The Volatility 75 Index is most commonly used by strategy-driven traders seeking investment opportunities in highly volatile markets. In this article, we will review the features, trading conditions and pros and cons of the 15 Best VIX75 Forex Brokers.

What is VIX75?

VIX75 is also referred to as the “Fear Gauge” and it ranges between 0 to 100. Values below 30 indicate higher stability markets and values above 30 indicate higher volatility markets.

How to use VIX75?

The VIX75 Index is useful for developing trading strategies and researching market trends and can be used to put historical data about support and resistance levels into perspective.

In most cases, this style of trading is popular amongst speculative traders and for hedging strategies, and the VIX75 tracks the prices of S&P500 Options – it does NOT track the prices of the US stock market.

Rank Broker Regulations Min. deposit Rating Open account MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA Click here FCA, FSA, FSCA, DFSA, CySEC, FSC Click here CySEC, FCA, SFSA, FSCA, CBCS, FSA, FSC $10 Click here ASIC, FCA, FSCA $50 Click here $100 Click here $50 Click here FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC $0 Click here FCA, KNF, CySEC, IFSC Click here Click here $200 Click hereTop 10 Brokers for 2024

Our top 5 Brokers for trading VIX75 are:

🏆 eToro

🏆 Pepperstone

City Index

eToro

eToro is the perfect platform for traders who are interested in Copy trading and for Social traders, and it is also a beginner-friendly platform that offers a dedicated trading academy for new traders.

Unlike most Forex brokers, eToro is available to US citizens and has a total of over 17 million clients from across the globe.

USD 50 FCA, CySEC, ASIC 📱 Platforms eToro app, OpenBook, eToro CopyTrade ₿ Crypto Yes 💵 Account Currency USD, AUD, CNY, CAD, GBP, EUR, JPY, RUB Yes 1:30 🛒 Instruments Stocks, Commodities, Indices, Forex, ETFs, Cryptocurrencies 🏛️ Visit Broker

eToro Pros and Cons:

| ✔️Pros | ❌Cons |

| Supports CopyTrading | Withdrawal fees charged |

| Supports Social trading | Slow withdrawal process |

| Flexible leverage | |

| Free stock and ETF trading in EU |

IC Markets

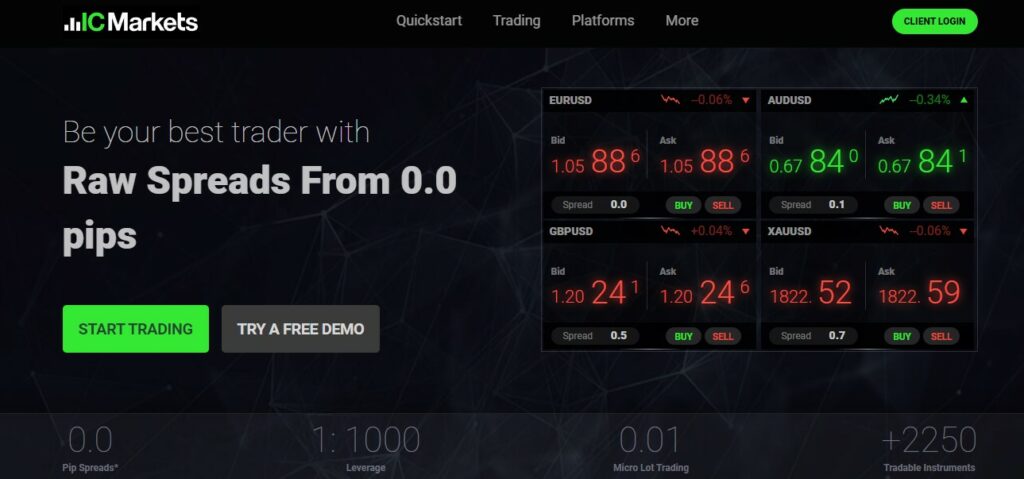

IC Markets was founded in 2007 and has established itself as one of the most popular ECN brokers in the world.

IC Markets is regulated by FSA, CySEC and ASIC, and offers 3 account types with tight spreads.

USD 200 FSA, CySEC, ASIC 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF Yes 1:500 🛒 Instruments Stocks, Commodities, Indices, Forex, Bonds, Crypto, Futures 🏛️ Visit Broker

The accounts offered by IC Markets can be used as Islamic accounts and are suitable for all styles of trading, including Day trading, Scalping, Expert Advisors and retail trading.

