Hedging is a popular trading strategy that commonly involves derivative instruments, such as options and futures. In this article, we reveal our 15 Best Hedging Forex Brokers and we review the features, trading conditions and instruments these brokers offer.

When using this trading strategy, investors will “hedge” one position by making a counter-trade on another in case the first order is unsuccessful.

To guard against a negative currency movement, one can use the forex market to hedge one’s position.

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

When a trader is worried about news or an event that could cause volatility in the foreign exchange markets, it is typically a type of short-term protection.

Our 5 Best Hedging Forex Brokers are:

🏆FXCM

🏆Axi

🏆Tickmill

Swissquote

So, let’s find out which brokers you can trade with if you are interested in hedging:

FXCM

In order to help high-volume traders, FXCM facilitates copy trading and offers an active trader program.

USD 50 ASIC, FCA, FSCA 📱 Platforms Trading Station, MT4, NinjaTrader, ZuluTrade, Capitalise AI, TradingView ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, CHF Yes 1:200 🛒 Instruments Forex, Shares, Indices, Crypto, Commodities 🏛️ Visit Broker

The referral program and a rebate program are both advantageous to FXCM customers.

FXCM welcomes new users by providing them with access to a vast collection of educational materials, trading manuals, and in-depth research.

FXCM Pros and Cons:

| ✔️Pros | ❌Cons |

| Great selection of technical research tools | Bank withdrawal fees are high |

| Comprehensive educational resources | Limited product offering |

| Rebate and Referral Program | Penalty fee for one year of inactivity |

| Allows Copy Trading |

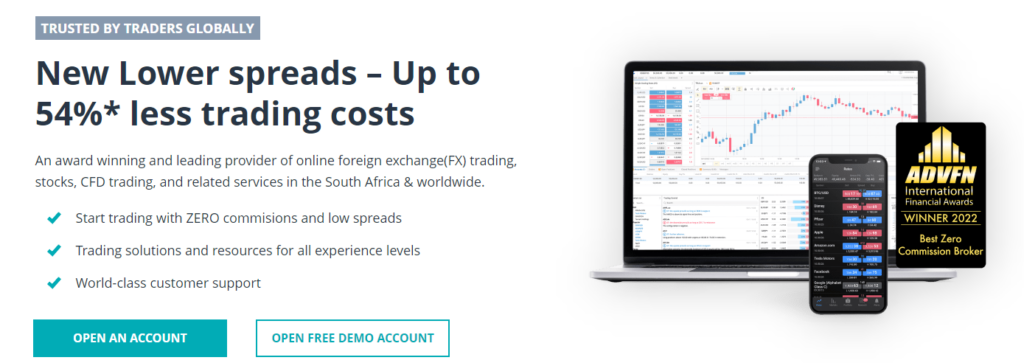

Axi

USD 0 ASIC, FCA 📱 Platforms MT4, Myfxbook, PsyQuation ₿ Crypto Yes 💵 Account Currency AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, PLN, SGD, USD Yes 1:400 🛒 Instruments Forex, Cryptocurrencies, Metals, Indices, Commodities 🏛️ Visit Broker

Axi (formerly AxiTrader) was founded in 2007 and has more than 60,000 clients.

No minimum deposit is required to open an account with Axi and there are more than 130 Cryptocurrencies, Forex pairs, Metals, Commodities and Indices to trade.

Axi offers 3 types of accounts that you can use on MT4 and spreads with this broker start as low as 0 pips.

Axi Pros and Cons:

| ✔️Pros | ❌Cons |

| No minimum deposit | No trading bonus |

| 8+ account currencies | |

| No inactivity fees | |

| ASIC-regulated |

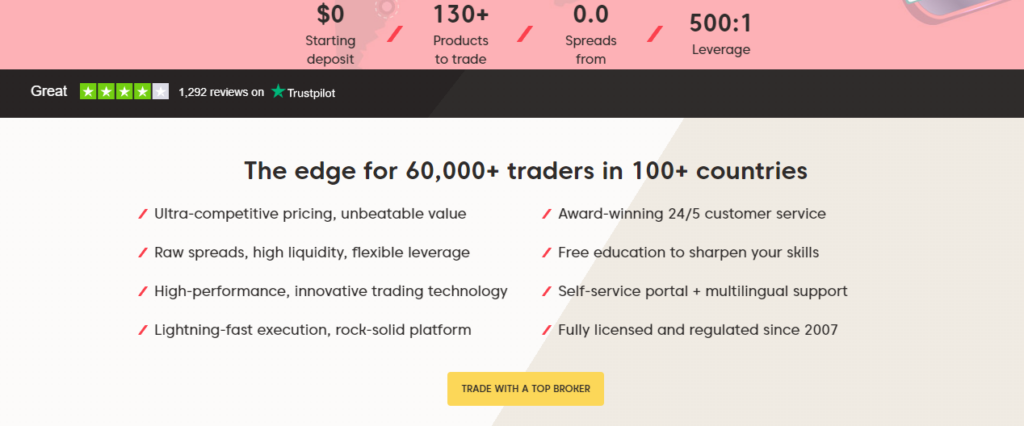

Tickmill

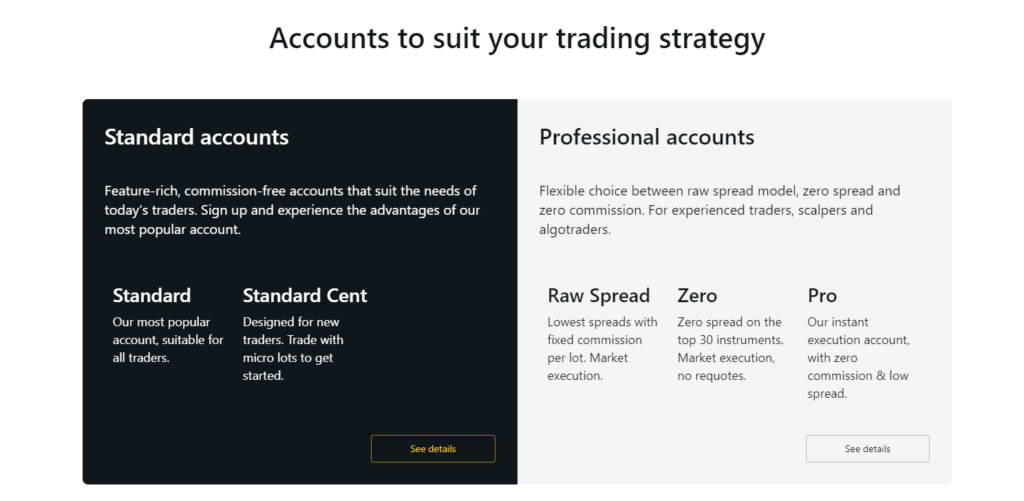

The 2014-founded Tickmill offers 3 different types of accounts, one of which is commission-free.

USD 100 FCA, FSCS, FSA, CYSEC, MiFID, ESMA 📱 Platforms MT4, MT5 ₿ Crypto Yes 💵 Account Currency EUR, GBP, USD Yes 1:500 🛒 Instruments Stocks, Shares, Indices, Metals, Energies, Bonds, CFDs, Forex, Commodities 🏛️ Visit Broker

Any trading strategy is supported and all accounts can be used as swap-free accounts.

A $30 welcome bonus is offered, and spreads begin at 0 pip.

Tickmill Pros and Cons:

| ✔️Pros | ❌Cons |

| Negative Balance Protection | No USA clients |

| Access to Autochartist and FIX API | Fixed spread accounts not available |

| Commission-free trading | |

| Highly regulated broker | |

| Welcome bonus |

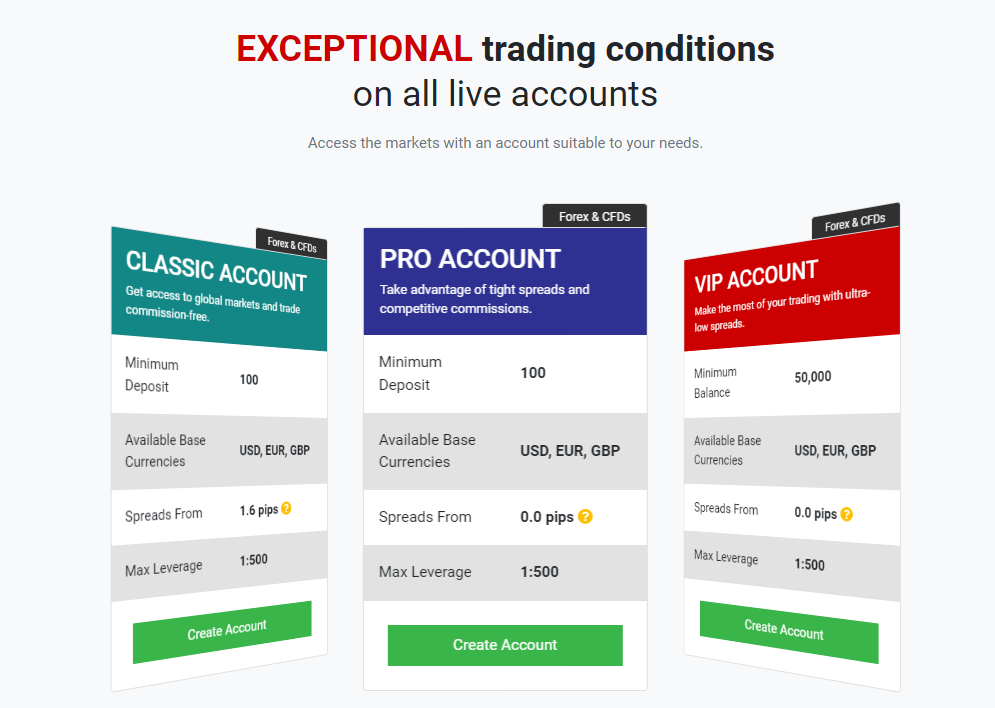

Swissquote

USD 1000 FINMA, FCA, DFSA, SFC, MFSA, MAS 📱 Platforms Advanced Trader, MT4, MT5 ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, CHF, JPY, AUD, CAD, NZD, PLN, SEK, DKK, NOK, HUF, TRY, ZAR, SGD, MXN, HKD, THB, ILS, AED Yes 1:100 🛒 Instruments Forex, Stocks, Commodities, Bonds, Indices, Crypto 🏛️ Visit Broker

Swissquote offers the same quality and safety that is synonymous with their country of origin, Switzerland.

Swissquote is a subsidiary of the Swissquote Group, a leading provider of online financial and trading services, located in a top-rated financial centre of the EU that is known for providing strict investor protection.

Swissquote’s customer support is available through many channels.

Swissquote Pros and Cons:

| ✔️Pros | ❌Cons |

| No penalties for inactivity | Expensive trading fees |

| Exposure to markets | Some useful tools are premium |

| Research tools are great | |

| Excellent pedigree |

Exness

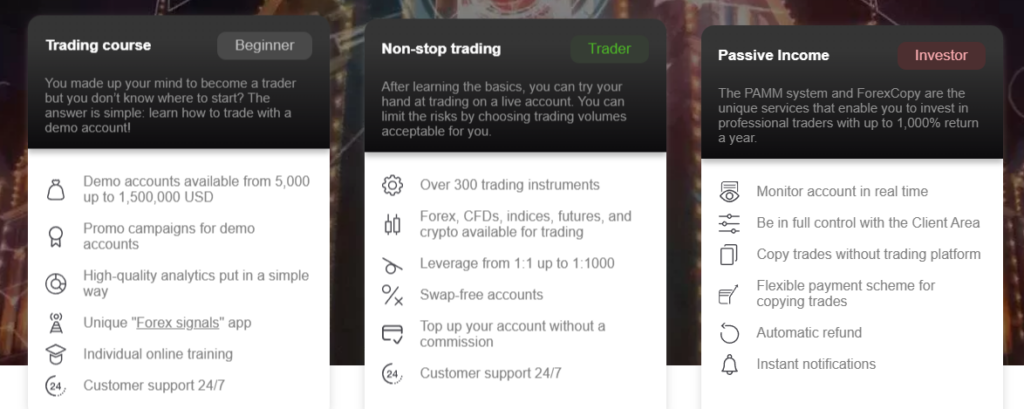

Exness has been in business for more than ten years and currently has more than 340,000 clients worldwide.

