The NFA (National Futures Association) is a regulatory agency in the USA that promotes transparency and fairness in derivatives markets and online trading. In this article, we reveal our 15 Best NFA regulated forex brokers and we review the features, trading conditions and instruments these brokers offer.

The NFA has been around for many years and this organization works closely with the Commodity Futures Trading Commission (CFTC).

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

Our Best NFA regulated forex brokers are:

🏆 OANDA

🏆 IG

So, let’s find out which brokers you can trade with if you are interested in trading with an NFA-regulated broker:

XM

XM is a beginner-friendly broker that offers 4 types of trading accounts. All accounts have negative balance protection.

XM is trusted by more than 5 million traders worldwide.

USD 5 ESMA, CySEC, ASIC, FCA, IFSC, DFSA 📱 Platforms Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform ₿ Crypto No 💵 Account Currency USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB Yes 1:1000 🛒 Instruments Commodities, Forex, Stocks, Crypto, Metals, Shares, Energies 🏛️ Visit Broker

XM provides market research and analysis, unlimited video tutorials and personal account managers.

XM Pros and Cons:

| ✔️Pros | ❌Cons |

| 1,000+ instruments | no USA clients |

| Low minimum deposit | Inactivity fees |

| Beginner-friendly | |

| 5 mil+ clients |

OANDA

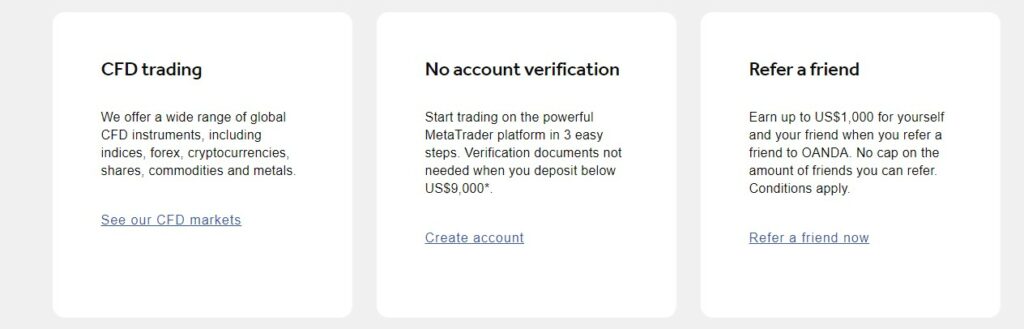

OANDA was established in 1996 as an American Forex broker and is regulated by the ASIC, FCA, IIROC, MFS, FIBO, BVIFSC, NFA and MAS.

OANDA is one of the most regulated Forex brokers and has been awarded for client satisfaction and exceptional services.

Creating an account with OANDA is easy and clients can choose from two flexible account types with tight spreads and innovative trading tools.

OANDA uses MarketPulse to provide its clients with market and Forex news, technical analysis and economic calendars.

OANDA offers a variety of educational resources for amateur traders that can be used with free demo accounts.

OANDA Pros and Cons:

| ✔️Pros | ❌Cons |

| 9 base currencies supported | Inactivity fee charged |

| Suitable for high-volume traders | Only Forex and CFDs offered |

| No withdrawal or deposit fees | |

| Compatible with MetaTrader 4 |

IG

IG is a regulated Forex broker that has offices in 12 countries, including South Africa, and has been operational since 1974 as IG Markets Ltd.

IG trading accounts can be funded using EUR, GBP and USD, and a total of 80 currency pairs is offered.

USD 0 FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC 📱 Platforms MT4, ProRealTime, L2 Dealer ₿ Crypto Yes 💵 Account Currency USD, GBP, AUD, EUR, SGD, HKD Yes 1:30 🛒 Instruments Crypto, Forex, Indices, Shares, Commodities 🏛️ Visit Broker

The website is available in 9 international languages, with a multilingual customer support team that can be reached via email, phone and office visits.

IG does not provide an Islamic account, but the demo account can be used on MT4, PureDeal, and L2 Dealer.

