| Instant transactions with no fees | No USA clients |

Of our top 10 Forex brokers, we have compared our top lowest deposit broker with our top highest deposit broker.

| Broker | Exness | ActivTrades |

| Minimum Deposit | $10 | $500 |

| Platforms |

|

ActivTrader

MT4 MT5 |

| Forex pairs | 105+ | 50+ |

| Regulations | CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC | FCA, CBS |

| Spreads | From 0 pips | From 0.5 pips |

| Commissions |

|

Commission-free trading on MT4 & MT5 |

| Trading fees |

|

|

| Account currencies | USD, EUR, ZAR, CHF, NZD, SGD, JPY, AUD | EUR, USD, GBP, CHF |

| Educational resources |

|

Trading glossary

Educational videos Webinars One-on-one training Manuals |

| Research material |

|

SMART tools:

Analysis:

|

| Advantages | 3 commission-free accounts, Social trading suppoted & Dedicated education website | 30% Cashback, Referral Bonuses & ActivTrader program/platform |

Exness vs. ActivTrades

Both brokers offer professional trading accounts that require a minimum deposit of at least $500.

However, ActivTrades offers only 1 account with spreads from 0.5 pips and Exness offers 3 professional accounts of which two have spreads from 0.0 pips and the other has spreads from 0.1 pips.

ActivTrades doesn’t charge commission fees, and Exness charges commission fees on 2 Pro accounts but the spreads are tighter.

Exness’s commission-free Pro account also offers tighter spreads than the ActivTrades account.

Exness doesn’t charge any inactivity fees but ActivTrades charges inactivity fees after one year of an account not being used.

ActivTrades is recommended for high-volume traderes because this broker offers a special active trader program and cashback rebates.

Conclusion

Both ActivTrades and Exness offer competitive trading conditions, educational resources, low-cost trading and a great selection of tools and research material, but overall, we chose Exness as the Best broker of our top 30 brokers.

Exness is one of the most-regulated, safest brokers in the world. Exness offers more than 100 currency pairs, 1:400 leverage on crypto and unlimited leverage on other instruments and stocks from companies like Amazon, Google, Tesla and Intel.

Exness offers 5 types of accounts, with 2 standard beginner-friendly accounts and 3 professional accounts. The Standard accounts are commission-free and have spreads from 0.3 pips with unlimited leverage.

The Pro account is commission free and offers spreads from 0.1 pips, and the Raw Spread and Zero accounts charge competitively low commission fees and offers spreads from 0 pips. All accounts can be used as swap-free accounts and 4 out of 5 accounts are commission-free.

Exness accounts can be used on the Exness mobile app and all MetaTrader platforms. Exness charges no inactivity fees, no deposit fees and no withdrawal fees.

Exness accounts can be used by beginners and professional traders, and demo accounts can be opened for testing strategies and learning how to trade. Exness has an entire website dedicated to providing trading guides, strategy guides, platform tutorials and news.

Exness also gives its clients access to Trading Central news and indicators, FXStreet news and an economic calendar.

Exness is not only a low-risk, low-cost broker that we recommend for any style of trading, but this broker is also a great option for social traders and copy trading.

We believe ActivTrades is the better option for high-volume traders with a big following on social media who only need one account and advanced trading tools.

On the other hand, Exness is the better option for beginners, social traders, news traders and professionals seeking competitive trading conditions and high-quality research material.

We hope that by comparing our 30 Best Forex Brokers, it’s easier for you to choose a broker that aligns with your trading goals and individual needs.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Most Regulated Forex Brokers

You might also like: Best Stock Trading Brokers

You might also like: Best NASDAQ100 Forex Brokers

You might also like: Best FTSE 100 Brokers

FAQ

How do you choose a broker?

When comparing brokers, there are a few things that you should always consider:

- How long have these brokers been in the industry?

- Are these brokers regulated?

- How many account types do these brokers offer?

- What trading conditions do these brokers offer?

- What instruments do these brokers offer?

- What level of experience are these brokers suitable for?

- What trading styles are these brokers good for?

- Is it easy to find information about accounts and is customer support responsive?

- Are educational resources and research materials provided?

- What platforms and trading tools can you use with these brokers?

Table of Contents

Toggle