USD 10 FSA, CBCS, FSC, FSC, FSCA, CySEC, FCA 📱 Platforms MT4, MT5 ₿ Crypto Yes 💵 Account Currency USD, EUR, ZAR, CHF, NZD, SGD, JPY, AUD Yes 1:unlimited 🛒 Instruments 100+ Forex, Cryptocurrencies, Energies, Metals, Shares, Stocks, Commodities 🏛️ Visit Broker

On its website for education, Exness also offers a wealth of educational resources, with content available in more than 5 different languages.

You can switch to swap-free accounts for Exness Pro, Raw Spread, Zero, Standard Cent, and Standard accounts.

Exness Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No trading bonus |

| Low minimum deposit | No USA clients |

| 5+ base currencies | |

| 100+ Forex pairs |

InstaForex

USD 1 FSC, BVI, CySEC 📱 Platforms MT4, MT5, InstaTick Trader ₿ Crypto Yes 💵 Account Currency EUR, USD Yes 1:1000 🛒 Instruments Forex, Stocks, Indices, Metals, Oil, Gas, Commodity Futures, Crypto, InstaFutures 🏛️ Visit Broker

Since being launched in 2007, InstaForex has accumulated a client basis of over 7 million active traders.

InstaForex is a highly regulated broker and has won several awards over the years.

InstaForex offers four flexible account types with low minimum deposits and the option to use high leverage.

InstaForex is compatible with MetaTrader and WebTrader platforms and provides a variety of innovative analytics tools and features for more experienced traders.

InstaForex Pros and Cons:

| ✔️Pros | ❌Cons |

| 110 currency pairs to choose from | Only 2 base currencies accepted |

| Suitable for beginners | High spreads |

| Great selection of education resources | Inactivity fee payable |

| Flexible account types |

HYCM

USD 100 FCA, CySEC, CIMA, DIFC 📱 Platforms MT4, MT5 ₿ Crypto Yes 💵 Account Currency USD, GBP, EUR, AED Yes 1:500 🛒 Instruments Forex, Stocks, Indices, Cryptocurrencies, Commodities, ETFs 🏛️ Visit Broker

HYCM offers 3 types of accounts and a great VIP program, and a minimum deposit of 100 USD will activate your live trading account.

With Forex.com, you can trade Cryptocurrencies, Commodities, Forex, Stocks, Indices and ETFs, and over 300 instruments can be traded in total.

Forex.com is regulated by FCA, DIFC, CySEC and CIMA, and is compatible with both MT4 and MT5.

HYCM Pros and Cons:

| ✔️Pros | ❌Cons |

| 300+ instruments | No accounts for US citizens |

| MetaTrader support | Monthly penalty fees for inactivity |

| Many regulations | |

| Negative Balance Protection |

FOREX.com

USD 100 FCA, IIROC, ASIC, CFTC 📱 Platforms MT4, MT5, Forex.com apps ₿ Crypto Yes 💵 Account Currency EUR, GBP, USD No 📊 Leverage 1:40 🛒 Instruments Forex, Indices, Stocks, Commodities, Metals, Crypto 🏛️ Visit Broker

Established in 2001, FOREX.com has made great strides in achieving a product offering that is able to cater for traders of any experience level.

Fundamental data has some limitations but the educational and research tool will prove to benefit traders.

User account creation is completely digital but may take some time to verify.

Customer support is best via telephone and their team does give an overall pleasant experience.

