With Prepaid MasterCard, you will be able to withdraw and refund your trading account within a few hours. In this article, we reveal our 15 Best Prepaid Mastercard Forex Brokers and we review the features, trading conditions and instruments these brokers offer.

A prepaid Mastercard is a credit or debit card that can be loaded with money. Once topped off, it can be used to make purchases anywhere Mastercard is accepted.

Because everything is prepaid, a Prepaid Mastercard is different from a credit card. A line of credit is not offered to cardholders.

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

MasterCard has established itself as a standard in online transactions and is supported by a variety of platforms because it enables quick and convenient payments.

Our 5 Best Prepaid MasterCard Forex Brokers are:

🏆 FxPro

🏆 Trading 212

HYCM

Let’s get started with the full breakdown of the Best prepaid MasterCard Forex Brokers:

IC Markets

The 2007 company IC Markets provides three different kinds of trading accounts.

USD 200 FSA, CySEC, ASIC 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF Yes 1:500 🛒 Instruments Stocks, Commodities, Indices, Forex, Bonds, Crypto, Futures 🏛️ Visit Broker

More than 1,980 instruments are available at IC Markets, which also offers spreads starting at 0 pip.

For day traders, scalpers, and EA traders, we recommend opening an account with IC Markets.

IC Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| No inactivity fees | No USA clients |

| Tight spreads | Commission fees |

| 2,200+ instruments |

FxPro

More than 2100 instruments from 6 asset classes can be traded on the FxPro platform, and a live account can be opened for just $100.

USD 100 FCA, CySEC, FSCA 📱 Platforms FxPro platform, cTrader, MT4, MT5 Yes 💵 Account Currency EUR, USD, GBP, CHF, PLN, AUD, JPY, ZAR Yes 📊 Leverage 1:200 🛒 Instruments Forex, Metals, Indices, Shares, Energies

Since its founding in 2006, FxPro has served more than 21 million clients.

FxPro is a great choice for social trading and copy trading because it has 2,100 instruments available.

FxPro Pros and Cons:

| ✔️Pros | ❌Cons |

| Highly regulated | Only 1 account type |

| 8 Base currencies | Inactivity fees |

| No funding fees | No USA clients |

Trading 212

USD 1 FCA, CySEC, FSC 📱 Platforms Trading212 mobile and web apps ₿ Crypto No 💵 Account Currency USD, EUR, GBP No 1:300 🛒 Instruments Stocks, Indices, Commodities, Forex 🏛️ Visit Broker

Trading212 provides over 2,500 CFDs in addition to over 10,000 stocks and ETFs overall.

Customers of Trading212 have access to 24/7 customer support and can receive returns on investments starting at just 1 GBP.

Trading212 offers two account types with a $20 or less minimum deposit.

Pros and Cons of Trading212:

| ✔️Pros | ❌Cons |

| 180 Forex pairs | Website feels outdated |

| Commission-free investments | No US clients |

| Negative balance protection | No Islamic accounts |

| No withdrawal or deposit fees on CFD account | Account creation is delayed when the server is busy |

GO Markets

GO Markets is a beginner-friendly broker that was founded in 2006 and is regulated by ASIC, AFSL and FSC.

USD 200 FSC, ASIC, AFSL 📱 Platforms MT4, MT5, GO Webtrader Yes 💵 Account Currency AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD No 1:500 🛒 Instruments Forex, Shares, Indices, Metals, Commodities

GO Markets accounts can be used on MT4 and 5 and as a client, you can use Trading Central, a-Quant and MetaTrader Genesis.

GO Markets is a great option for social traders and beginners, but the minimum deposit (of $200) required is high.

GO Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| ASIC-regulated | No swap-free account |