IC Markets provides a variety of trading tools, such as alarm managers, stealth orders, trading terminals, and session matrices and maps.

IC Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| Multiple accounts types | Not available in USA |

| Secure VPS | |

| 10 base currencies |

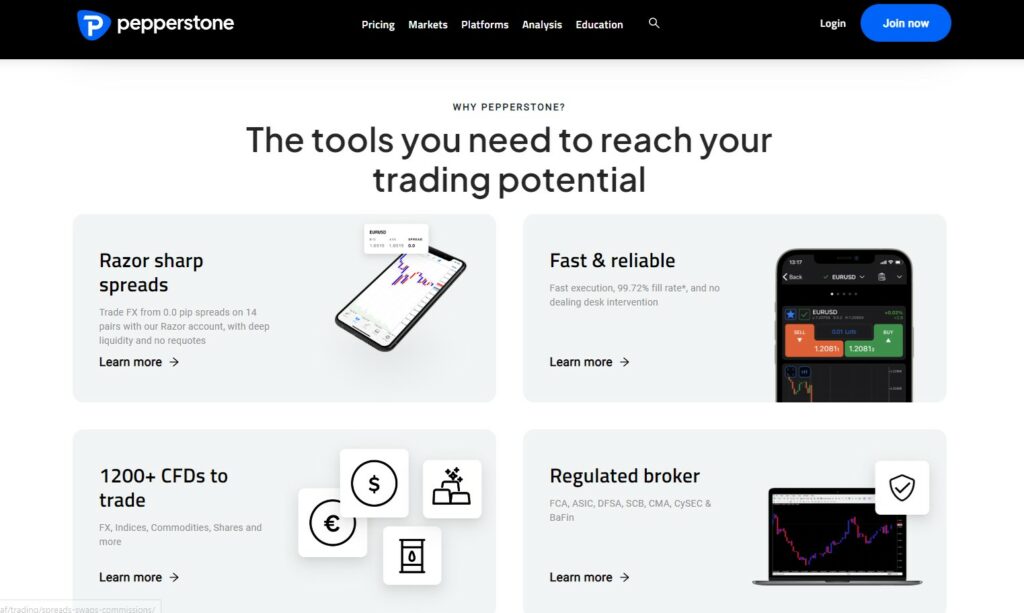

Pepperstone

Pepperstone is a highly-regulated Forex and CFD broker that is compatible with 3 popular platforms and supports Social trading.

Pepperstone has more than 300,00 clients worldwide and offers 2 flexible account types.

USD 200 ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN 📱 Platforms MT4, MT5, cTrader ₿ Crypto Yes 💵 Account Currency USD, GBP Yes Low 🛒 Instruments Forex, Crypto, Shares, ETFs, Indices, Commodities 🏛️ Visit Broker

Both accounts have institutional-grade spreads and the Standard account offers commission-free trading.

Pepperstone provides a variety of tutorials and trading guides for beginners, along with SMART trading tools, Autochartist and Figaro advanced trading tools.

Pepperstone Pros and Cons:

| ✔️Pros | ❌Cons |

| Many regulations | Only one account |

| Good customer service | |

| Great product offering | |

| No inactivity fees |

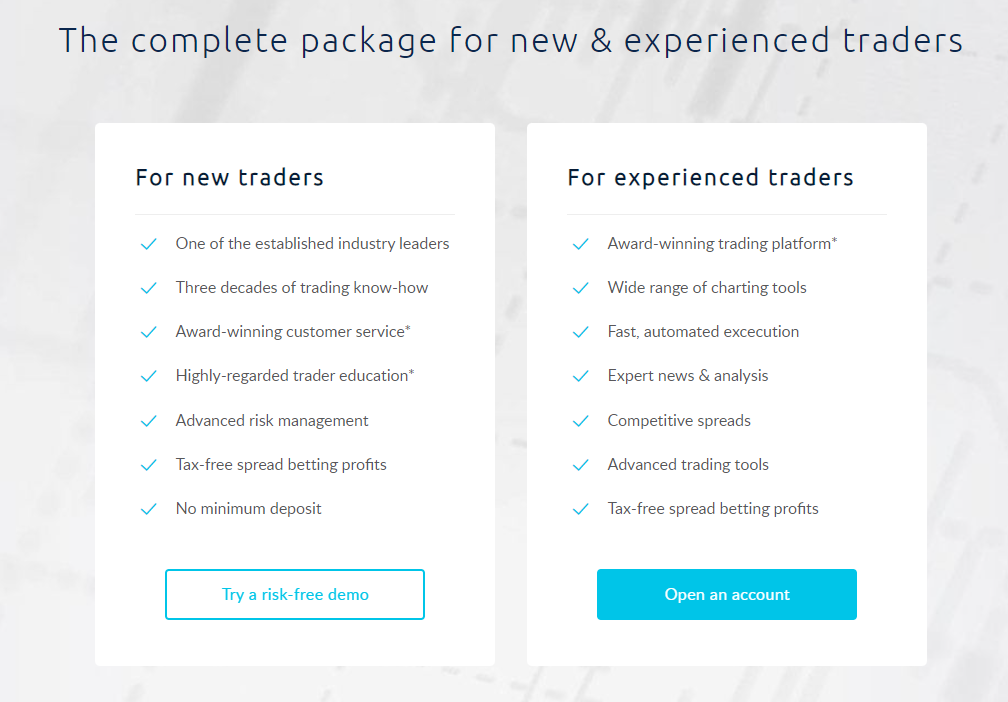

City Index

City Index offers more than 12,000 instruments across several asset classes, with more than 4,500 shares and 84 Forex pairs.

City Index provides over 65 advanced technical indicators and different types of charts, and is listed on the NASDAQ.

£50 IIROC, JFSA, ASIC, FCA, CFTC MT4, City Index app ₿ Crypto No USD, CHF, EUR, GBP, HUF, AUD, JPY, PLN Yes 1:30 🛒 Instruments Indices, Shares, Forex, Metals Bonds, Options, Commodities 🏛️ Visit Broker

Other trading tools offered include SMART signals, strategy tools and SMS alerts, and there is an abundance of educational resources to teach inexperienced clients how to trade.

City Index Pros and Cons:

| ✔️Pros | ❌Cons |

| Many different trading tools | Penalty fees |

| Great range of products | High stock CFD fees |

| Free deposits and withdrawals | Not many accounts |

| Part of StoneX |

AvaTrade

AvaTrade is a great option for beginners and CFD traders, and offers more than 1,250 instruments with a variety of popular platforms.

AvaTrade also provides its own proprietary trading platform and beginners have access to plenty of helpful educational resources, such as eBooks, tutorials, trading guides and more.

USD 100 MiFID, FSA, ASIC, BVI, FFAJ, FSCA, ADMG, FRSA 📱 Platforms MetaTrader 4, MetaTrader 5 ₿ Crypto Yes 💵 Account Currency AUD, EUR, USD, GBP, CHF Yes 1:400 🛒 Instruments Forex, Bonds, Stocks, Commodities, ETFs, Indices, Crypto 🏛️ Visit Broker

AvaTrade is one of the most regulated brokers in the world and is our top pick for online trading!

AvaTrade Pros and Cons:

| ✔️Pros | ❌Cons |

| Easy to open an account | Not available in US |

| No charges on deposits and withdrawals | Unreliable telephonic support |

| Suitable for beginners | |

| Highly regulated |

IG

USD 0 FCA, ASIC, CFTC, FINMA, MAS, JFSA, DIFC 📱 Platforms MT4, ProRealTime, L2 Dealer ₿ Crypto Yes 💵 Account Currency USD, GBP, AUD, EUR, SGD, HKD Yes 1:30 🛒 Instruments Crypto, Forex, Indices, Shares, Commodities 🏛️ Visit Broker

IG has more than 300,000 clients and facilitates the trading of over 17,000 instruments.

IG has been around since 1974 and accommodates corporate, retail and beginner traders.

Inexperienced clients can learn to trade using the IG trading academy, where they can access webinars, tutorials and more.

Customer support is offered 24 hours a day and can be reached through multiple channels.

IG Pros and Cons:

| ✔️Pros | ❌Cons |

| Well-developed web platform | Limited product portfolio |

| Great variety of educational tools | Phone support is lacking |

| Low trading fees |

Plus500

USD 100 FCA, CySEC, ASIC, FMA 📱 Platforms Plus500 app ₿ Crypto Yes 💵 Account Currency USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, SGD Yes 📊 Leverage 1:300 🛒 Instruments Forex, Indices, Cryptocurrency, Commodities, Shares, Options, ETFs 🏛️ Visit Broker

Plus500 guarantees transparent pricing and tight spreads, with commission-free trading accounts and reliable executions.