FOREX.com Pros and Cons:

| ✔️Pros | ❌Cons |

| Low Forex fees | Platform needs development |

| Useful research tool | Limited products offered |

| Easy user registration | High Stock CFD fees |

| Well regulated | No VPS |

| Good variety of technical research | |

| Well-established holding company |

BDSwiss

USD 200 CySec, FSC, FSA, BaFin, NFA 📱 Platforms MT4, MT5, BDSwiss app Yes 💵 Account Currency EUR, USD, GBP, PLN, CHF, SEK, DKK, NOK Yes 1:500 🛒 Instruments Forex, Commodities, Shares, Indices, Cryptocurrencies

Since its founding in 2012, BDSwiss has served more than 10.5 million customers.

BDSwiss provides 250 instruments and is an ECN and STP broker.

BDSwiss is a great choice for beginners because it offers live education and daily market analysis.

BDSwiss Pros and Cons:

| ✔️Pros | ❌Cons |

| Zero-commission accounts | High minimum deposit |

| Great variety of research tools | Not available to US citizens |

| Instant withdrawals | |

| Beginner-friendly |

IG

USD 0 FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC 📱 Platforms MT4, ProRealTime, L2 Dealer ₿ Crypto Yes 💵 Account Currency USD, GBP, AUD, EUR, SGD, HKD Yes 1:30 🛒 Instruments Crypto, Forex, Indices, Shares, Commodities 🏛️ Visit Broker

IG is a multi-regulated broker that can be used to trade in over 17,000 markets.

The IG account can be used with MetaTrader 4, ProRealTime and L2 Trader.

IG supports several base currencies for the funding of accounts and a minimum initial deposit of 250 USD is required to trade with this broker.

IG Pros and Cons:

| ✔️Pros | ❌Cons |

| Many regulations | High minimum deposit |

| Trading bonuses | No Islamic accounts |

| Low fees |

XTB

USD 0 FCA, KNF, CySEC, IFSC 📱 Platforms xStation 5 ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, HUF Yes 📊 Leverage 1:500 🛒 Instruments 2,100+ Forex, Commodities, Indices, Crypto, Stocks, ETFs, CFDs 🏛️ Visit Broker

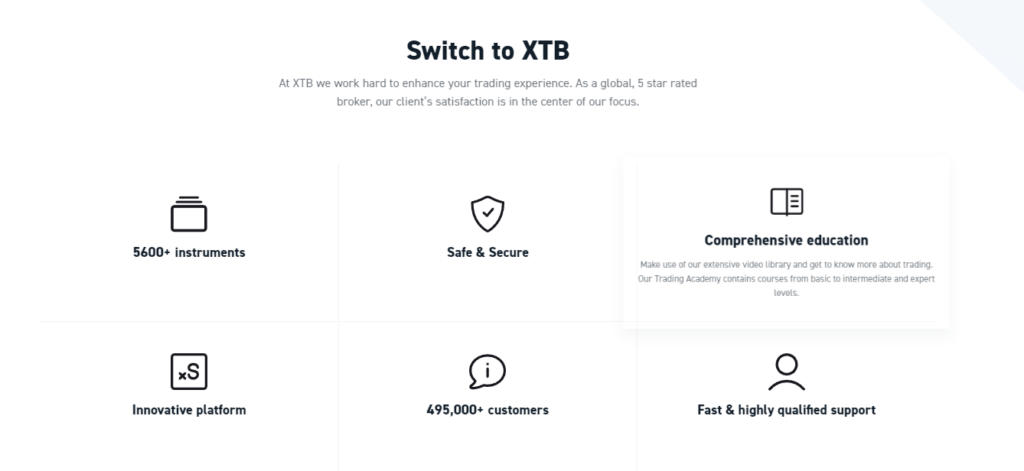

XTB is a Forex and CFD broker that is governed by the FCA. It was established in 2002.

With just one account type that can be used to trade more than 2,100 instruments, XTB has amassed close to 400,000 devoted customers.

New traders can use XTB’s trading academy to learn about the fundamentals of trading, and various training programs are offered, depending on experience levels.