IG Pros and Cons:

| ✔️Pros | ❌Cons |

| Free educational resources | not many account types |

| free access to Autochartist | low leverage cap |

| low spreads | |

| negative balance protection |

Tastyworks

Tastyworks is regulated by FINRA, ASIC and SEC, and is based in the US.

Tastyworks is a popular stock exchange and no minimum deposit is required to open an account with this broker.

USD 0 SEC, FINRA, ASIC 📱 Platforms Tastyworks app ₿ Crypto Yes 💵 Account Currency USD No 1:2 🛒 Instruments US stocks and options, crypto, futures 🏛️ Visit Broker

Tastyworks offers a proprietary trading platform and a variety of US stocks and options, cryptocurrencies, and futures.

tastyworks Pros and Cons:

| ✔️Pros | ❌Cons |

| No min. deposit | Inactivity fees |

| 6 account types | No swap-free account |

| Proprietary platform provided | Only 1 base currency |

| Detailed commission fee structure |

Forex.com

Forex.com has been around for more than 2 decades and facilitates trades in more than 4,000 markets across 7 asset classes.

Forex.com offers 3 flexible account types and a rewards program for active traders.

USD 100 FCA, IIROC, ASIC, CFTC 📱 Platforms MT4, MT5, Forex.com apps ₿ Crypto Yes 💵 Account Currency EUR, GBP, USD No 📊 Leverage 1:40 🛒 Instruments Forex, Indices, Stocks, Commodities, Metals, Crypto 🏛️ Visit Broker

Forex.com provides a variety of trading tools, including SMART signals, advanced charting, performance analytics, and several innovative platform tools.

Beginners have access to educational materials that cover many different topics and can take a quiz to find out what type of trader they are.

Forex.com Pros and Cons:

| ✔️Pros | ❌Cons |

| Cash rebates for high-volume trades | Not a CySEC-regulated broker |

| Great range of research tools | Inactivity is penalised |

| Withdrawals and deposits are free |

Ally Invest

USD 0 SEC, FINRA, CFTC 📱 Platforms Maxit Tax Manager, Ally Invest proprietary platforms ₿ Crypto No 💵 Account Currency USD No 1:50 🛒 Instruments Stocks, ETFs, Options, Bonds, Mutual Funds 🏛️ Visit Broker

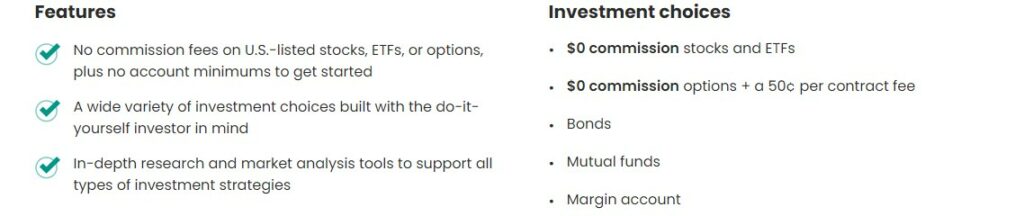

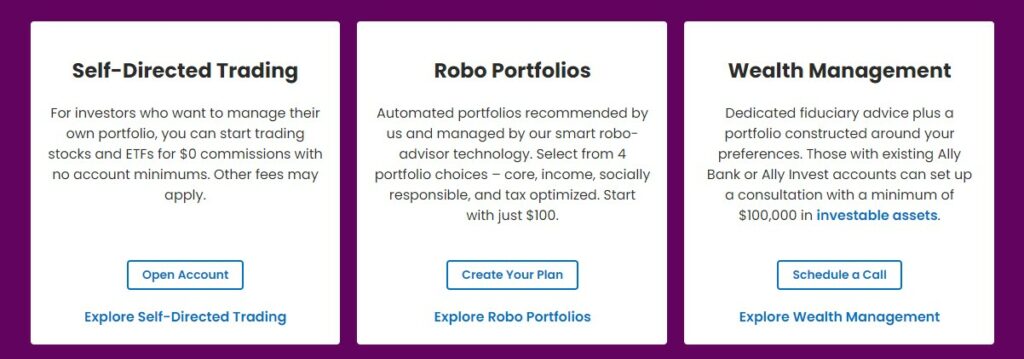

Whether you are interested in self-directed trading or you are curious about trading with Robo advisors, Ally Invest has an account for you.