Plus500 offers flexible payment methods and has developed its own innovative trading app with free notifications, trade management tools and more.

Although educational resources on Plus500 seem lacking, a trading guide and eBook are provided for use by inexperienced clients.

Plus500 Pros and Cons:

| ✔️Pros | ❌Cons |

| Educational material provided | No copy trading |

| Negative Balance Protection | Inactivity fees |

| 16 Account currencies | |

| Highly regulated |

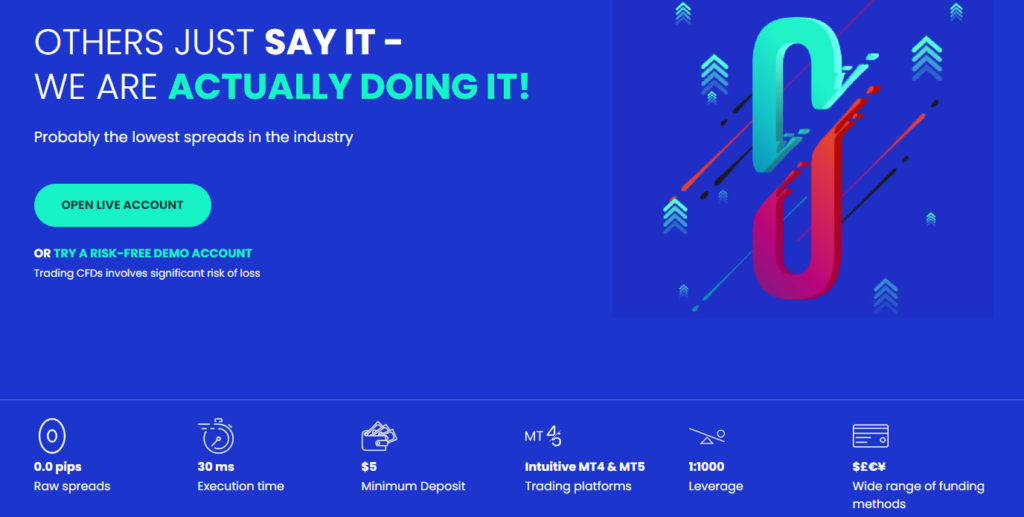

HFM

USD 5 FCA, FSA, FSCA, DFSA, CySEC, FSC 📱 Platfoms MT4, MT5 ₿ Crypto No 💵 Account Currency USD, ZAR, USD, NGN Yes 1:1000 🛒 Instruments Forex, Metals, Energies, Indices, Shares, Commodities, Bonds, Stocks, ETFs 🏛️ Visit Broker

HFMhas been around since 2008 and offers 5 accounts that have variable but tight spreads and low minimum deposits.

HFM clients benefit from the loyalty program, contests and other promotional bonuses and beginners can learn to trade using a demo account with the educational resources provided.

HFM also offers a VPS service and premium trading tools. including AutoChartist, MQL5 and much more.

HFM Pros and Cons:

| ✔️Pros | ❌Cons |

| 5 account types offered | Trading fees are high |

| Highly regulated | Penalty fees for inactivity |

| 18 trading tools provided | |

| Negative Balance Protection |

Saxo Bank

USD 2000 FCA, ASIC, FSC, JFSA, FSA, MAS 📱 Trading Desk SaxoTraderGO, SaxoTraderPRO ₿ Crypto Yes 📈 Total Pairs 182 No Low 🕒 Account Activation Time 24 Hours 🏛️ Visit Broker

Saxo Bank is trusted by more than 800,000 clients and offers over 40,000 instruments that can be traded using 3 account types.

The accounts offered by Saxo Bank accommodate corporate, retail and professional traders, and despite the lack of educational content, inexperienced clients can practice using the demo account.

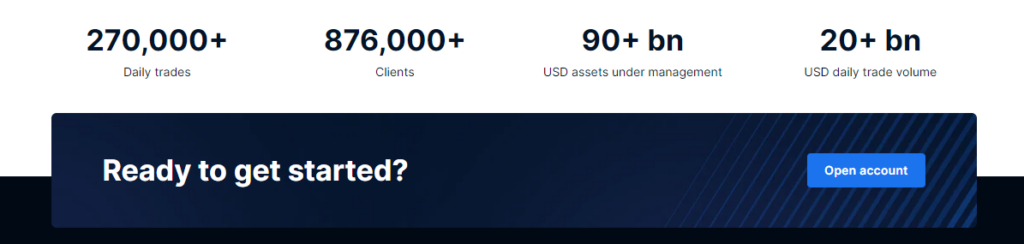

Saxo Bank guarantees tight spreads with low commission fees, and more than 188,000 trades are processed every day.