XTB Pros and Cons:

| ✔️Pros | ❌Cons |

| 2,100+ instruments | Inactivity fees |

| No minimum deposit | No USA clients |

| Beginner-friendly | No MetaTrader support |

| Cashback rebates |

Markets.com

USD 100 CySEC, ASIC, FSCA 📱 Trading Desk MT4, MarketsX, Marketsi, MT5 ₿ Crypto Yes 📈 Total Pairs 65 Yes Low 🕒 Account Activation Time 24 Hours 🏛️ Visit Broker

Markets.com has provided international trading solutions in the financial markets since 2008.

In 2017 and 2020, Markets.com won awards for Best FX Platform, Best Forex Provider, and Best Forex Trading Platform in the Middle East.

For traders with little experience, Markets.com offers a knowledge centre with eBooks, analysis reports, webinars, and more.

Pros and Cons of Markets.com:

| ✔️Pros | ❌Cons |

| 2,200+ CFDs | No trading bonuses |

| Supports MetaTrader platforms | Inactivity fees |

| 11 base currencies | |

| Tight spreads |

FxPro

USD 100 FCA, CySEC, FSCA 📱 Platforms FxPro platform, cTrader, MT4, MT5 Yes 💵 Account Currency EUR, USD, GBP, CHF, PLN, AUD, JPY, ZAR Yes 📊 Leverage 1:200 🛒 Instruments Forex, Metals, Indices, Shares, Energies

FxPro was established in 2006 and has more than 21 million customers.

FxPro is a great choice for social trading and copy trading because it has 2,100 instruments available.

FxPro has received positive reviews for its customer service and more than 95 international awards.

FxPro Pros and Cons:

| ✔️Pros | ❌Cons |

| Highly regulated | Only 1 account type offered |

| 8 Base currencies | Inactivity fee charged |

| Supports Copy trading and Social trading | No clients from USA, Canada & Iran |

OANDA

In addition to updated feeds on business news and economic events, OANDA provides sophisticated charting tools, technical analysis, an Algo Lab for algorithmic traders, and other services.

MotiveWave, Beeks VPS, and Mutlicharts are partners with OANDA.

The Standard account and the Core account are the two different types of trading accounts that OANDA provides.

OANDA Pros and Cons :

| ✔️Pros | ❌Cons |

| Highly regulated broker | 4 base currencies |

| Good for active trading | No live chat |

| No minimum deposit | |

| Negative Balance protection |

City Index

£50 IIROC, JFSA, ASIC, FCA, CFTC MT4, City Index app ₿ Crypto No USD, CHF, EUR, GBP, HUF, AUD, JPY, PLN Yes 1:30 🛒 Instruments Indices, Shares, Forex, Metals Bonds, Options, Commodities 🏛️ Visit Broker

GAIN Capital has been supporting City Index since 1985. City Index has been a main player in the Forex economy, acquiring a good track record as a trusted broker.

Their account registration process is easy and effortless. Leverage offerings are an impressive 1:500, while their toolset consists of a most comprehensive and excellent training and research material.

While City Index does not offer multi-platform support services and only resolves technical user queries via e-mail, their support team is fast and efficient in resolving user queries.

City Index Pros and Cons:

| ✔️Pros | ❌Cons |

| Minimum trading fees | Desktop platform to be improved |

| Fast user registration | Limited product offering |

| Great training and research material |

Conclusion

We hope that this review of our 15 Best Hedging Forex Brokers will help you find a broker that aligns with your trading goals so that you can trade with confidence and peace of mind.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Most Regulated Forex Brokers

You might also like: Best Stock Trading Brokers

You might also like: Best NASDAQ100 Forex Brokers

You might also like: Best FTSE 100 Brokers

FAQ

What is Hedging?

To guard against a negative currency movement, one can use the forex market to hedge one’s position. The first strategy is to use hedging by taking the opposite position in the same currency pair. The second strategy is to purchase forex options.

Is hedging in Forex a good strategy?

By strategically utilizing financial instruments or market strategies to offset the risk of any unfavorable price movements, investment risk can be hedged. However, if the investment loses money and your hedge was effective, your loss will have been minimized.

Which Forex brokers allow hedging?

Our 5 Best Hedging Forex Brokers are:

- FXCM

- Axi

- Tickmill

- Swissquote

- Exness

Table of Contents

Toggle