| 6+ account currencies | High minimum deposit |

| Free VPS |

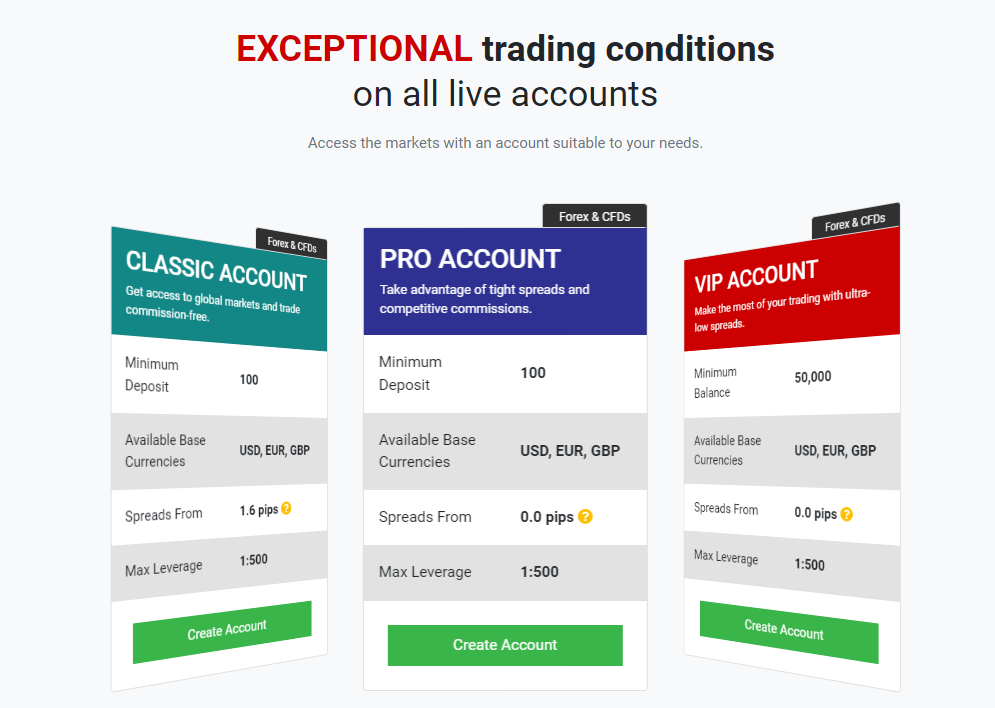

HYCM

USD 100 FCA, CySEC, CIMA, DIFC 📱 Platforms MT4, MT5 ₿ Crypto Yes 💵 Account Currency USD, GBP, EUR, AED Yes 1:500 🛒 Instruments Forex, Stocks, Indices, Cryptocurrencies, Commodities, ETFs 🏛️ Visit Broker

Established in 1998, HYCM is a Forex broker that welcomes new traders.

More than 300 instruments are available for trading with HYCM, which also offers flexible accounts with narrow spreads and commission-free trading.

At the moment, HYCM provides more than 40 tradeable currency pairs with spreads as low as 0.1 pips.

Pros and Cons of HYCM:

| ✔️Pros | ❌Cons |

| More than 300 tradable instruments | Not available to US citizens |

| Suitable for beginners | Monthly penalty for inactivity |

| Regulated by several entities | |

| Negative Balance Protection |

OvalX (ETX Capital)

USD 100 FCA, FSCA 📱 Platforms ETX TraderPro, MT4 ₿ Crypto Yes 💵 Account Currency GBP, USD, EUR No 1:30 🛒 Instruments Forex, Indices, Shares, Commodities, Crypto 🏛️ Visit Broker

OvalX was established in 1965.

OvalX’s trading experience is satisfactory at best with a glaring need for development to improve the educational and training resources platform.

User account creation is a short and sweet process and customer support is capable to resolve queries quickly and effectively.

OvalX Pros and Cons

| ✔️Pros | ❌Cons |

| Great selection of transactions | Certain withdrawals attract fees |

| Easy registration | Research tools need improvement |

| Adequate resources |

Tickmill

Tickmill was established in 2014 and provides 3 different types of accounts, one of which is commission-free.

Every account supports every trading strategy and can be used as a swap-free account.

There is a $30 welcome bonus and spreads as low as 0 pip.

Pros and Cons of Tickmill:

| ✔️Pros | ❌Cons |

| Negative Balance Protection | Not available to US clients |

| Access to Autochartist and FIX API | Fixed spread accounts not available |

| Zero-commission trading | |

| Highly regulated | |

| Welcome bonus |

XM

USD 5 ESMA, CySEC, ASIC, FCA, IFSC, DFSA 📱 Platforms Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform ₿ Crypto No 💵 Account Currency USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB Yes 1:1000 🛒 Instruments Commodities, Forex, Stocks, Crypto, Metals, Shares, Energies 🏛️ Visit Broker

XM has more than 5 million customers and offers multilingual customer support that is available around-the-clock.

Additionally, XM provides unlimited access to video tutorials, personal account managers, and market research.

Customers of XM have access to more than 1,000 tradable instruments and stocks from more than 600 foreign companies.