Saxo Bank Pros and Cons:

| ✔️Pros | ❌Cons |

| Innovative point system | High minimum deposits |

| VIP package | Does not support MetaTrader |

| Free withdrawals | Penalty fees |

| Low Forex fees |

XTB

USD 5 ESMA, CySEC, ASIC, FCA, IFSC, DFSA 📱 Platforms Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform ₿ Crypto No 💵 Account Currency USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB Yes 1:1000 🛒 Instruments Commodities, Forex, Stocks, Crypto, Metals, Shares, Energies 🏛️ Visit Broker

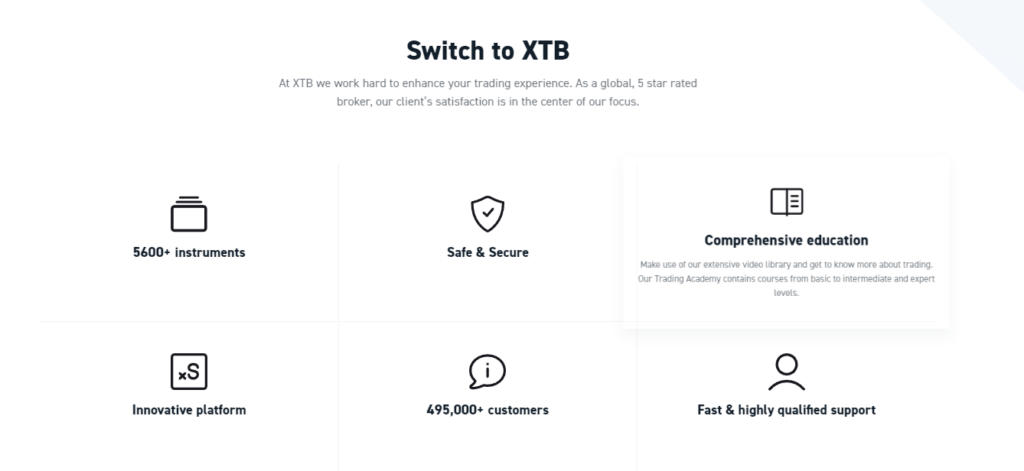

XTB offers over 2,100 instruments with a customisable, user-friendly proprietary platform and a variety of trading tools for charting, research, analytics and more.

XTB has over 389,000 clients and provides updated market news and plenty of educational content for beginners.

XTB facilitates trading across several different asset classes and provides reliable customer support.

XTB Pros and Cons:

| ✔️Pros | ❌Cons |

| 5 Base currencies | Penalty fees |

| No minimum deposit | Not available in US |

| Beginner-friendly | |

| Great product offering |

FXCM

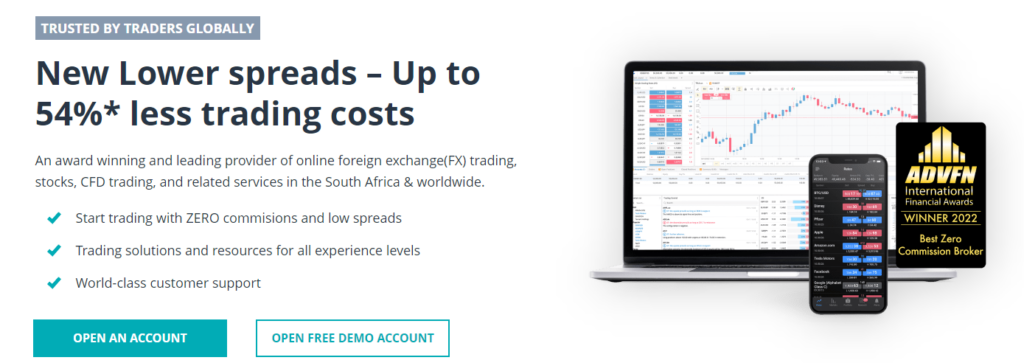

USD 50 ASIC, FCA, FSCA 📱 Platforms Trading Station, MT4, NinjaTrader, ZuluTrade, Capitalise AI, TradingView ₿ Crypto Yes 💵 Account Currency EUR, USD, GBP, CHF Yes 1:200 🛒 Instruments Forex, Shares, Indices, Crypto, Commodities 🏛️ Visit Broker

FXCM is a copy trader-friendly broker with an active trader program, a rebate rewards system and an excellent educational section.