Ally Invest offers commission-free trading and clients can connect to the markets 24/7.

No minimum deposit is required to activate a live account with Ally Invest and a bonus of up to $3,000 is offered for creating an investment account with this broker.

Ally Invest offers its own proprietary trading platform with charts, research and analysis tools, watchlists and much more.

Ally Invest Pros and Cons:

| ✔️Pros | ❌Cons |

| Beginner-friendly | Only 1 base currency supported |

| Comprehensive product and service offering | Difficult to find specific account info on website |

| Available to US citizens | No cryptocurrencies or Forex |

| 24/7 customer support |

TradeStation

USD 0 SEC, FINRA 📱 Platforms TradeStation platform suite ₿ Crypto Yes 💵 Account Currency USD, EUR, GBP, AUD, CAD, HKD, SGD, CHF, JPY No Low 🛒 Instruments Stocks, ETFs, Options, Futures, Crypto, Mutual funds, Bonds 🏛️ Visit Broker

TradeStation was founded in 1982 and offers over 2,000 Stocks, ETFs, Options, Futures, Cryptocurrencies, Mutual funds and Bonds.

No minimum deposit is required to open an account with TradeStation and you can trade commission-free.

TradeStation provides plenty of educational resources for beginners and multiple account types that can be used on the TradeStation platform suite.

TradeNation Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No USA clients |

| No withdrawal and deposit fees | No swap-free accounts |

| 5+ base currencies | |

| No minimum deposit | |

| Beginner-friendly |

USD 100 MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA 📱 Platforms MetaTrader 4, MetaTrader 5 ₿ Crypto Yes 💵 Account Currency AUD, EUR, USD, GBP, CHF Yes 1:400 🛒 Instruments Forex, Bonds, Stocks, Commodities, ETFs, Indices, Crypto 🏛️ Visit Broker

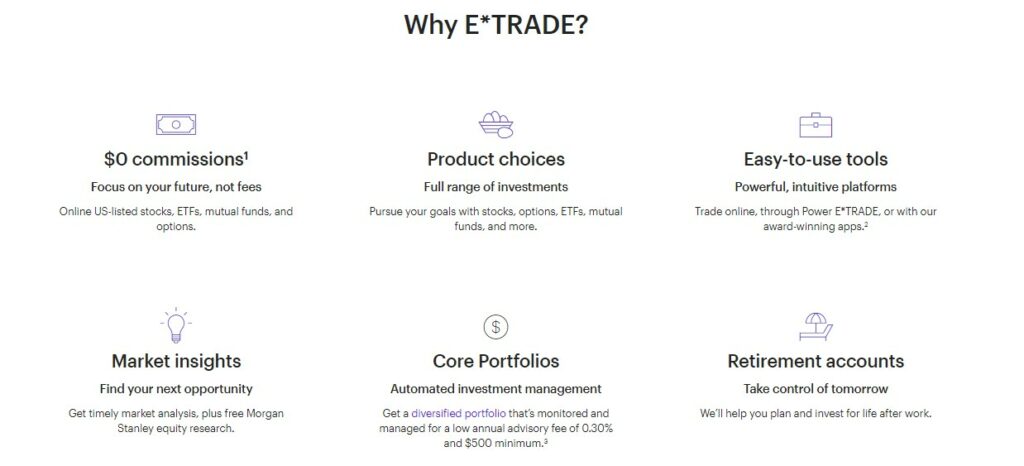

E*Trade

USD 500 FINRA, SEC 📱 Platforms Power E*TRADE, E*TRADE official platform and mobile apps ₿ Crypto Yes 💵 Account Currency USD No 1:1 🛒 Instruments Futures, Fund, Options, Crypto, Bonds, ETFs, Stocks 🏛️ Visit Broker

E*Trade was founded in 1982 and is based in the USA.