XM Pros and Cons:

| ✔️Pros | ❌Cons |

| User-friendly website | Fixed spreads not offered |

| Low minimum deposit | Not available to US clients |

| Negative Balance Protection | Inactivity is penalised |

| Promotions and signup bonuses |

HFM

USD 5 FCA, FSA, FSCA, DFSA, CySEC, FSC 📱 Platfoms MT4, MT5 ₿ Crypto No 💵 Account Currency USD, ZAR, USD, NGN Yes 1:1000 🛒 Instruments Forex, Metals, Energies, Indices, Shares, Commodities, Bonds, Stocks, ETFs 🏛️ Visit Broker

HotForex offers four different kinds of accounts that you can create.

Spreads on all HFM accounts are variable, and a separate account is available for copy trading.

You can fund your account with South African Rands or US Dollars, with the required minimum deposits ranging from $5 to $300.

When funding your account, there are no deposit fees.

HFM Pros and Cons:

| ✔️Pros | ❌Cons |

| 3 mil+ clients | Limited number of assets |

| 1:1000 leverage | Inactivity fee |

| Trading bonuses | |

| Low minimum deposit |

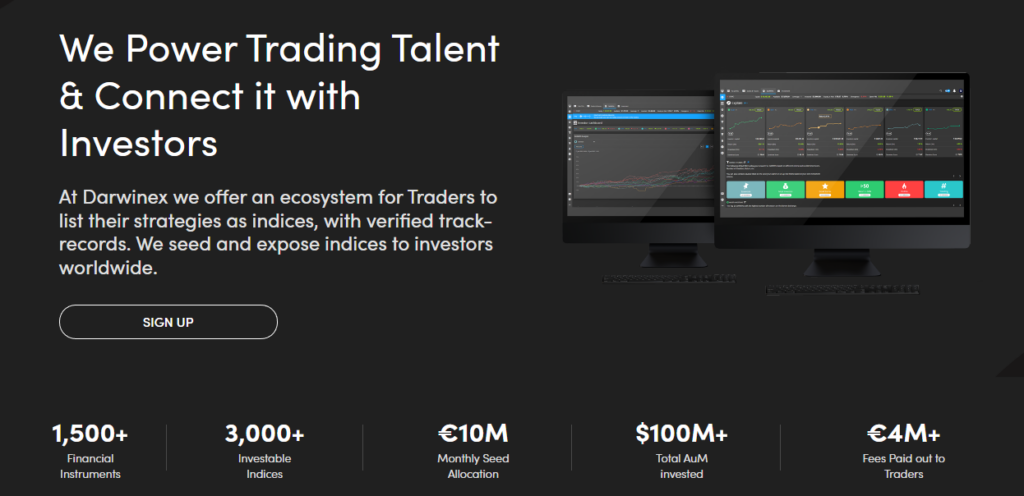

Darwinex

USD 500 FCA 📱 Platforms Darwin API, FIX, MT4, MT5 ₿ Crypto No 💵 Account Currency GBP, USD, EUR No 1:30 🛒 Instruments Forex, Indices, Commodities, US Stocks 🏛️ Visit Broker

Darwinex is an FCA-regulated Forex broker offering more than 300 (DMA) tradable assets with low spreads and ultra-fast execution speeds. More than 80 countries can access Darwinex and traders can use MetaTrader 4 and 5 and join a community of Social and Copy traders.

Darwinex creates a unique opportunity for novice and expert Copy Traders who would like to buy or sell strategies. Currently, there are more than 2,000 strategies available and over $55 million has been invested into Darwinex by its members.

Darwinex was founded in 2012 and has more than 3,000 loyal traders. The customer support team can be reached telephonically or by email.

Darwinex Pros and Cons

| ✔️Pros | ❌Cons |

| Large community of social and copy traders | High minimum deposit of $500 |

| Highly regulated | No access for US clients |

| Supports MT4 and FixAPI | Limited education content |

Pepperstone

USD 200 ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency USD, GBP Yes Low 🛒 Instruments Forex, Crypto, Shares, ETFs, Indices, Commodities 🏛️ Visit Broker

With compatibility with three well-known platforms and support for social trading, Pepperstone is a highly regulated forex and CFD broker.

There are two flexible account types offered by Pepperstone, which has more than 300,000 customers worldwide.

Both accounts have spreads that are of an institutional calibre, and the Standard account provides commission-free trading.

Pepperstone Pros and Cons:

| ✔️Pros | ❌Cons |

| No withdrawal fee | No USA clients |

| Referral program | Low leverage cap |

| 1,200+ CFDs | 2 account currencies |

| No inactivity fees |

Swissquote

USD 1000 FINMA, FCA, DFSA, SFC, MFSA, MAS 📱 Platforms Advanced Trader, MT4, MT5 ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, CHF, JPY, AUD, CAD, NZD, PLN, SEK, DKK, NOK, HUF, TRY, ZAR, SGD, MXN, HKD, THB, ILS, AED Yes 1:100 🛒 Instruments Forex, Stocks, Commodities, Bonds, Indices, Crypto 🏛️ Visit Broker

The reputation of the swiss certainly precedes them and Swissquote does not fall short in any way.