FXCM has received many rewards since its inception in 1999 and focuses on spread betting, CFD trading and Forex trading.

FXCM is a great option for algorithmic trading and is compatible with multiple platforms, making it a broker for all types of traders that accommodates all levels of experience.

FXCM Pros and Cons:

| ✔️Pros | ❌Cons |

| Great selection of tools | High bank withdrawal fees |

| Promotional offerings | Penalty fees |

| Suitable for beginners | |

| Allows Copy Trading |

IFC Markets

USD 1 CySEC, LFSA, BVI, FSC 📱 Platforms MT4, MT5, NetTradeX ₿ Crypto Yes 💵 Account Currency USD, EUR, JPY, uBTC Yes 1:400 🛒 Instruments CFDs, Commodities, Forex, Gold, ETFs, Metals, Crypto 🏛️ Visit Broker

IFC Markets has been around for over 15 years and offers more than 600 instruments across 7 asset classes.

IFC Markets is trusted by thousands of traders around the world and is available in 100 countries.

IFC Markets offers 3 accounts with competitive trading conditions and a variety of innovative tools for trading and research, and is also a great option for inexperienced traders who are seeking educational resources.

IFC Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| Low minimum deposit | Limited funding currencies |

| Deposit bonus | Inactivity fees |

| VIP package | |

| Superior trading tools |

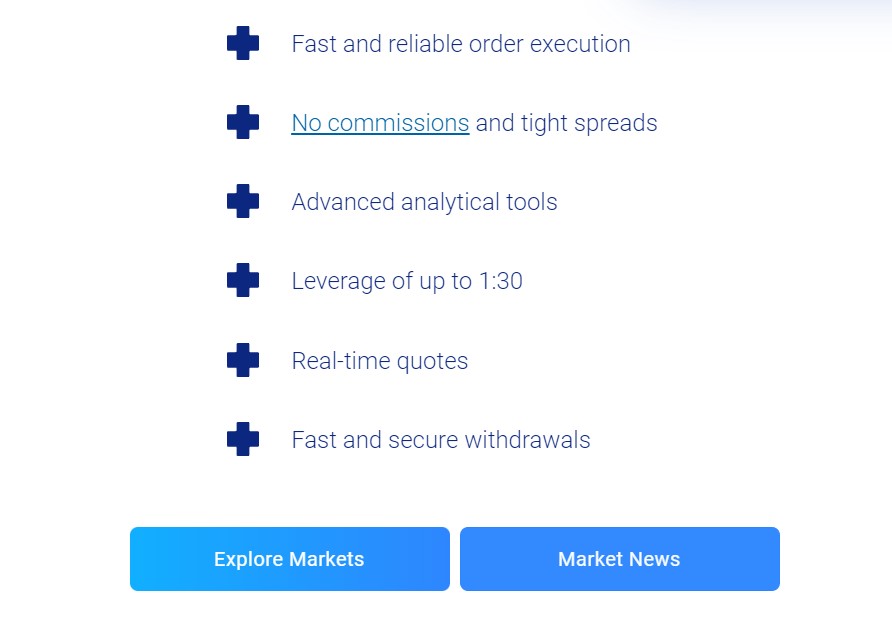

Capital.com

USD 20 FCA, ASIC, CySEC 📱 Platforms MT4, TradingView, Capital.com CFD app ₿ Crypto Yes 💵 Account Currency GBP, USD, EUR, PLN, AUD No 📊 Leverage 1:30 🛒 Instruments Crypto, Forex, Commodities, Indices, Shares 🏛️ Visit Broker

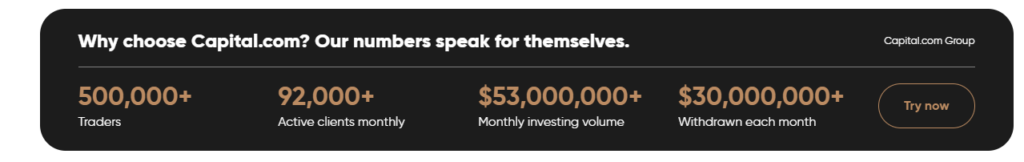

Capital.com offers 3 account types and more than 1,000 instruments that can be traded in global markets using a variety of advanced tools and features.