E*Trade is regulated by FINRA and SEC, and offers brokerage accounts, retirement accounts, managed portfolios and bank accounts.

You can also open an Automated investment account by depositing $500 and you can trade Futures, Fund, Options, Cryptocurrencies, Bonds, ETFs and Stocks.

E*Trade Pros and Cons:

| ✔️Pros | ❌Cons |

| Commission-free trading | High minimum deposit |

| Multiple account types | No swap-free accounts |

| Automated investments | |

| Multiple platforms | |

| Referral program |

TD Ameritrade

USD 0 SEC, FINRA, CFTC 📱 Platforms thinkorswim ₿ Crypto Yes 💵 Account Currency USD No 1:2 🛒 Instruments Stocks, Forex, Bonds, ETFs, Crypto, Options, Futures 🏛️ Visit Broker

TD Ameritrade is a beginner-friendly US stock exchange that offers a wide range of investment products and financial solutions.

TD Ameritrade offers annuity accounts, bonds, fixed income accounts, managed cash accounts, dividend accounts and lending programs.

TD Ameritrade is one of our top-rated, low-leverage brokers for beginners because this broker provides plenty of guides on trading and finance.

TD Ameritrade Pros and Cons:

| ✔️Pros | ❌Cons |

| No minimum deposit | 1 account currency |

| Commission-free trading | no swap-free accounts |

| Managed account services | |

| Multiple account types | |

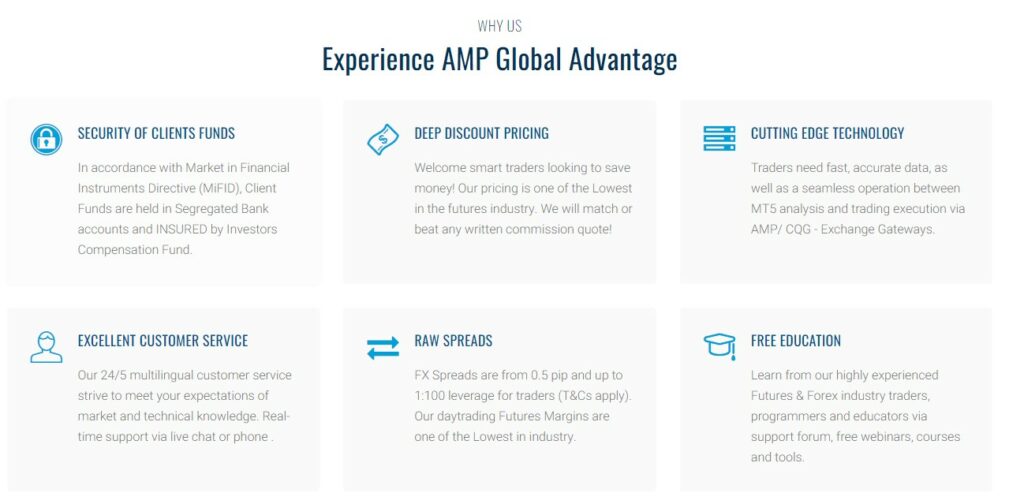

AMP Global

AMP Global is a beginner-friendly broker that offers low commission fees and tight spreads on a wide range of instruments.

AMP Global provides plenty of educational resources such as trading guides and video tutorials.

There are two types of accounts that you can open with AMP Global, as well as a demo account and a swap-free account.

AMP Global is registered in over a dozen jurisdictions and is a regulated broker.