Users are offered a great experience with the well-designed platforms and have access to useful educational and research tools.

Creating an account is an easy, effortless and completely digital process with Swissquote.

The customer support centre is available through many contact channels and provides great assistance.

Swissquote Pros and Cons:

| ✔️Pros | ❌Cons |

| Inactivity does not attract penalties | High trading fees |

| Great market exposure | Some research tools are not free |

| Great research tools |

LCG

USD 0 FCA, CySEC 📱 Platforms MT4, LCG Trader ₿ Crypto No 💵 Account Currency USD, EUR, GBP Yes 1:30 🛒 Instruments Forex, Indices, Commodities, Shares, Bonds, Spot Metals, ETFs, Vanilla Options 🏛️ Visit Broker

LCG ( London Capital Group) was founded over 20 years ago and has won several awards since its inception.

LCG clients have access to over 7,000 highly liquid international markets and can rest assured that their funds are safe with this FCA- and CySEC-regulated Forex broker.

LCG is an excellent option for beginners who are looking for a broker that provides educational webinars, trading guides, glossaries and market news.

More experienced traders can use different technical indicators and advanced analysis and research tools to support their trading strategies and these tools can be used on MetaTrader 4 and the LCG proprietary platforms.

LCG Pros and Cons:

| ✔️Pros | ❌Cons |

| More than 7,000 tradable instruments | Limited account types |

| Regulated by CySEC and FCA | Clients from several countries cannot use this broker |

| Educational resources provided | ECN trading requires a minimum deposit of $10,000 |

| Multilingual website |

OANDA

Many prestigious companies, including AirBnB, Twitter, Expedia, Tesla, and PwC, rely on OANDA.

In order to trade on OANDA API, which is OANDA’s proprietary platform, or on MetaTrader 4, traders can open a live account or a demo account.

OANDA provides technical analysis, updated market news, and advanced charting tools. It also has an Algo Lab for algorithmic traders.

OANDA Pros and Cons :

| ✔️Pros | ❌Cons |

| Highly regulated with a good reputation | |

| High-volume traders can use the Active Trader account | No live chat |

| No minimum deposit | |

| Negative Balance protection |

Interactive Brokers

USD 0 USSEC, CFTC, ASIC, FCA 📱 Platforms Trader Workstation, IBKR mobile app, IBKR APIs ₿ Crypto No 💵 Account Currency AUD, CHF, TRY, USD, GBP, DKK, EUR, KRW, MXN, NZD, HKD, CAD, CNH, CZK, HUF, ILS, YEN, NOK, PLN, RUB, SGB, ZAR, SEK No 1:40 🛒 Instruments Forex, CFDs, Stocks, Options, Bonds, Mutual Funds, Commodities, Metals 🏛️ Visit Broker

130 markets can be traded through Interactive Brokers and this broker provides premium trading tools.

This beginner-friendly broker promises transparent trading and low trading costs.

With access to 80 international market centres, there are a total of more than 7,000 CFD products and more than 100 Forex pairs that can be traded.

Interactive Brokers Pros and Cons:

| ✔️Pros | ❌Cons |

| 100+ currencies | No swap-free accounts |

| No minimum deposit | Low leverage cap |

| Wide range of instruments | |

| 20+ account currencies |

Conclusion

We hope that this review of our 15 Best Prepaid Mastercard Forex Brokers will help you find a broker that aligns with your trading goals so that you can trade with confidence and peace of mind.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Most Regulated Forex Brokers

You might also like: Best Stock Trading Brokers

You might also like: Best NASDAQ100 Forex Brokers

You might also like: Best FTSE 100 Brokers

FAQ

What is Mastercard prepaid?

Adding money to a Prepaid Mastercard allows you to use it as a payment card. Once topped off, you can use it to make purchases anywhere Mastercard is accepted.

What are the benefits to traders of using a Mastercard prepaid?

The fact that MasterCard is almost universally accepted is the main benefit of using this service. As a result, you will be able to use your MasterCard credit card on almost every online Forex broker platform.

Which brokers accept prepaid Mastercard payments?

Our 5 Best Prepaid MasterCard Forex Brokers are:

- IC Markets

- FxPro

- Trading 212

- GO Markets

- HYCM

Table of Contents

Toggle