Capital.com is suitable for beginners and provides guides, courses and much more to assist inexperienced clients on their trading journies.

Capital.com is a trustworthy broker that offers special perks for professional traders and guarantees tight spreads and fast order execution.

Capital.com Pros and Cons:

| ✔️Pros | ❌Cons |

| Low Forex fees | Limited Product offering |

| Easy account creation | No platform tutorials |

| Customer support is great | |

| Free withdrawals |

CMC Markets

USD 0 FCA 📱 Platforms MT4, CMC Markets Next Generation app ₿ Crypto Yes 💵 Account Currency GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD Yes 1:30 🛒 Instruments Forex, Indices, Crypto, Commodities, Shares, Treasuries, ETFs 🏛️ Visit Broker

CMC Markets has over 300,000 clients from across the globe and offers more Forex pairs than any other regulated broker.

CMC Markets offers 3 account types that support 10 base currencies and offer negative balance protection.

Each account gets free education, market analyst insights, a pattern recognition scanner, ad a special market calendar.

CMC Markets offers cash rebates on all accounts and there is a total of more than 11,000 tradable instruments available to all accounts.

CMC Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| 300 currency pairs | High fees on Stock CFDs |

| Low spreads | Penalty fees |

| Advanced research tools |

M4 Markets

USD 5 FSA 📱 Platforms MT4, MT5 ₿ Crypto No 💵 Account Currency USD, EUR, GBP, JPY Yes 1:1000 🛒 Instruments Forex, Commodities, Indices, Shares, Crypto 🏛️ Visit Broker

M4 Markets is a regulated Forex broker that offers low-cost trading and tight spreads on accounts.

M4 Markets has 3 types of accounts that are compatible with the MetaTrader platforms and guarantees clients low-latency transactions with no rejected orders and no requotes.

M4 Markets provides educational materials for new traders and customer support is available 24/5 from anywhere in the world.

M4 Markets Pros and Cons:

| ✔️Pros | ❌Cons |

| Multiple deposit methods | Research tools seem limited |

| Low minimum deposit | |

| Beginner-friendly |

Conclusion

If you prefer to use strategies instead of trading on impulse, then we recommend that you use one of the 15 Best VIX75 Forex Brokers.

Some of these brokers allow Copy trading, which will make it much easier for you to test strategies that have already proven to be successful for professional traders – AND you can experiment with the VIX!

The most common trading strategies used with the Volatility 75 Index, are Bullish VIX Strategies (which is based on the prediction that volatility will return to a market and the VIX will increase when the level is below 20) or Bearish VIX Strategies (where the index is above 40 and volatility is expected to stabilize).

Despite the risks of trading in highly volatile markets, you will find that using the Volatility 75 index to navigate the US stock markets will greatly diversify your trading portfolio and open up the doors to many new and exciting investment opportunities.

Good luck with your trading!

You might also like: Lowest Spread Forex Brokers

You might also like: Most Regulated Forex Brokers

You might also like: Best Stock Trading Brokers

You might also like: Best NASDAQ100 Forex Brokers

You might also like: Best FTSE 100 Brokers

FAQ

What is the Volatility 75 Index?

The Volatility 75 index was created by the CBOE to indicate the levels of greed and fear in US stock markets so that the overall volatility could be predicted when analysing short-term market trends.

Why should you use the Volatility 75 Index?

The Volatility 75 index is most commonly used for the purposes of assessing risks and analysing market sentiments so that investors can capitalise on volatile market opportunities, and it is often used as a benchmark for the US stock market.

How do you trade on the Volatility 75 Index?

Generally, VIX 75 is traded with CFDs, options, futures and swaps. The easiest way to trade VIX 75 is by using a broker that facilitates this type of trading and offers the right instruments.

What must you research when you trade VIX75?

The 5 most important things to consider when trading with this index is:

- economic factors

- market structure

- historical market trends

- price action

- support and resistance levels

Disclaimer

Remember, 75% of retail investors lose money when trading CFDs and there is a high risk of losing your capital in the forex markets.

The information on this website is in no way intended to be used as financial advice and opening an account with any broker is done at your own discretion and risk.

Table of Contents

Toggle