AMP Global Pros and Cons:

| ✔️Pros | ❌Cons |

| Highly regulated | Minimum deposit may be high for some traders |

| beginner-friendly | no USA clients |

| Great selection of resources | |

| MT5 supported | |

Interactive Brokers

USD 0 USSEC, CFTC, ASIC, FCA 📱 Platforms Trader Workstation, IBKR mobile app, IBKR APIs ₿ Crypto No 💵 Account Currency AUD, CHF, TRY, USD, GBP, DKK, EUR, KRW, MXN, NZD, HKD, CAD, CNH, CZK, HUF, ILS, YEN, NOK, PLN, RUB, SGB, ZAR, SEK No 1:40 🛒 Instruments Forex, CFDs, Stocks, Options, Bonds, Mutual Funds, Commodities, Metals 🏛️ Visit Broker

Interactive Brokers is a beginner-friendly broker that offers low-cost trading on more than 7,000 CFD instruments.

Interactive Brokers was founded in 1978 in New York and there are 12 account types to choose from, including hedge fund accounts and managed accounts.

Interactive Brokers provides educational resources and you can learn to trade by visiting the Trader’s Academy.

As a client you can perform advanced analytics, use over 100 order types, trade in spot markets, make more informed decisions based on comprehensive reporting and use APIs.

Interactive Brokers Pros and Cons:

| ✔️Pros | ❌Cons |

| Beginner-friendly | no swap-free accounts |

| No minimum deposit | no mainstream platforms |

| 12 account types | |

| commission-free trading | |

Webull

Webull is a regulated beginner-friendly broker that offers Free Real-Time Quotes, 24/7 online support and low-cost, commission-free trading.

The Webull mobile app has voice-activated trading enabled, with level 1 and level 2 NASDAQ quotes provided and multiple advanced order types.

If you’d like access to more advanced charting tools and technical indicators, we recommend downloading the desktop platform.

Webull offers an IRA account (for retirement savings and planning) and an Individual Brokerage Account that can be used for trading.

Webull Pros and Cons:

| ✔️Pros | ❌Cons |

| No minimum deposit | Low leverage cap |

| Commission-free trading | |

| No inactivity fees | |

Plus500

USD 100 FCA, CySEC, ASIC, FMA 📱 Platforms Plus500 app ₿ Crypto Yes 💵 Account Currency USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, SGD Yes 📊 Leverage 1:300 🛒 Instruments Forex, Indices, Cryptocurrency, Commodities, Shares, Options, ETFs 🏛️ Visit Broker

Plus500 is a globally regulated Forex and CFDs broker that offers tight spreads on a variety of trading instruments that can be traded on the proprietary Plus500 app.

Plus500 provides innovative tools for risk management and offers eBooks and guides for beginners to use along with a demo account.

Plus500 clients can choose from 2 account types and benefit from no commissions and fast order executions.

Plus500 is trusted by more than 25 million traders worldwide and you can trade thousands of CFDs with this broker.

Plus500 Pros and Cons:

| ✔️Pros | ❌Cons |

| Educational content provided | No copy trading |

| Negative Balance Protection | Inactivity fees |

| 16 Account currencies | |

| Regulated |

Conclusion

Trading with a broker that is regulated ensures that you are exposed to fewer risks when it comes to account security. These brokers operate under strict supervision and will face legal consequences if any fraudulent activity is detected.

We hope that this review of our 15 Best NFA regulated forex brokers will help you find a broker that aligns with your trading goals so that you can trade with confidence and peace of mind.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Most Regulated Forex Brokers

You might also like: Best Stock Trading Brokers

You might also like: Best NASDAQ100 Forex Brokers

You might also like: Best FTSE 100 Brokers

FAQ

What is the NFA?

NFA safeguards the integrity of the derivatives markets, protects investors and ensure Members are compliant with regulations and policies.

What does NFA mean?

National Futures Association

What jurisdiction is the NFA?

USA

What does the NFA do?

The NFA regulates the commodities and futures industry in the USA.

Disclaimer

Remember, 75% of retail investors lose money when trading CFDs and there is a high risk of losing your capital in the forex markets.

The information on this website is in no way intended to be used as financial advice and opening an account with any broker is done at your own discretion and risk.

Table of Contents

Toggle